On-chain data shows Dogecoin and XRP have recently been seeing the sharpest decreases in Supply in Profit out of the major cryptocurrencies.

Dogecoin & XRP Have Seen A Notable Drop In Profitability During Last 30 Days

In a new post on X, the on-chain analytics firm Glassnode has discussed about the latest trend in the Supply in Profit for the major assets in the cryptocurrency sector.

The “Supply in Profit” here is an indicator that keeps track of the percentage of the total circulating supply of a given digital asset that’s being held at some net unrealized profit.

The metric works by going through the transaction history of each coin on the network to see what price it was last moved at. If this previous transfer value of any token was less than the current spot price, then that particular coin is assumed to be sitting on a profit right now.

The Supply in Profit adds up all coins of this type and determines what part of the supply that they make up for. An alternate indicator known as the Supply in Loss takes into account for the supply of the opposite type. The value of the Supply in Loss can also simply be calculated by subtracting the Supply in Profit from 100, as the total supply must add up to a 100%.

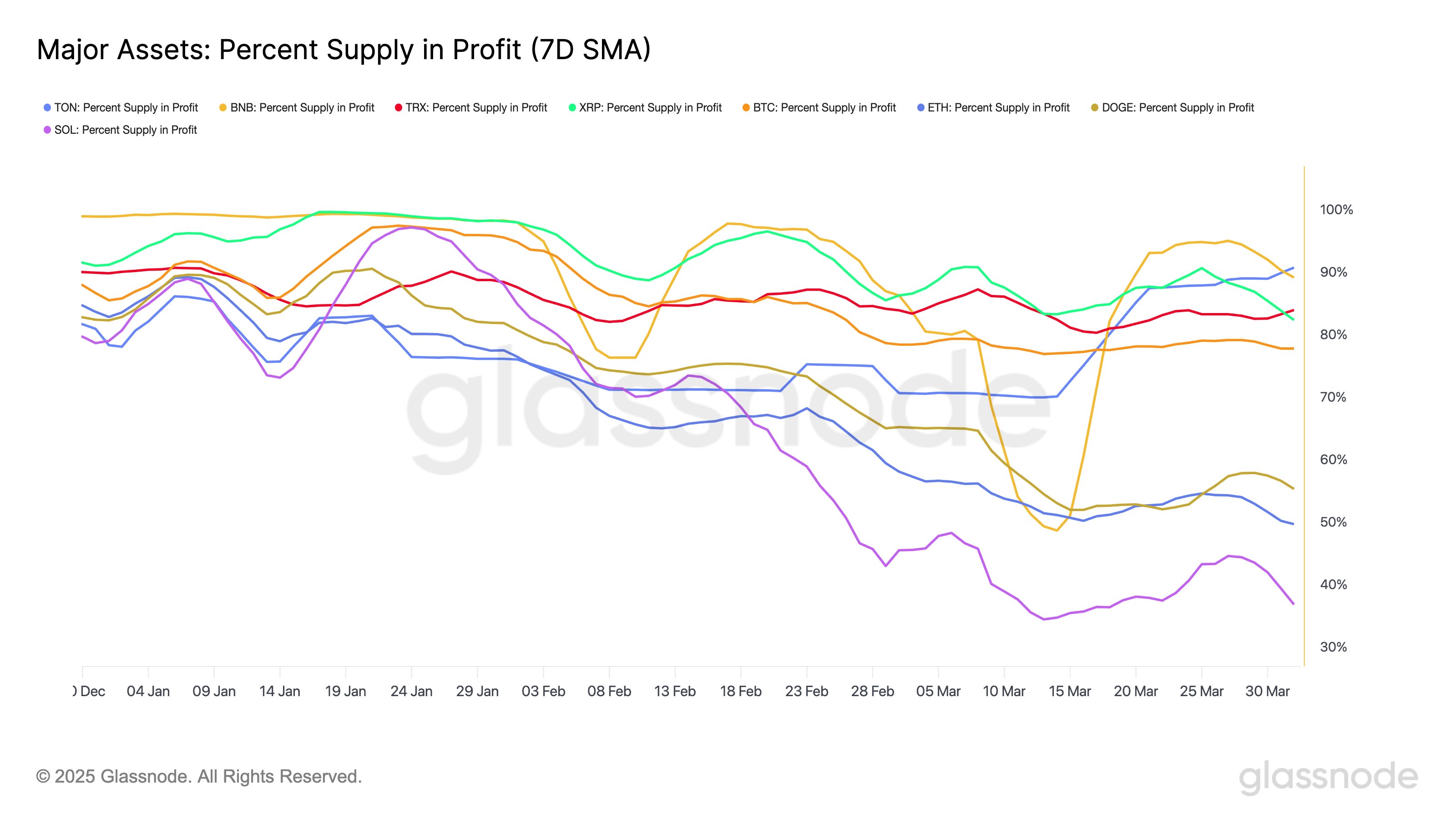

Now, here is the chart shared by the analytics firm that shows the trend in the 7-day simple moving average (SMA) of the Supply in Profit for eight cryptocurrencies over the last few months:

As is visible in the above graph, Toncoin (TON) and BNB (BNB) have seen the Supply in Profit go through a significant increase recently. Over the last 30 days, TON has seen an additional 23.8% of the supply get into the green, taking the total to a whopping 94.1%. Similarly, BNB has seen a rise of 17.4%, putting the metric at 86.3%.

