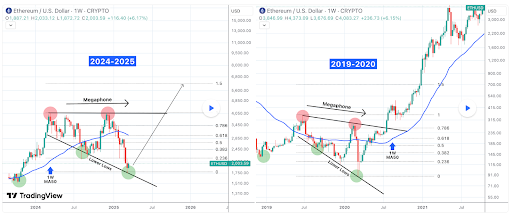

Crypto analyst TradingShot has revealed that the Ethereum price has formed a megaphone bottom which has not been seen since 2020. The analyst revealed what happened the last time ETH formed this bottom, which provides a bullish outlook for the altcoin.

Ethereum Price Forms Megaphone Bottom

In a TradingView post, TradingShot stated that the Ethereum price has formed a megaphone bottom like in March 2020. He noted that ETH is currently on the first week of a rebound after recording three consecutive red weeks when it could not break above the 1-week MA50. The analyst further remarked that ETH is taking on a lower lows trendline, which is technically the bottom of a 1-year megaphone since the March 11, 2024 high.

TradingShot claimed that the market is no stranger to long-term megaphone consolidation periods like that. He stated that the Ethereum price eventually broke upward the last time it formed this megaphone between June 2019 and March 2020, which happened after the brutal COVID crash bearish leg that touched bottom.

He noted that the March 2020 period is quite similar to the current bearish Ethereum price action since late December. The analyst then highlighted how perfectly aligned the Fibonacci retracement levels are. Based on this development, he predicted that the Ethereum price could at least test the 1.5 Fibonacci extension at $6,000 before this cycle tops at the end of the year.

Crypto analyst Crypto Patel also raised the possibility of the Ethereum price rallying to as high as $8,000. He suggested that this parabolic move could happen in phase E of ETH’s bull run. He indicated that ETH could face significant resistance at around $4,050 to this price level.

Bullish Fundamentals For ETH

Despite its underperformance, the Ethereum price has bullish fundamentals, which could spark a reversal to the upside and cause it to reach new highs. Crypto analyst Alternative Bull revealed that the exchange reserves of ETH are significantly declining. He remarked that this would lead to a limited supply which makes it only a matter of time before ETH goes parabolic. In line with this, the analyst affirmed that the altcoin is still in the early phases of its bull run.

Crypto analyst Ali Martinez has also revealed that whales are actively accumulating ETH, which is bullish for the Ethereum price. In an X post, he stated that 360,000 ETH were withdrawn from crypto exchanges in the last 48 hours, a development that could spark a supply shock.

It is also worth mentioning that the Ethereum price could soon witness a supply shock through the ETH ETFs. Asset managers like Bitwise have filed with the US SEC to include staking in their funds. If approved, this could take more ETH out of circulation as some institutional investors opt to stake their ETH to receive yields.

At the time of writing, the Ethereum price is trading at around $1,969, down almost 2% in the last 24 hours, according to data from CoinMarketCap.