As Bitcoin (BTC), the market’s leading cryptocurrency, continues to trend lower, recent insights from industry experts highlight critical factors influencing BTC’s trajectory.

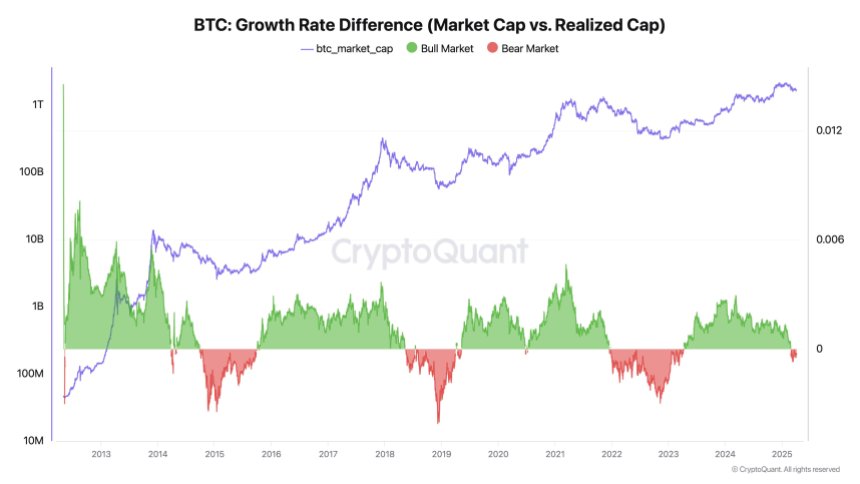

According to Ki Young Ju, CEO of market intelligence firm CryptoQuant, the current Bitcoin bull cycle may be coming to an end. This assertion is grounded in the concept of Realized Cap, a metric that quantifies the actual capital entering the BTC market through on-chain activity.

Insights From Ki Young Ju

For context, the Realized Cap metric operates on a straightforward premise: when Bitcoin enters a wallet, it represents a purchase, and when it leaves, it signifies a sale.

By calculating the average cost basis for each wallet and multiplying it by the amount of BTC held, Ju derives the total Realized Cap. This metric reflects the total capital that has genuinely entered the BTC ecosystem, contrasting sharply with market capitalization, which is determined by the last traded price on exchanges.

A common misconception, according to Ju, is that a small purchase, such as $10 worth of Bitcoin, only increases market capitalization by that same amount. In reality, prices are influenced by the balance of buy and sell orders on the order book.

Low sell pressure means that even modest buys can significantly elevate prices and, consequently, market cap. This phenomenon was notably exploited by MicroStrategy (MSTR), which issued convertible bonds to acquire Bitcoin, thereby inflating the paper value of its holdings far beyond the initial capital deployed.

Key Price Levels For Bitcoin

Currently, Bitcoin appears to be in a challenging position, dropping below the key $80,000 mark. When sell pressure is high, even substantial purchases fail to affect prices, as seen when Bitcoin traded near its all-time high of nearly $100,000. Despite massive trading volumes, the price remained stagnant.

Ju points out that if Realized Cap is increasing but market cap is either flat or declining, it signals a bearish trend. This indicates that while capital is entering the market, it is not translating into price appreciation—a hallmark of a bear market.

Conversely, if market capitalization is rising while Realized Cap remains stable, it suggests that even minimal new investment is driving prices up, indicative of a bull market.

Presently, data suggests that Bitcoin is experiencing the former scenario: capital is flowing in, but prices are not responding positively. Historically, significant market reversals require at least six months to manifest, making a short-term rally seem unlikely.

Adding to the complexity, market expert Ali Martinez has identified key resistance levels that Bitcoin must overcome to regain upward momentum.

Notably, there is a major resistance cluster at $87,000, where the 50-day moving average, 200-day moving average, and a descending trendline from the all-time high converge.

For Bitcoin to resume its upward trajectory, the expert asserts that BTC must break through critical resistance points at $85,470 and $92,950. Additionally, support at $80,450 remains vital; failure to hold this level could lead to further declines.

As of now, the leading cryptocurrency trades at $78,379, recording a 6% decline on Sunday.

Featured image from DALL-E, chart from TradingView.com