The post TRX Defies Crypto Crash, $0.255 Breakout Incoming? appeared first on Coinpedia Fintech News

Despite ongoing market uncertainty, Tron (TRX) is making waves in the cryptocurrency market with its impressive price surge. However, this surge comes at a time when major assets like Bitcoin (BTC), Ethereum (ETH), and others are experiencing a notable price decline.

Current Price Momentum

TRX is currently trading near $0.235 and has registered a 2.56% price surge in the past 24 hours, defying the market trend. However, during the same period, its trading volume dropped by 42%, indicating that investors and traders are still hesitant to participate in the asset as overall market sentiment remains bearish, with prices continuing to fall.

TRX Technical Analysis and Upcoming Levels

With this upside momentum, the market condition seems to be shifting TRX’s overall trend. According to CoinPedia’s technical analysis, TRX has recently broken out from a bullish flag and pole price action pattern and is poised for massive upside momentum.

Besides this breakout, the uptrend remains strong as TRX has taken a retracement from Fibonacci’s 38.2% level, indicating a strong trend and momentum. Based on recent price action and historical patterns, if TRX maintains itself above $0.234, there is a strong possibility that the asset could soar by 12% to reach the $0.255 level in the coming days.

However, this level represents the upper boundary of the consolidation zone where TRX has been trading on a higher time frame. If the asset reaches this level and successfully closes a daily candle above $0.255, there is a strong possibility that it could see a price jump of over 20%.

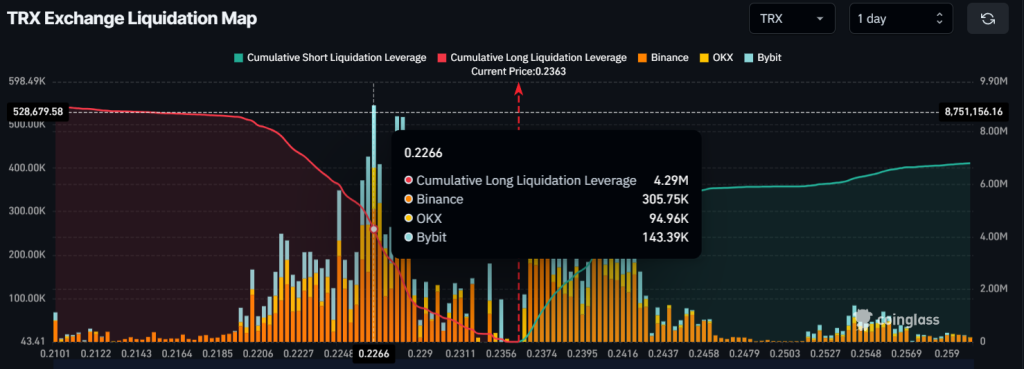

Tron’s (TRX) Over-Leveraged Levels

At press time, traders are over-leveraged at the $0.226 level, with $4.30 million worth of long positions. Meanwhile, $0.24 is another over-leveraged level, where traders betting on the short side are also over-leveraged.

Given the current market sentiment, it appears that traders are bullish, and the price may soon surge, which could explain the $4.30 million worth of long positions at the $0.226 level.