Today is a crucial day in the cryptocurrency market, as more than $14 billion worth of Bitcoin and Ethereum options are due to expire. Such a huge expiration may result in significant price changes and trading volumes. Currently, Bitcoin is trading at around $85,000, down by 3% from earlier this week.

Market Reaction To Bitcoin, Ethereum Options Expiry

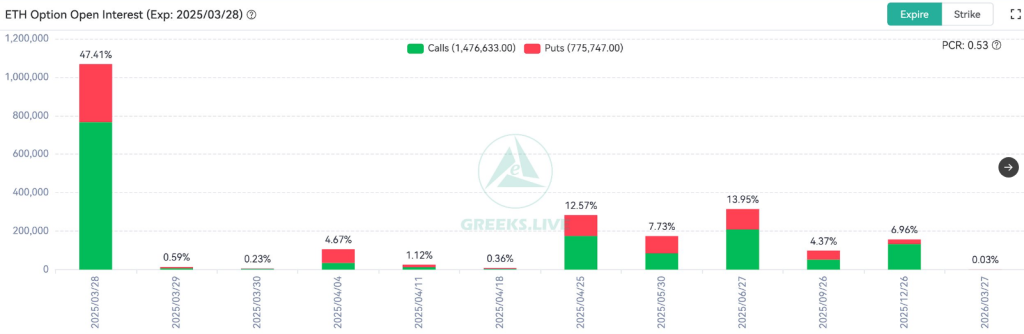

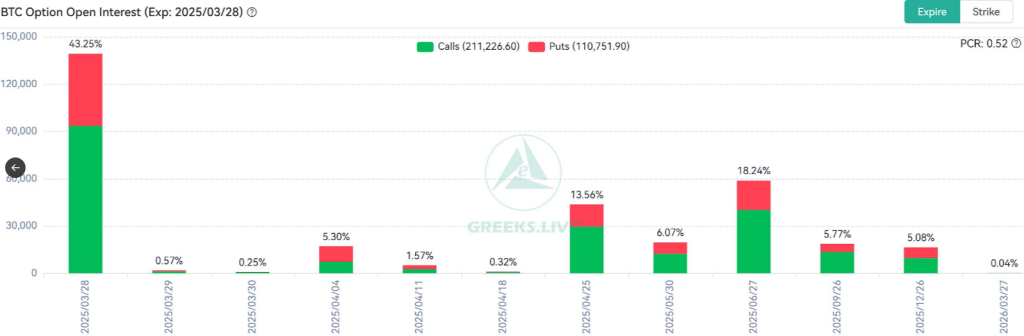

Based on figures from Greeks.live, the aggregate options expiring today comprises 139,000 Bitcoin options worth about $12.1 billion. Another 301,000 Ethereum options worth about $2.13 billion are also expiring. The put-call ratios of these options stand at 0.49 for Bitcoin and 0.39 for Ethereum, reflecting differing degrees of trader sentiment.

28 Mar Options Data

139,000 BTC options are expiring with a Put Call Ratio of 0.49, a Maxpain point of $85,000 and a notional value of $12.1 billion.

301,000 ETH options are expiring with a Put Call Ratio of 0.39, a Maxpain point of $2,400 and a notional value of $2.13 billion.… pic.twitter.com/1zcEz3VBss— Greeks.live (@GreeksLive) March 28, 2025

Understanding Max Pain Points

Each quarter, options expirations such as today’s can cause substantial market movements. Market makers typically follow a strategy that has the effect of driving asset prices to what are referred to as max pain points. The max pain point for Bitcoin is $85,000, and that for Ethereum is $2,400. This approach may be the reason behind Bitcoin’s drop as traders respond to these technical points.

Broader Market Sentiment

Although the options expiration is the most prominent on everyone’s mind, other things are also affecting market dynamics. Media reports indicate that uncertainty over new tariffs by US President Donald Trump might be behind the downtrend in Bitcoin and the broader crypto space. Because of that, the effect of today’s options expiration is made more complex by outside market pressures.

Challenges Ahead For Investors

In the future, Greeks.live cautions that selling pressure is becoming more prevalent in the cryptocurrency market. Several investors might struggle to maneuver the challenges anticipated in the second quarter of 2025. In the absence of new catalysts that would push the prices higher, the market might have a bumpy ride ahead for the buyers to make profits.

As the countdown begins to the expiration, investors and traders are monitoring closely. Today’s events can determine the shape of the market for weeks. With huge amounts of money at risk, the crypto community is preparing for volatility.

In short, the expiry of more than $14 billion worth of Bitcoin and Ethereum options is set to send waves in the market. Traders are closely watching price action as different factors align, pointing to the intricacies of dealing with the cryptocurrency world.

Featured image from Gemini Imagen, chart from TradingView