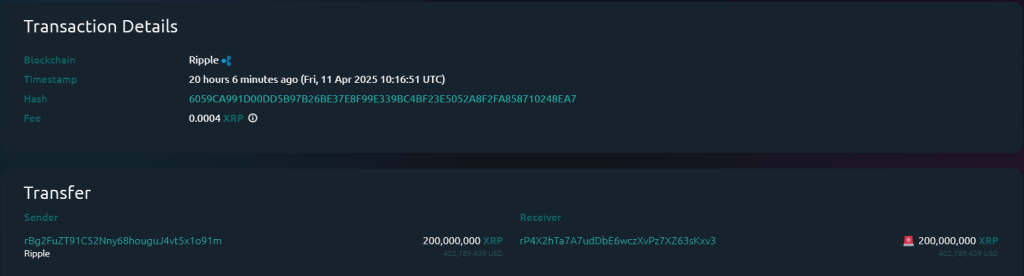

San Francisco-based Ripple has transferred 200 million XRP tokens, worth approximately $400 million, between company-controlled wallets. The massive movement occurred today and was first spotted by cryptocurrency tracking service Whale Alert.

Tracking The Money Trail

The transaction initially appeared to be heading to an unknown destination when Whale Alert reported the funds moving to an unidentified address ‘rP4X2…sKxv3’. But blockchain analytics platform Bithomp later clarified that both the sending and receiving wallets belong to Ripple.

The receiving wallet was created by Ripple on October 2, 2023, with an initial funding of 70 million XRP. Since its creation, this wallet has only interacted with other Ripple-linked addresses, strengthening the evidence that this was an internal transfer rather than funds moving to an outside entity or exchange.

200,000,000 #XRP (402,739,474 USD) transferred from #Ripple to unknown wallethttps://t.co/cZz7k5fum8

— Whale Alert (@whale_alert) April 11, 2025

Why The Big Money Move

According to crypto community figure XRP_Liquidity, who tracks Ripple’s token movements, the transaction represents standard treasury management – Ripple simply shifting money between its own accounts. The 200 million XRP tokens remain untouched at the receiving address, suggesting no immediate plans for their use.

The receiving wallet now holds around 290 million XRP tokens, valued at about $577 million as of the current XRP price of $2.04 per token, based on figures by Coingecko.

According to historical trends, the funds can be used for various purposes in Ripple’s business operations. They can be used to finance On-Demand Liquidity (recently renamed Ripple Payments), finance exchange-traded products that mirror XRP’s value, or give liquidity to cryptocurrency exchanges where XRP is listed.

The Bigger Financial Picture

The sending wallet didn’t empty its cash register with this transfer. It still contains 200 million XRP tokens. That wallet had received 300 million XRP on April 2 from another Ripple-linked address, which itself had received 500 million XRP from Ripple’s monthly escrow release.

Ripple maintains most of its XRP holdings in escrow accounts, with programmed releases occurring monthly. The April release showed unusual timing compared to Ripple’s standard practice.

Breaking From Routine

Ripple broke from its traditional first-of-month schedule for its April token release. Instead of unlocking the funds on April 1, the company first returned 700 million XRP to escrow, then released 1 billion XRP on April 3.

This shift in schedule runs counter to Ripple’s established tradition of releasing tokens on the first day of each month, although the company has not commented publicly on its reasoning for this timing change.

The wallet transactions are significant, as XRP trades at over $2 per token, giving the cryptocurrency such a high valuation that even normal transfers are worth several hundreds of millions of dollars.

These huge transfers are usually followed closely by crypto market watchers, as they can on occasion be indicative of any potential future market move or strategic decision taken by the company.

Featured image from Gemini Imagen, chart from TradingView