The post Bitcoin Price Outlook: Can Reduced Selling Pressure Drive a Surge? appeared first on Coinpedia Fintech News

Currently, the Bitcoin market stands over 30% below the all-time high. In February, the market recorded a drop of 17.5%. In the previous months, it registered a decline of 2.19%. In the last seven days alone, the market has decreased by 3.2%. However, in the last 24 hours, it has witnessed a surge of 0.9%. An on-chain analysis suggests that short-term BTC investors are selling less. Is a Bitcoin Price rebound coming? Let’s explore!

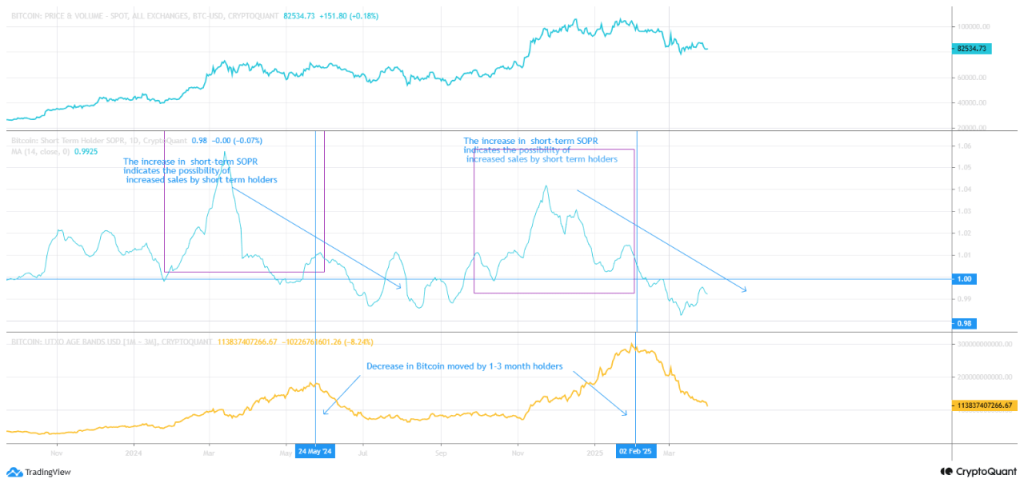

SOPR and UTXO Data Indicate Lower Selling Pressure in the BTC Market

Highlighting data from the Short-Term Spent Output Profit Ratio chart and UTXO Age Band (1-3 months), a crypto analyst suggests that short-term investors are selling less.

This chart group looks specifically at all the Bitcoin that has not been moved for 1 to 3 months. It shows how much BTC is being held by people who have owned it for this short period. Changes in this band can suggest the behaviour of recent buyers – are they holding onto their Bitcoin or are they starting to sell?

Why Are Short-Term BTC Investors Holding Back?

The analysis reveals that short-term Bitcoin investors are holding back. This indicates that short-term BTC investors are confident about the future prospects of the Bitcoin market.

Recently, several analysts predicted that the Bitcoin market would witness a sharp shift in its current trend.

Experts, like Axel Adler Jr, revealed that long-term holders have resumed accumulation. He even predicted that if either the US Federal Reserve or the Trump administration provides positive signals, the Bitcoin price could rise as high as $130K.

Will Bitcoin See a Price Surge As Selling Decline?

Bitcoin’s RSI remains at 48.30, indicating that there is enough room for growth in the market. The BTC price sits at $84,853.24. Bitcoin’s 50-day SMA is $88.056.04. Its 100-day SMA is $93,407.43. Its 200-day SMA is $86,309.97. The 24-hour volume of Bitcoin is $29,690,672,629.

According to analysts, reduced selling pressure may help stabilise BTC prices.

Yesterday alone, the Bitcoin market experienced a rise of over 3.08%.

Historically, April is a favourable month for BTC. Since 2011, at least nine times the market has shown positive momentum in April, compared to six times in March and eight times in May.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

On-chain data suggests short-term BTC investors are selling less, indicating confidence in a potential price rebound.

Historically, April has shown positive momentum for BTC in 9 out of the last 13 years, making it a strong month for potential gains.