The Bitcoin (BTC) market continues to remain in consolidation following another trading week with no convincing price breakout. As multiple analysts continue to speculate on the asset’s next movement, prominent market expert Ali Martinez has identified two resistance zones that could be pivotal to reigniting a crypto bull run.

Bitcoin Must Break Past $85,470 And $92,950 – Here’s Why

Over the past month, Bitcoin has struggled to maintain a sustained uptrend, with investor uncertainty dominating the market. During this period, the leading cryptocurrency has faced multiple rejections, most notably at the $85,000 and $88,000 resistance levels. However, in an X post on Friday, Martinez identified the two resistance zones critical to a Bitcoin bull rally using on-chain data from IntoTheBlock.

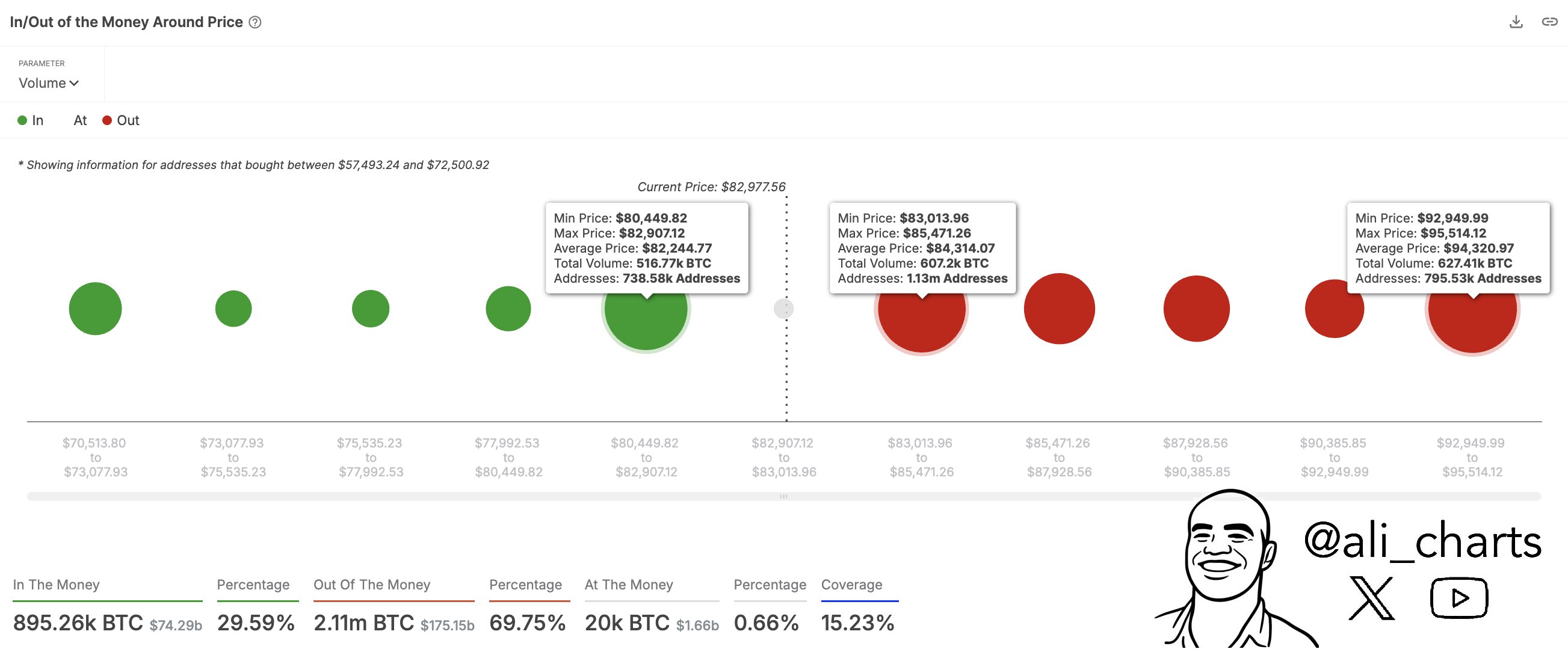

According to the crypto analyst, the first resistance lies at $85,470 which marks the upper boundary of a price barrier that begins at $83,023. Notably, 1.13 million wallet addresses have traded 607,200 BTC within this price range suggesting a strong historical activity that backs potential heavy selling pressure at these levels.

If Bitcoin bulls can push past this initial threshold, the next resistance zone lies at $92,950 – the lower boundary of another price ceiling that extends to $95,514. Compared to the initial resistance, this zone has seen lower investor participation, with 795,830 active wallet addresses. However, its potential market impact is more significant, as approximately 627,410 BTC have been traded within this range.

If Bitcoin can successfully clear both resistance zones, Ali Martinez postulates the premier cryptocurrency could enter a prolonged uptrend and resume its bull rally. However, Bitcoin bulls must avoid any price fall below a crucial support zone at the $80,450 price level.

According to the on-chain data presented, the $80,450 level represents the lower boundary of a key support zone, which extends up to $82,907. Within this range, approximately 516,770 BTC have been transacted, involving around 738,580 active wallet addresses. This data indicates substantial buying activity that could serve as a buffer in the advent of a price fall.

Bitcoin Fees Fall By 57%

In other developments, IntoThe Block also reports that Bitcoin network fees dropped by 57.3% in the past week indicating a decline in user engagement and general investor activity. Albeit, the premier cryptocurrency has shown only a minor 0.11% decline in price during this period.

Following the recent announcement of new US tariffs on imports, Bitcoin and the broader crypto market have responded more positively compared to previous tariff-related news. Ryan Rasmussen, Head of Research at Bitwise Invest, notes that Bitcoin has risen by 2.2% since the announcement on April 2. In contrast, traditional stock markets have seen notable losses, with the “Magnificent Seven” falling by an average of 12.18%.