Solana celebrated its 5th birthday yesterday. In honour of the occasion, we decided to take a look at this blockchain’s journey to becoming a leading platform and the home of the best meme coins.

Solana was launched on March 16, 2020, by Solana Labs CEO Anatoly Yakovenko and Solana co-founder Raj Gokal and his team. That was right around the time the entire world was forced into lockdown by the COVID-19 pandemic.

Some 408B transactions and close to $1T in trading on DEXs later, today Solana is second only to Ethereum in terms of total value locked, at $6.85B.

Solana was designed to address the scalability issues that plagued the likes of the Bitcoin and Ethereum blockchains. And, over the past five years, it has been widely adopted in areas such as DeFi, NFTs, gaming, Web3 applications, and – of course – as the launchpad for some of the best meme coins.

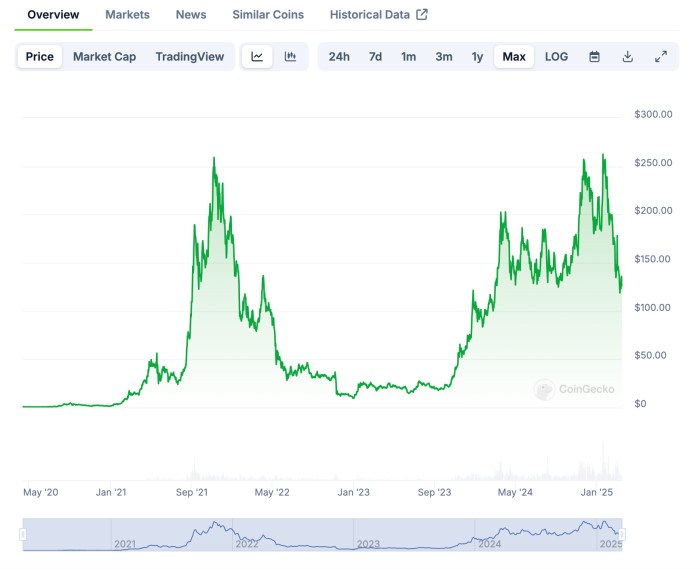

The high-speed, low-cost Layer 1 blockchain has had its fair share of ups and downs over the past five years.

At the peak of the 2020–2021 bull run, Solana’s market cap surged to $77.8B. However, it plummeted by a massive 96% in late 2022. The Solana price fell to $8.30, and its market cap bottomed out at around $3B.

Yet, Solana has proven quite the comeback kid, thanks in large part to the meme coin craze. Last year, the meme coin market exploded, and its collective market cap grew by 330%, according to CEX.io.

Solana’s impressive speed (up to 65K transactions per second), low costs, strong community, and developer-friendly environment have made it the go-to blockchain for the best altcoins, giving it a considerable edge over competitors.

Solana Back On Track For A Good Year Ahead

As Solana celebrates its 5th birthday, it seems good things are in store for this blockchain. For one, US President Donald Trump recently announced $SOL will be included in the country’s proposed strategic reserve.

Institutional players are acknowledging Solana’s strong position – with the likes of asset manager BlackRock on the brink of launching $SOL spot ETFs.

Solana also has two protocol upgrades in the pipeline. The first, SIMD 0123, proposes a system whereby Solana’s priority fees go to validator stakers. This should boost staking rewards, block off-chain transactions, and improve on-chain processing.

SIMD 0228, meanwhile, is a proposal to change how new $SOL tokens are released, in a bid to make token issuance more balanced and efficient. Instead of a fixed schedule, staking rewards would adjust based on how many people are staking.

The Solaxy Presale Solution To Solana’s Pitfalls

Solana’s ecosystem continues to flourish in the cryptocurrency and Web3 landscape, proving that speed, efficiency, and innovation can co-exist in a decentralized world. That said, the Solana blockchain is still known for traffic congestion and failed transactions.

To the rescue comes Solaxy ($SOLX), the meme coin behind the world’s first-ever Solana Layer 2 ecosystem.

$SOLX aims to build on Solana’s good points (speed and low transaction costs) by boosting scalability and adding even more speed.

As an Ethereum-based token, Solaxy will bridge Solana and Ethereum, meaning $SOLX holders will be able to capitalize on the strength of these two blockchain powerhouses.

This is exciting news for the crypto world, and investors are taking note. The Solaxy presale has raised $26.7M since it launched in December last year.

Right now, 1 $SOLX costs $0.0016666 (with 153% staking rewards). Being a presale, however, it won’t stay that low for long.

If you’re interested in investing in what is potentially a game changer for Solana, the Solaxy whitepaper is a good starting point, as is the $SOLX X channel. Our guide to buying $SOLX will walk you through the steps if you decide this is the investment for you.

Remember to do your own research, as we’re not financial advisers. That said, it will be exciting to see what’s in store for the Solana blockchain if the last five years are anything to go by.