The post Bitnomial Drops SEC Lawsuit After Ripple’s Victory, Prepares to Launch XRP Futures appeared first on Coinpedia Fintech News

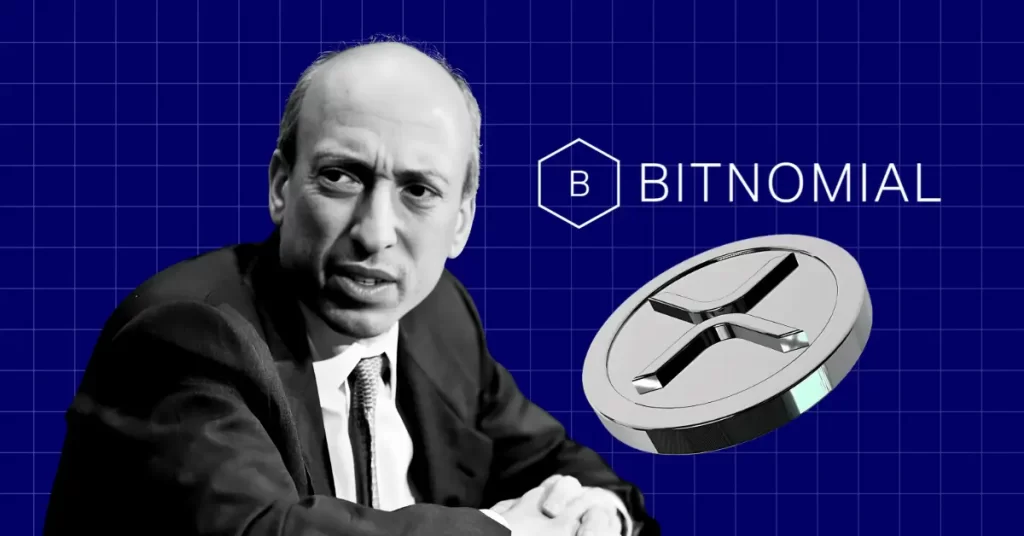

After nearly four years of legal drama, the SEC’s case against Ripple has come to a close, bringing a sigh of relief to the entire community. The SEC, which initially filed the lawsuit in December 2020 over claims that Ripple’s XRP was an unregistered security, has now dropped its appeal, marking a major shift in the legal battle.

Despite the SEC dropping its appeal, Garlinghouse clarified that the case isn’t fully over. A cross-appeal is still pending, but the situation has changed. “We go from being the defendant to the plaintiff,” he said. “Now, we’re in the driver’s seat, deciding how we want to proceed.”

Ripple’s Legal Victory Sets Industry Precedent

Notably, this decision has been seen as a win not only for Ripple but for the broader cryptocurrency industry, as it set a precedent that could influence future regulatory decisions. Following this news, FOX Business journalist Eleanor Terrett shared in an X post that following the SEC’s decision to drop its appeal against Ripple, the crypto derivatives exchange Bitnomial plans to dismiss its lawsuit against the SEC.

Bitnomial had filed the lawsuit in October, challenging the SEC’s claim that it had jurisdiction over Bitnomial’s proposed XRP futures contract. The case was important because it highlighted the ongoing debate over cryptocurrency regulations and the SEC’s authority over crypto products.

Bitnomial Dismisses Case Against SEC, To Launch XRP Futures

“Bitnomial is launching the first-ever CFTC-regulated $XRP futures in the U.S. — physically settled for real market impact,” the exchange noted in an X post. “Plus, we’ve voluntarily dismissed our case against the SEC as regulatory clarity improves.”

But with the SEC’s legal action against Ripple winding down, Bitnomial is set to officially launch its XRP futures contract tomorrow morning, following approval from the CFTC. This could further shape the landscape of crypto derivatives trading.

Bitnomial will launch its CFTC-approved XRP futures contracts on March 20. The decision to withdraw the lawsuit follows the SEC’s choice to drop its legal action against Ripple. The contracts will be physically settled, offering a new regulated way for both institutional and retail investors to trade XRP. Bitnomial clients can trade XRP futures right at launch. New clients can join through FCM partners like R.J. O’Brien, Marex Capital Markets, and Bitnomial Clearing.

SCOOP: In the wake of the

SCOOP: In the wake of the  XRP futures are here!

XRP futures are here!