Bitcoin has dropped below the $85,000 level as selling pressure returns across the crypto market. After several days of tight consolidation just under the $88K resistance zone, bearish momentum has regained control, dragging prices lower and signaling the end of a short-lived period of stability. The broader financial landscape remains tense, with trade war fears and mounting uncertainty continuing to weigh heavily on risk assets — and Bitcoin is no exception.

Global markets are facing increasing volatility, driven by geopolitical tensions and fragile investor sentiment. As traditional markets falter, the crypto space has followed suit, showing signs of weakness amid macro headwinds. Many traders are now watching for signs of deeper corrections across the board.

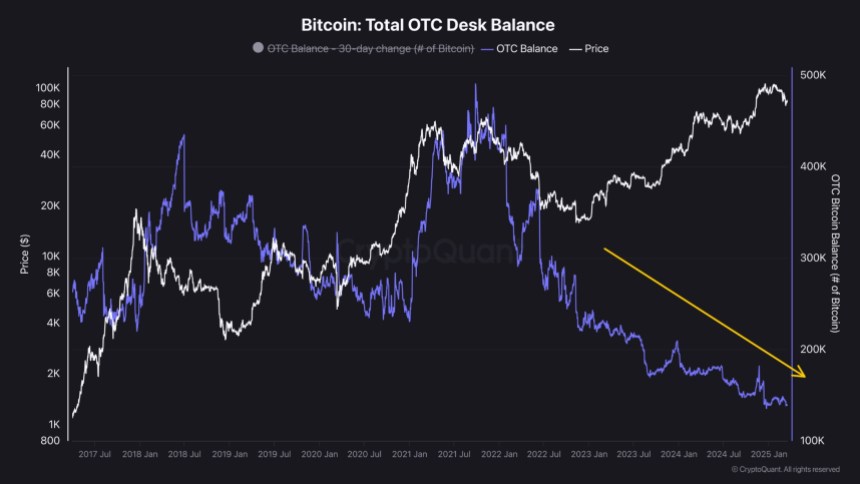

Despite the pullback, there may be a silver lining. According to fresh data from CryptoQuant, OTC (Over-the-Counter) desks are draining at a fast pace. This trend often indicates increased institutional accumulation — as OTC transactions are typically used by larger players to avoid slippage on exchanges. While short-term price action remains bearish, the reduction in OTC supply could be an early signal of long-term confidence building under the surface. For now, Bitcoin must find stability before bulls can attempt a meaningful rebound.

Bitcoin Holds $84K As Analysts Debate Market Direction

Bitcoin is at a critical point, with bulls struggling to reclaim the $90,000 level but managing to hold firm above the $84,000 support zone. This tight range reflects growing uncertainty in the market, as price action stalls and sentiment becomes increasingly divided. Some analysts argue that the bull market has run its course, pointing to fading momentum and macroeconomic pressure as signs that a deeper correction is underway. Others believe that this is simply a healthy pause in a longer-term uptrend, with new all-time highs still ahead.

Top analyst Quinten Francois has weighed in, pointing to a key on-chain metric that may support the bullish case. According to Francois, the total balance held by OTC desks has been steadily draining since January 2022 — a trend that has continued into 2025.

A declining OTC desk balance typically signals increasing demand from large-scale buyers, such as institutions or high-net-worth investors. These desks are used to facilitate large trades off-exchange to avoid slippage, so when their balances trend down, it often means big players are buying directly and moving assets into cold storage or long-term holdings. This can reduce circulating supply and act as a quiet form of accumulation during periods of uncertainty.

While short-term price action remains uncertain, the continued OTC desk outflows suggest that large investors are positioning for long-term gains. For now, all eyes remain on the $84K–$90K range. A breakdown below support could trigger deeper losses, but a breakout above resistance may reignite bullish momentum — especially if institutional interest continues to grow behind the scenes.

BTC Struggles To Reclaim Higher Supply Levels

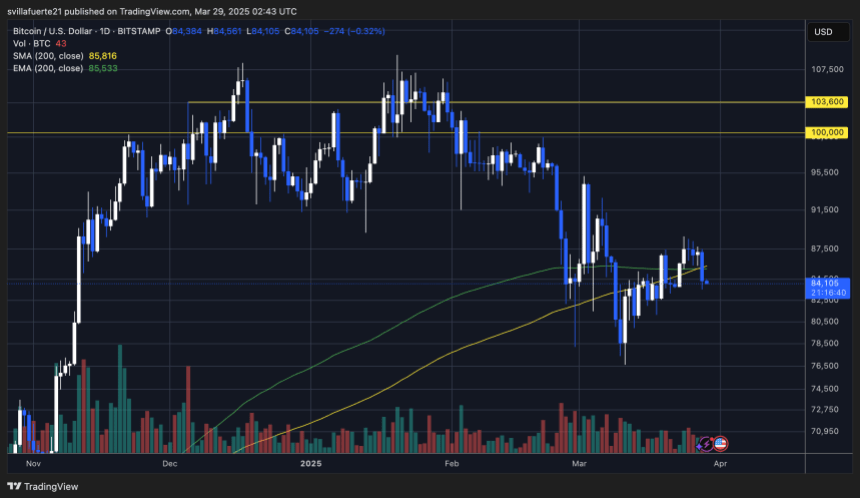

Bitcoin is trading at $84,100 after losing the 200-day moving average (MA) and exponential moving average (EMA), both of which were positioned around $85,500. This breakdown has weakened the bullish structure and placed BTC in a vulnerable position, with momentum now clearly favoring the bears. For bulls to regain control, they must hold above the $82,500 support level in the coming sessions.

Maintaining this level would signal stability and could pave the way for a rebound toward the key resistance zone between $89,000 and $91,000. Reclaiming that area would be a significant step toward restoring bullish sentiment and potentially reigniting the broader uptrend.

However, if BTC fails to hold above the $82,000 mark, the market could see intensified selling pressure and a sharp drop below $80,000. A break of that psychological level would likely confirm a deeper correction and shift sentiment further in favor of the bears.

With volatility rising and macroeconomic uncertainty still shaking global markets, the next few days will be critical for Bitcoin’s short-term direction. Bulls need to act quickly to avoid further downside and re-establish momentum above the $85K mark.

Featured image from Dall-E, chart from TradingView