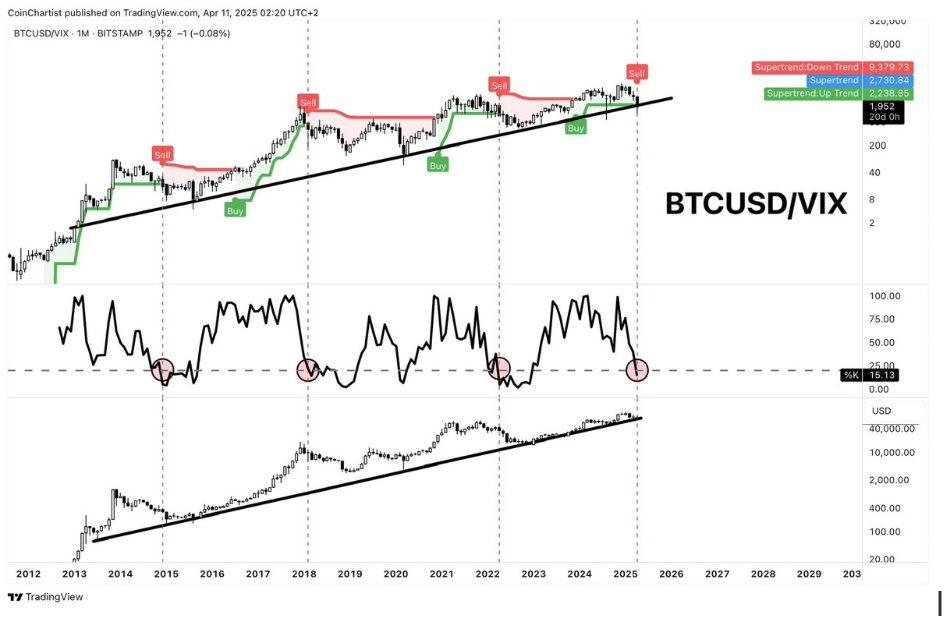

Technical expert Tony Severino has warned that the Bitcoin/VIX is not as bullish as market participants might believe. Instead, the expert revealed that the current indicators point to the flagship crypto being in a bear market.

Bitcoin/VIX Points To A Bear Market: Analyst

In an X post, Severino warned that the Bitcoin/VIX isn’t bullish as some crypto influencers might paint it out to be. He remarked that the technical analysis of it suggests that the current signals are what market participants tend to see during Bitcoin bear markets. However, the expert noted that the month isn’t over yet, which suggests that these indicators could still turn bullish.

Severino previously highlighted several reasons why he is no longer bullish on Bitcoin and other crypto assets. Back then, he alluded to BTC’s chart, which, based on the Elliott Wave theory and other technical indicators, showed that the flagship crypto has likely topped in this market cycle.

Severino previously highlighted several reasons why he is no longer bullish on Bitcoin and other crypto assets. Back then, he alluded to BTC’s chart, which, based on the Elliott Wave theory and other technical indicators, showed that the flagship crypto has likely topped in this market cycle.

Amid Severino’s warning, crypto analysts like Saeed have offered a more bullish outlook for Bitcoin. Saeed stated that this correction is simply a healthy retracement and that the flagship crypto’s broader trend is still bullish. The analyst highlighted $85,000 as the level Bitcoin needs to break above to reach new highs.

The macro side also looks to be bullish for Bitcoin at the moment. The latest CPI and PPI inflation data, which were released, came in lower than expectations, raising hopes of a Federal Reserve rate cut soon. According to a recent report, Boston Fed President Susan Collins also assured that the US central bank is ready to help stabilize the market if necessary.

With US President Donald Trump’s tariffs persisting, the US Fed might have to step in soon, which is bullish for Bitcoin and other crypto assets, as more liquidity will flow into them.

