On-chain data shows the large Ethereum investors have been adding to their holdings recently, a sign that could be bullish for the ETH price.

Ethereum Large Holders Netflow Has Turned Positive Recently

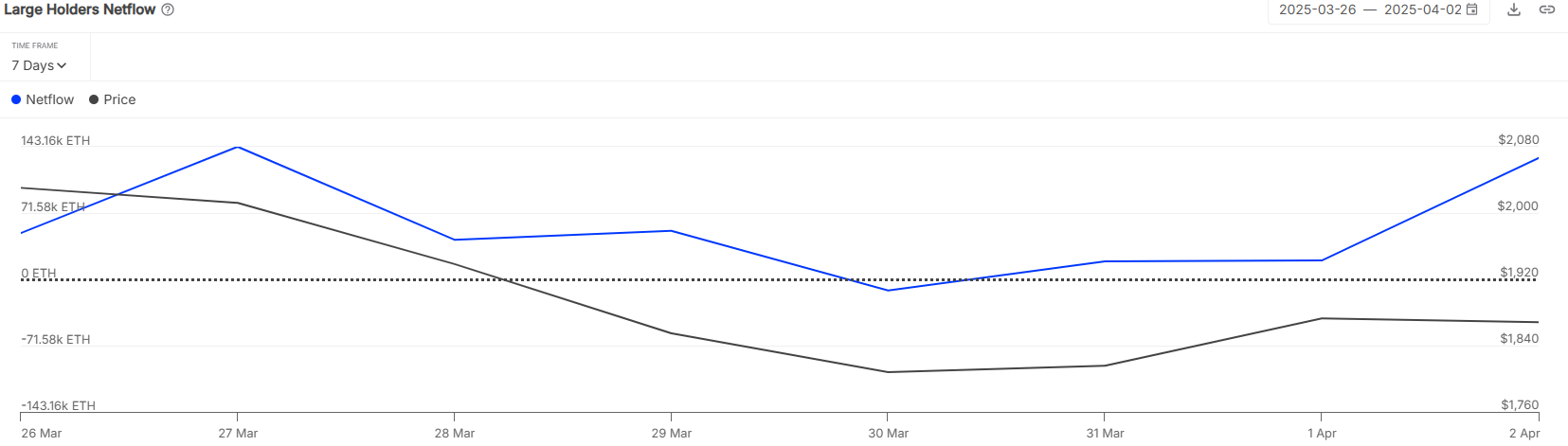

In a new post on X, the market intelligence platform IntoTheBlock has talked about the trend in the Large Holders Netflow for Ethereum. This metric measures the net amount of the cryptocurrency that’s moving into or out of the wallets controlled by the Large Holders.

The analytics firm defines three categories for investors: Retail, Investors, and Whales. Members of Retail hold less than 0.1% of the supply in their balance, that of Investors between 0.1% and 1%, and that of Whales more than 1%.

At the current exchange rate, 0.1% of the ETH supply, the cutoff between Retail and Investors, is worth over $214 million, a very substantial amount. This means that the addresses who are able to qualify for Investors are already quite large, let alone those who have made it to the Whales.

As such, the Large Holders, the actual cohort of interest in the current discussion, includes both of these groups. Thus, the Large Holders Netflow keeps track of the transactions related to Investors and Whales.

When the value of this metric is positive, it means the big-money investors on the network are receiving a net number of deposits to their wallets. On the other hand, it being under the zero mark suggests these key holders are participating in net selling.

Now, here is the chart shared by IntoTheBlock that shows the trend in the Ethereum Large Holders Netflow over the past week:

As is visible above, the Ethereum Large Holders Netflow has remained almost entirely in the positive territory for the period of the graph, which implies that the Investors and Whales have been accumulating. On the second of the month alone, these key entities loaded up on a net 130,000 ETH (about $230 million).

The net inflows for the Large Holders have come while the cryptocurrency has been declining, so it’s possible that this cohort believes the recent prices have been offering a profitable entry into the asset. It now remains to be seen whether this accumulation would be enough to help ETH attain a bottom or not.

In some other news, the Ethereum fee is down to the lowest level since 2020 this quarter, as the analytics firm has pointed out in another X post.

Following a sharp drop of 59.6%, the Ethereum total transaction fees is down to $208 million. According to IntoTheBlock, this trend is “primarily driven by the gas limit increase and transactions moving to L2s.”

ETH Price

Ethereum saw recovery above $1,900 earlier in the week, but it seems bullish momentum has already run out as the coin’s back to $1,770.