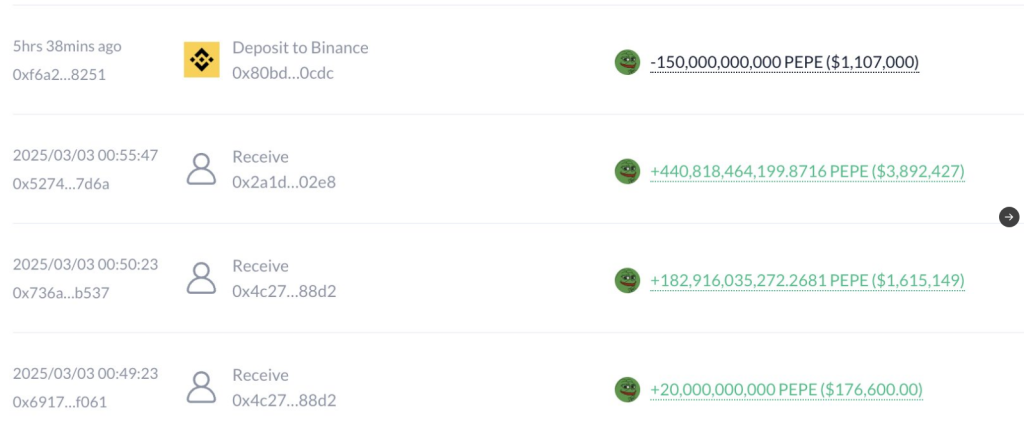

A big player in the world of Pepe coin has cashed out a large chunk of their holdings, causing the price of the meme coin to wobble. This investor, who got in early on Pepe, sold off 150 billion tokens on a crypto exchange, Binance. The sale amounted to about $1.14 million. It’s a significant move that has caught the attention of people who follow the ups and downs of these digital currencies.

Early Investment Pays Off Big

The story gets even more interesting when we look at how much this investor initially put into Pepe. Reports say they only spent around $2,184 to buy a massive 1.5 trillion Pepe tokens way back when.

A $PEPE OG sold 150B $PEPE($1.14M) again 5 hours ago.

This OG spent only $2,184 to buy 1.5T $PEPE($43M at the peak) in the early stage.

He sold 1.02T $PEPE for $6.66M, leaving 493B $PEPE($3.64M), with a total profit of $10.3M(4,718x).https://t.co/tyzLr10sGj pic.twitter.com/FD6fFpyqCi

— Lookonchain (@lookonchain) March 29, 2025

Now, after selling off some of their stash, this person has already made a profit of $6.66 million. That’s like getting back almost 4,718 times their initial investment. Even after this big sale, they still have a considerable amount of Pepe left – about 493 billion tokens, which are currently worth around $3.64 million.

Price Takes A Dip

News of this large sale seems to have affected the price of Pepe. Over the last day, the value of the coin dropped by about 4.59%, according to the transaction. Other sources are even reporting a slightly bigger drop, over 5%.

Right now, one Pepe coin is trading for about $0.00006976. It’s a reminder that when someone holds a lot of a particular cryptocurrency, their actions can have a real impact on the market price.

Market Shows Signs Of Weakness

It’s not just this big sale that’s putting pressure on Pepe’s price. The total cryptocurrency market has been moving a bit slow recently, and that’s contributing to the negative trend for Pepe.

Although the price is lower, plenty of trading is still going on with Pepe. The trading volume in one day has actually increased by around 3.90% to $421.28 million. That indicates that even with the price decline, individuals are continuing to buy and sell the meme coin.

Technical Indicators Point Downward

Glancing at some of the technical charts that traders follow, things don’t appear too good for Pepe at this moment. One of them, known as the MACD, indicates a bearish signal, which means the price may continue to go down. Another one, the RSI, is in what’s termed “oversold” territory, at 24.55. This generally indicates there’s been considerable selling pressure.

Data also shows that money has been flowing out of Pepe since the middle of January, which isn’t a good sign for its price. Some analysts are even predicting that if Pepe stays below a certain price point, around $0.0000075, it could fall another 20% to about $0.00000585.

Featured image from Gemini Imagen, chart from TradingView