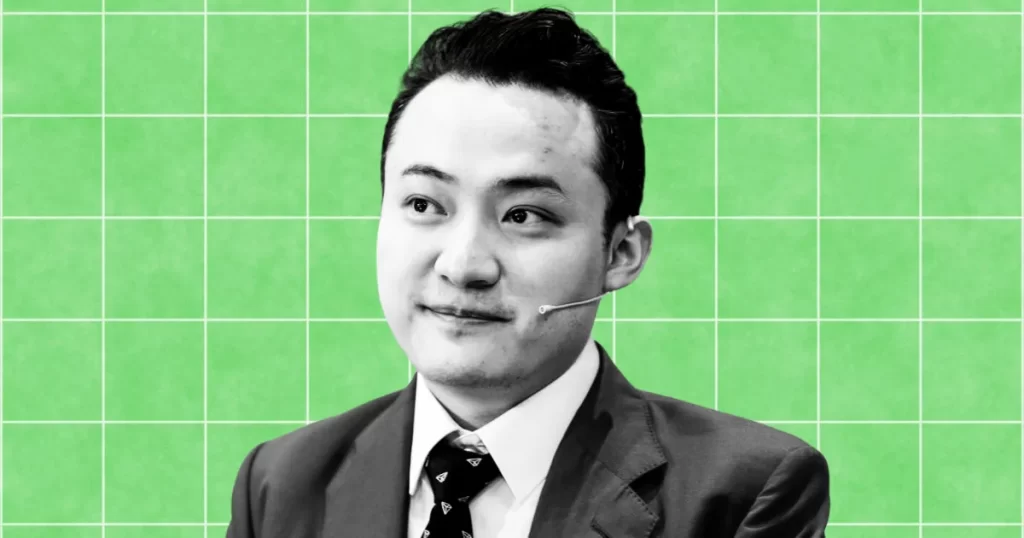

The post Justin Sun Claims First Digital Trust Scandal Is ‘Worse Than FTX’ appeared first on Coinpedia Fintech News

The crypto world is no stranger to scandals, but Tron founder Justin Sun is sounding the alarm on a situation he claims could be even worse than the infamous FTX collapse. The controversy is built around the First Digital Trust (FDT), a Hong Kong-based custodian reportedly involved in unauthorized fund transfers. Sun isn’t pulling any punches—he says this is “significantly worse” than what FTX pulled off.

FTX vs. FDT: What’s the Deal?

According to Sun, while FTX founder Sam Bankman-Fried masked his misuse of funds as collateralized loans backed by tokens and shares, FDT allegedly skipped the smoke and mirrors altogether. In an x post, Sun claims FDT directly took $456 million from TUSD (TrueUSD) custodial reserves without client knowledge or permission, funneling it into a shady Dubai-based company without collateral.

He further alleges that this company laundered the money, and that FDT CEO Vincent Chok played a direct role. That’s a bold accusation, especially considering the implications for users who trusted FDT to safeguard their assets.

FDUSD Depeg and a $50 Million Bounty

The fallout has already started. The FDUSD stablecoin briefly lost its peg, raising red flags. In response, Justin Sun has put up a $50 million bounty to track and recover the missing funds. He’s calling for swift action, warning that the credibility of Hong Kong’s entire financial system is now at risk. Meanwhile, a Hong Kong lawmaker has taken note, promising enforcement action if these claims hold up. So, this isn’t just crypto drama anymore soon, it could become a major legal and political issue.

FDT Fires Back

FDT hasn’t taken the allegations lightly. The company denied everything, calling Sun’s claims a smear campaign meant to damage its reputation and that of FDUSD. They insist they’re solvent and plan to pursue legal action to defend themselves. Despite the controversy, FDUSD has mostly held its value, staying above $0.99. But in crypto, perception matters and damage to trust can be hard to repair.

Why It Matters

Sun argues that while the U.S. acted quickly in the FTX case to protect financial integrity, Hong Kong needs to do the same now. With crypto adoption growing and more governments setting rules, this could become a defining moment for Hong Kong’s crypto credibility.

If Sun’s claims prove true, it might be the biggest crypto scandal since FTX and this time, the world is watching.