An analyst has pointed out two major Dogecoin resistance levels that could potentially pave the path to the next bull run for the memecoin’s price.

These Dogecoin Levels Stand Out In Terms Of On-Chain Resistance

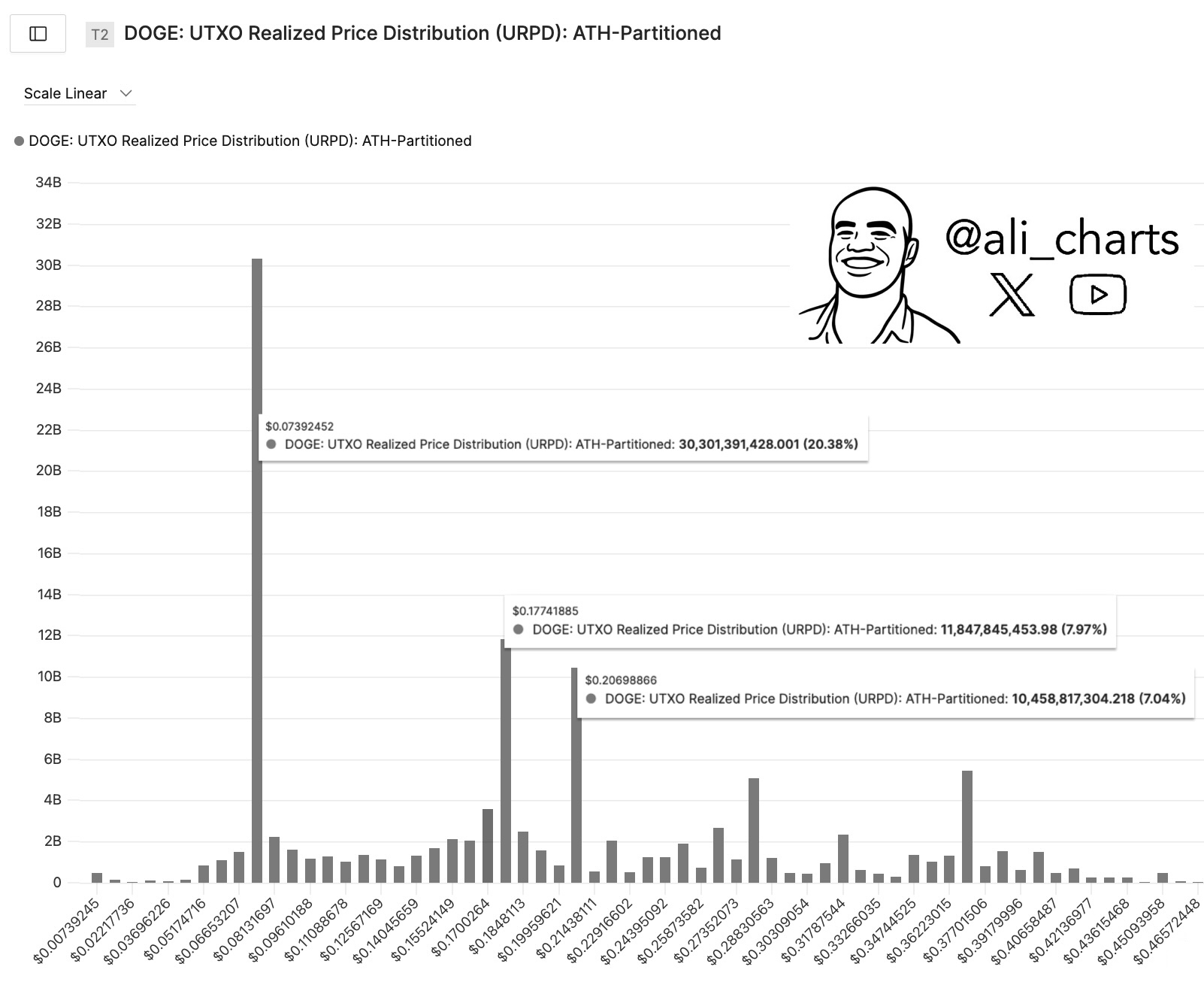

In a new post on X, analyst Ali Martinez has discussed about the resistance walls present ahead for DOGE based on the UTXO Realized Price Distribution (URPD). The URPD is an on-chain metric created by the analytics firm Glassnode that tells us, in short, about the amount of supply that was bought at various levels that Dogecoin has visited in its history.

Coins are said to be ‘bought’ when they become involved in a transaction on the blockchain. As such, the URPD records the price at the time of any coin’s last transaction as its cost basis.

Now, here is the chart shared by the analyst that shows how the Dogecoin URPD is looking right now:

As is visible in the above graph, the largest supply wall that Dogecoin has is present around the $0.07 level, where over 20% of all coins in circulation were last transacted. Given that the DOGE price is currently trading far above this level, all of this supply would be sitting on a notable profit.

Generally, when the cryptocurrency’s price retests the cost basis of investors who were in profit just before, the holders may react by accumulating more if the mood in the market is bullish. This is because of the fact that they may be inclined to think the same level would end up being profitable again in the future, so the retest would look like a ‘dip‘ opportunity.

Similarly, when the retest occurs from the opposite direction, investors can react by selling instead, as they may fear that the asset would fall back again, so this could be their opportunity to at least exit with their entire investment back.

From the chart, it’s visible that in terms of the loss levels of Dogecoin, two currently stick out for their size: $0.18 and $0.21. The former hosts the acquisition level of around 8% of the supply, while the latter that of 7%.

Considering the significant amount of supply present at them, the levels could act as major resistance barriers due to the selling effect explained earlier. If DOGE can cross these levels, however, there are no other supply walls as large in sight. “Breaking through both could be the catalyst for the next major bull rally,” notes Martinez.

DOGE Price

Dogecoin made an attempt at recovery last week, but the memecoin’s price has since returned to its baseline as it’s now trading around $0.17.