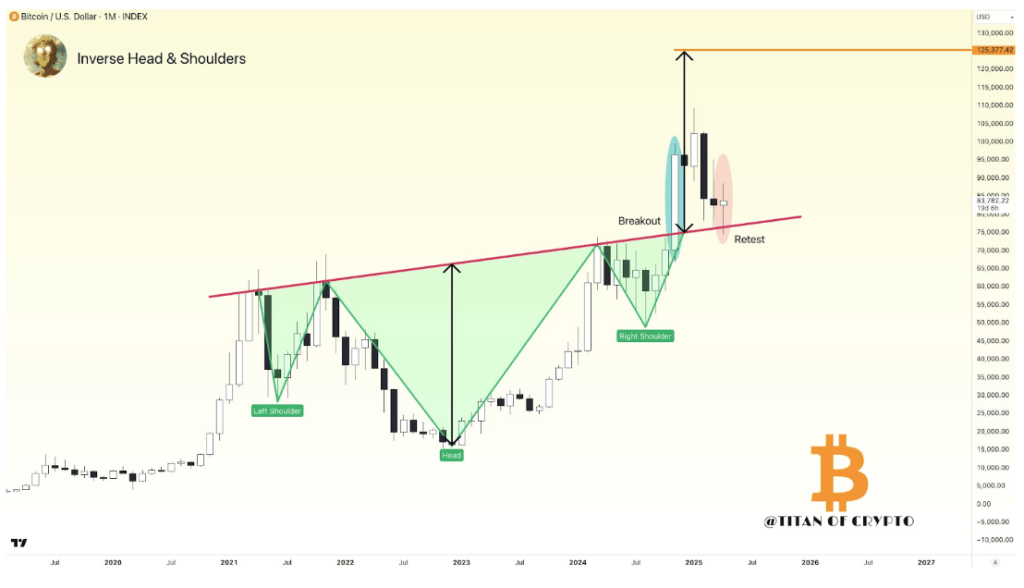

Bullish Technical Analysis For BTC

In a recent X post, crypto analyst Titan of Crypto revealed that Bitcoin is forming an inverse Head-and-Shoulders pattern, although it still looks like a clean retest for now. He remarked that if this pattern plays out, the flagship crypto could reach $125,000 this year, marking a new all-time high (ATH).

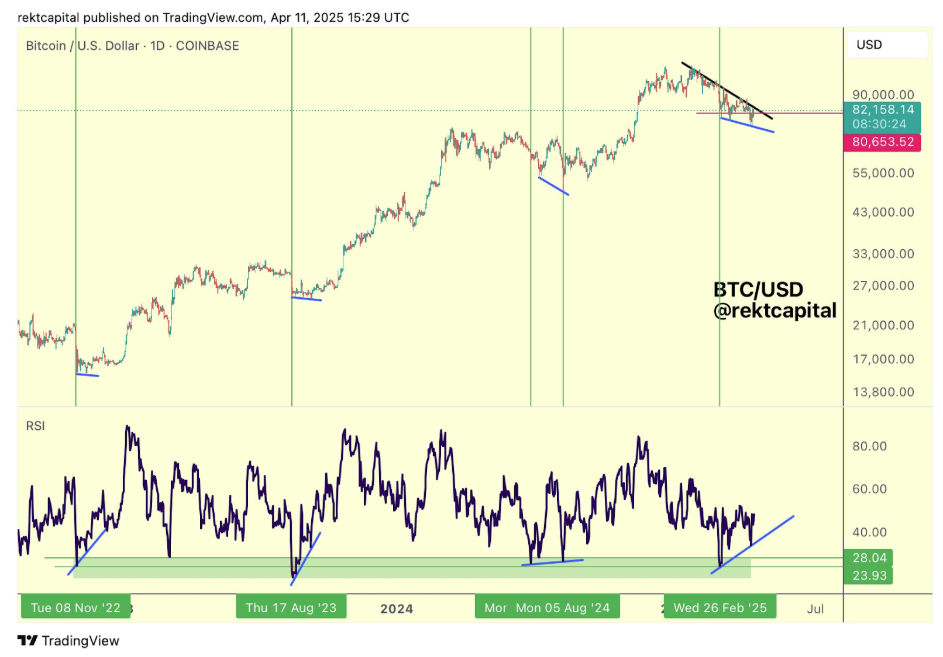

Meanwhile, crypto analyst Rekt Capital revealed that Bitcoin is developing another Higher Low on the Relative Strength Index (RSI) while forming Lower Lows on the price. He noted that throughout the cycle, BTC has formed bullish divergences like this on a few occasions. This is a positive for the flagship crypto, as each divergence has always preceded reversals to the upside, indicating that BTC could again rally to the upside soon.

At the time of writing, Bitcoin price is trading at around $83,400, up over 3% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pexels, chart from TradingView