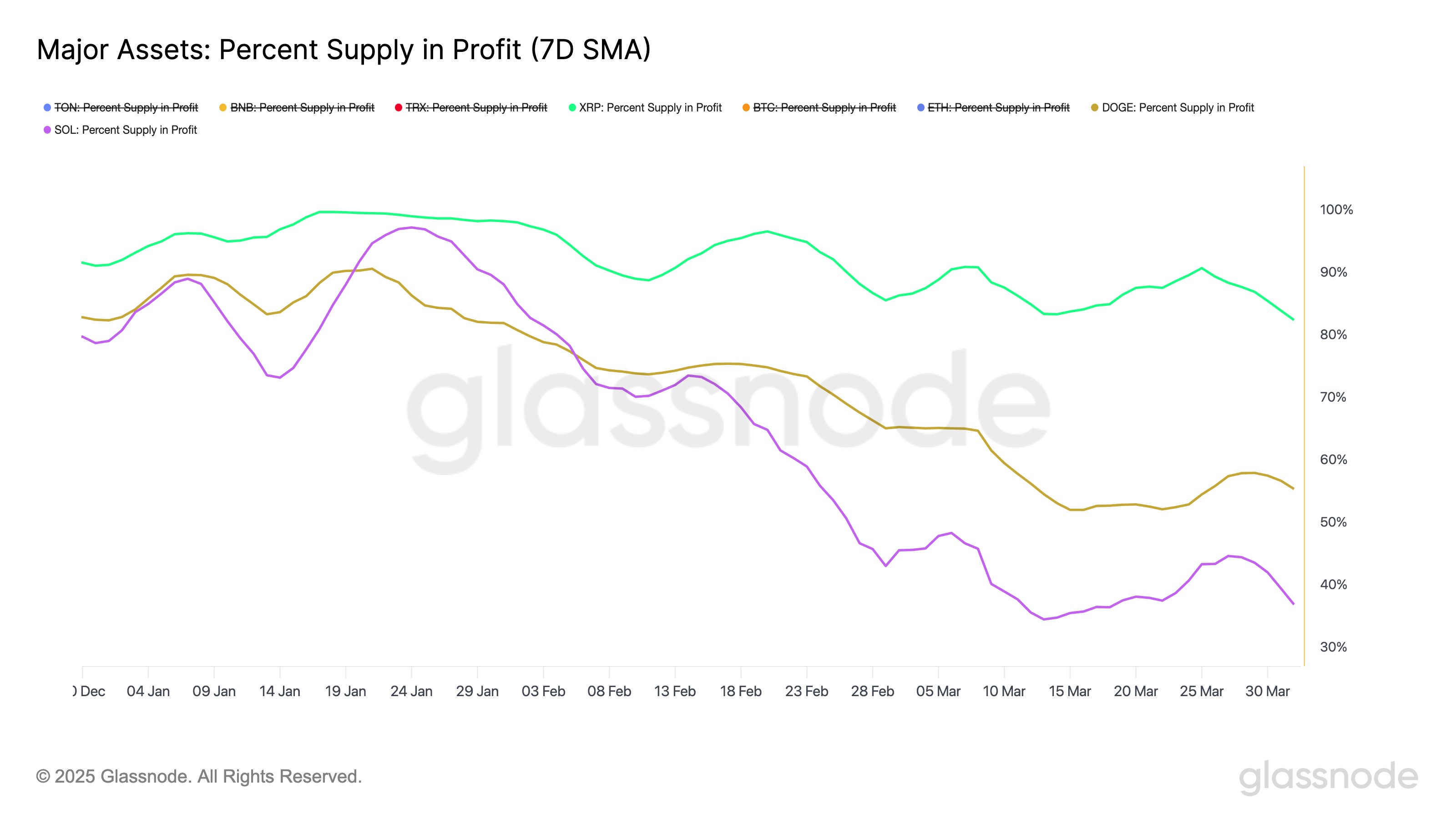

On the other end of the spectrum are Dogecoin (DOGE), XRP (XRP), and Solana (SOL), with each registering a notable decrease in the indicator. Below is a chart that filters out the other assets to focus on the curves for these coins.

With the decrease, XRP has seen another 5.2% of its supply fall into a loss to take the total Supply in Profit to 81.5%. Dogecoin has seen an almost double digit decrease in the metric, but a majority of its coins are still above water as the indicator sits at 53.6%.

Solana hasn’t been so lucky, however, as despite a decline of just 4.4%, only 35.2% of the the cryptocurrency’s supply is currently holding a gain. From one perspective, though, this development may not actually be so bad for SOL. Generally, profit-sellers are what impede bullish moves, but when there aren’t many investors left in gain anymore, the price tends to bottom out.

With Solana and even Dogecoin sitting on a relatively low level of profit supply, it’s possible that their prices could be near a rebound.

DOGE Price

At the time of writing, Dogecoin is floating around $0.173, down more than 11% over the last week.