Xapo Bank is the latest in a string of financial institutions that have introduced Bitcoin-backed loans for its customers. This is yet another good indication that the world is warming towards accepting cryptocurrency as a genuine asset.

A Bitcoin-backed loan provides access to US dollars without having to sell your $BTC. This means that Xapo Bank customers can now borrow up to 40% of their $BTC collateral for a maximum loan amount of $1M.

That’s with zero fees. However, Xapo Bitcoin-backed loans are subject to eligibility and a variable interest rate that’s linked to US Federal Reserve rates. And loans aren’t available to customers who reside in the UK or Australia.

According to the bank, the loan will be accessible within a minute of being approved and can be used via debit cards, bank, or crypto transfers. There’s no set schedule for repayments nor penalties for early repayments. But loans must be repaid within the agreed-upon 30, 90, 180, or 365 days.

Is the Xapo Loan an Indication of Improved Market Sentiment?

It could well be. In fact, an HTF Market Intelligence report expects the $8.58B global Bitcoin loan market to grow at a CAGR of 26.4%. At that rate, the market will be worth $45.27B by 2029. And Xapo Bank isn’t the first institution to offer Bitcoin-backed loans.

Coinbase, for instance, introduced Bitcoin-backed loans in November 2021. Amid the 2023 market downturn, however, Coinbase stopped issuing them, citing changing customer demands.

However, around the time of $BTC’s all-time high price of $109, Coinbase reintroduced Bitcoin-backed loans. The CEX now offers $USDC loans powered by Morpho, which is an open-source lending protocol on Base – Coinbase’s Layer 2 blockchain.

Coinbase has also hinted at adding some of the best altcoins to its loan offering. However, the jury is still out on whether that would include leading meme coins.

In all, the fact that banks and exchanges are offering Bitcoin-backed loans reflects a positive market sentiment in terms of Bitcoin and a global acceptance of $BTC as a legitimate asset.

Do Bitcoin-Backed Loans Mean Using a Custodial Wallet?

Yes. You need to be a Xapo Bank customer, and that means using the company’s wallet.

In fact, this Gibraltar-based bank was established in 2013 as a custodial Bitcoin wallet. It has since evolved into a licensed digital banking group. Its wallet is still custodial, though. In other words, Xapo Bank customers’ wallets are regulated by the bank.

That’s not necessarily a bad thing. It means the wallet has bank-grade protection. At the end of the day, though, it’s better to have your own non-custodial wallet, like the Best Wallet app, for complete ownership of your private keys.

The exchange or bank behind a custodial wallet holds your private keys on its server, making your private keys vulnerable to data breaches, meaning your crypto could end up in the wrong hands.

Don’t forget hackers love attacking crypto banks and exchanges, as ByBit will tell you — and a recent Chainanalysis report notes that ‘Private key compromises accounted for the largest share of stolen crypto in 2024, at 44%.’

Here’s another thing to keep in mind. If you take out a Bitcoin-backed loan from Xapo Bank, you won’t be able to access the $BTC you used as collateral. It’ll be held in the bank’s Bitcoin Vault until your loan is fully repaid.

How the Best Wallet Token ($BEST) Ups the Ante

The Best Wallet app is a fully self-custodial, no KYC, multi-chain, multi-currency wallet. It’s also the only crypto wallet that lets you buy the best presale tokens. And now, in a move to capture 40% of the explosive crypto wallet market by end-2026, it has launched its native Best Wallet Token ($BEST).

Analysts forecast that the crypto wallet market will expand at a 24.8% CAGR by 2032. With the general trend leaning towards software wallets, Best Wallet plans to dominate the market. And it will use the Best Wallet Token to complete its mission.

This top non-custodial wallet seems to be well on track to reaching its target with its 50% monthly user growth rate.

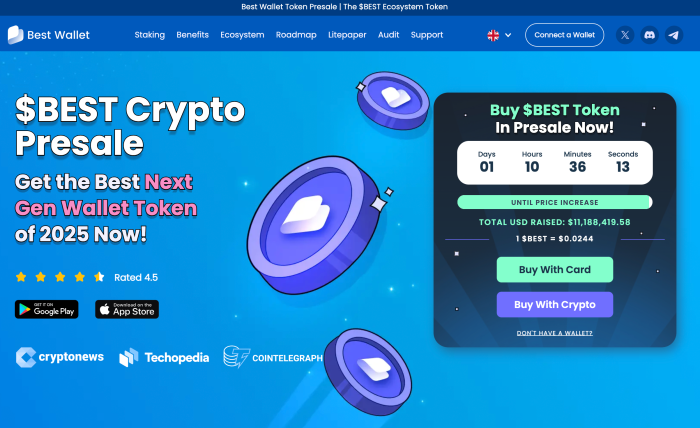

The $BEST token presale is also proving highly successful. After raising $160K within 24 hours of the presale launch, the total kitty now stands at $11M+. At the moment, 1 $BEST costs just $0.0244.

But as with any investment, we urge you to DYOR. The Best Wallet Token whitepaper is a good starting point. And if you decide that $BEST is best for you, we recommend reading our full guide to buying the Best Wallet Token.