Following the downturn in the United States’ traditional markets, there has been increased commentary about the crypto bull cycle and its current phase. Nonetheless, the Bitcoin market has remained relatively steady compared to the blue-chip stocks in the US equities market over the past few days.

The price action of Bitcoin has been disappointing yet again this weekend, slipping below the $83,000 mark in the early hours of Saturday, April 5. A prominent crypto analyst has emerged with fresh insight on the future trajectory of the premier cryptocurrency.

BTC Price At Risk Of Sales Pressure?

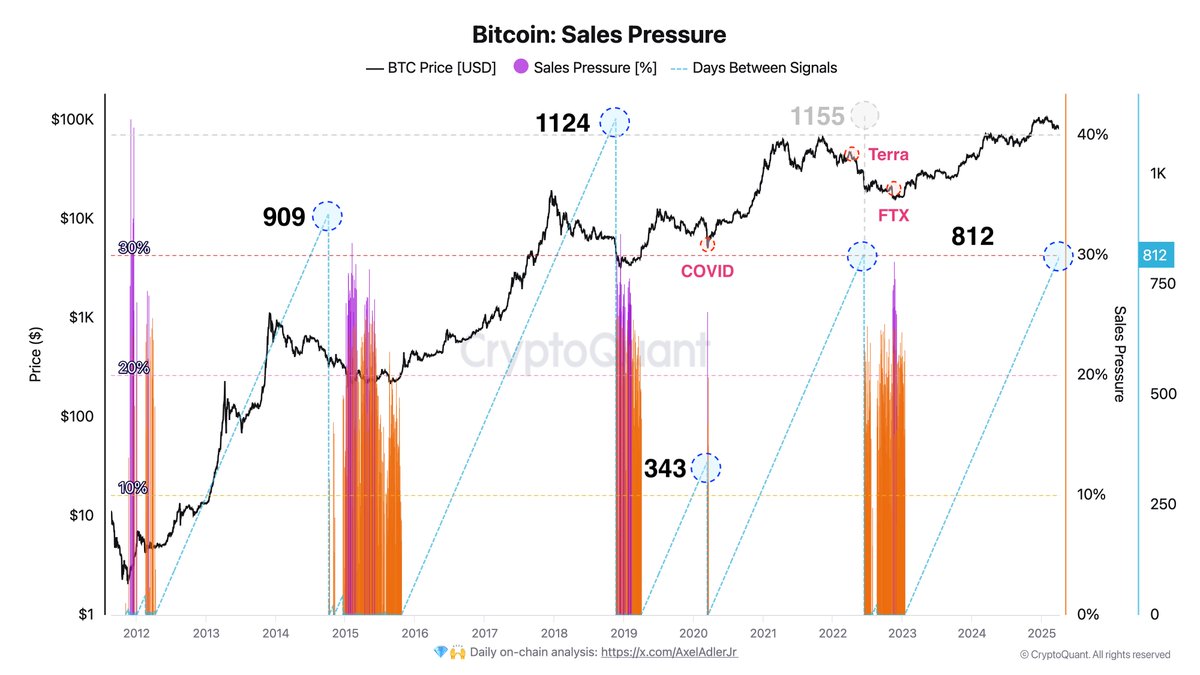

In a recent post on the X platform, crypto analyst Axel Adler Jr. reviewed how the Bitcoin price is faring amid the turbulent macroeconomic headwinds. The relevant on-chain indicator here is the Bitcoin Sales Pressure model, which combines the Net Unrealized Profit/Loss (NUPL) and Spent Output Profit Ratio (SOPR) metrics.

Based on the NUPL and SOPR indicators, the Bitcoin Sales Pressure model tracks when long-term holders may begin selling off their assets, often marking cyclical tops or the start of downward pressure in the market. According to Adler Jr., genuine sales pressure for a digital asset may emerge after 800 days.

The analyst noted:

If, during a bullish rally, no serious negative event akin to a “Black Swan” occurs – triggering fear and forced selling – it could take over 1000 days for sales pressure to develop.

As observed in the chart above, the indicator has reached the 800-day mark, which suggests an increased risk for genuine sales pressure. However, the Bitcoin price has been displaying strength despite the brewing global trade war weighing down on the US equities market. Adler Jr. attributed BTC’s show of resilience to institutional buying, the lack of sales pressure in the spot market, and neutral sentiment in the futures market.

The stock market atmosphere does not seem set for recovery, especially with the VIX (volatility index) rising above 30 while the S&P 500 falling by more than 4%. Crossing these thresholds has been historically associated with further downward pressure for the stock market.

In response to the dwindling market sentiment, US President Donald Trump is believed to have called on the Federal Reserve to resume aggressive monetary stimulus. “We all understand that this could stimulate market growth,” Adler Jr. added.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $83,350, reflecting an almost 1% jump in the past 24 hours.