Developments around the global regulation, hash rate and adoption of Bitcoin made for a unique year in 2021. So how will 2022 play out?

This past year was certainly a unique one for bitcoin. We saw the first bitcoin exchange-traded fund (ETF) get approved in the United States, the largest-ever Bitcoin conference in Miami, the much anticipated Taproot upgrade, all-time highs nearing $70,000, oh, and a nation state made bitcoin legal tender. Despite all this exciting news, some things never change — the FUD was as prevalent as ever. Bitcoin saw a variety of bans throughout 2021 and, to no one’s surprise, China stole the show in this regard.

Below is a list of bitcoin bans in 2021 alone:

- Turkey banned all bitcoin payments

- Nigeria banned all regulated institutions (financial and non-financial) from “dealing in crypto currencies or facilitating payments for cryptocurrency exchanges”

- Iran banned the trading of bitcoin mined abroad and banned domestic bitcoin mining as well (though the latter measure was lifted before being reimposed)

- Last, but not least, China banned financial institutions and payments companies from offering bitcoin services; then it brought the hammer down on bitcoin mining

With 2021 nearly in the rearview mirror, I’ve been thinking a lot lately about what geopolitical bitcoin moves will occur throughout 2022. Below, I offer up a few questions to think about as we approach the new year:

- On a global scale, will we see bitcoin regulation turn friendly or grow increasingly hostile?

- Will hash rate continue to accumulate in the U.S. (possibly eclipsing a 50% share) or will we see a greater distribution moving forward?

- Will another country adopt bitcoin as legal tender? And if so, which one? There couldn’t be multiple throughout 2022, could there?

These questions fall into three categories: hash rate, regulation and adoption. I’ve addressed each below in more detail.

Regulation

If we step back and look at 2021 regulation on a global scale, would you think the overall trend was friendly or hostile? Even with the passing of El Salvador’s Bitcoin law, I’d say the global regulatory environment is still quite hostile toward Bitcoin. Iran, Turkey and Nigeria all made hostile moves in 2021. India and the State of New York considered hostile regulatory action as well. We all know what happened in China.

While the news of bans and corresponding FUD was prevalent, there is still a sense of optimism in the air. After the dust settled post-El Salvador’s bitcoin law, the obvious next question was: Who’s next? Many assumptions have been made about it being another Latin American country. This certainly makes sense.

In retrospect, El Salvador was almost the perfect country to make this huge leap. It is a small nation that has struggled economically and doesn’t have autonomy over its currency. As a dollarized country, Salvadorans are subject to the whim of the U.S. dollar and the Federal Reserve. I’m not going to debate whether severing ties with the colón in 2001 was the right move (Alex Gladstein covered that topic well here), but I certainly think taking a step toward a Bitcoin standard was.

El Salvador, like many countries in Latin America, is often harmed by U.S. foreign policy and International Monetary Fund (IMF) intervention. The Cantillon effect created by the U.S. hurt the people of El Salvador by inflating their local currency (and any benefits accompanied by this hidden tax are not seen by Salvadorans), enacting sanctions and controlling trade policy. The IMF harms the people of El Salvador by keeping the country indebted and degrading its credit quality to ensure unfavorable terms for future loans (or even holding hostage future lending prospects).

“El Salvador bond spreads to U.S. Treasuries hit a record high on Thursday on growing investor fears the Central American nation will not reach a potential $1 billion loan agreement with the International Monetary Fund and faces negative credit implications linked to its use of bitcoin.”

So, what did El Salvador do about this? It opted out (though not completely). It took a step in the direction of financial sovereignty and a corresponding step away from nefarious U.S. statecraft and IMF financial tyranny. But El Salvador is not the only struggling, dolarized country in Latin America. So, again I’ll ask, who’s next?

Politicians across Latin America have been equipping their laser eyes, starting to engage with the bitcoin community and proposing pro-bitcoin legislation. Little has materialized as of this writing (on the surface, at least), but we all know bitcoin acts “gradually, then suddenly.”

Congressman Carlitos Rejala of Paraguay, Mexican lawmaker Eduardo Murat Hinojosa, Panamanian congressman Gabriel Silva and Brazil’s Federal Deputy Aureo Ribeiro have all signaled support for bitcoin in one way or another.

It very well could be one of these countries that becomes the next Bitcoin hub, whether it be via a legal tender law or otherwise friendly regulation. And just maybe, we won’t be talking about another single country making bitcoin legal tender, but a handful when we look back at 2022.

Even if Alexander Höptner’s prediction of five more developing countries adopting bitcoin as legal tender by the end of 2022 turns out to be accurate, there will still be FUD (there will always be FUD). We likely haven’t seen the last of Bitcoin bans and they may become more sophisticated and more strictly enforced as financial elites across the globe feel the increased pressure put upon them by this new freedom money.

“In reality, U.S. economic statecraft is alive and well in the region, and helped foment the dire conditions that sparked the recent wave of uprisings.”

–Alexander Main, director of international policy at the Center for Economic and Policy Research, on recent protests across Latin America

Hash Rate

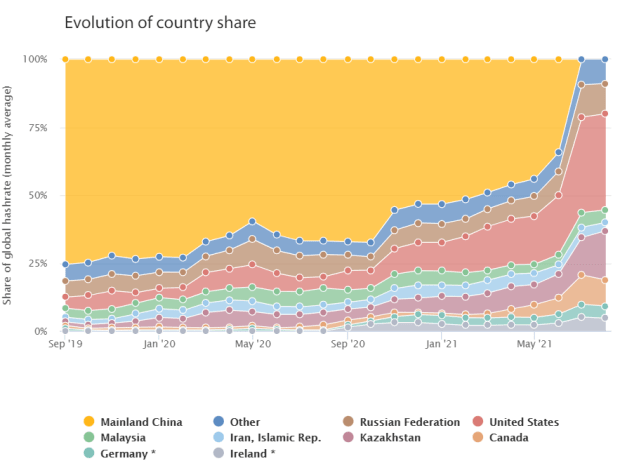

In the fall of 2019, Mainland China controlled approximately 75% of the global Bitcoin hash rate. That number fell, but was still over 50% as we kicked off 2021. Now, in the early days of 2022, it sits at 0%.

This was one of the best stories in bitcoin in 2021. Sure, the FUDsters were sounding the alarm when China banned bitcoin mining this past summer, but that was to be expected and they failed to zoom out. China enacting a legitimate and all-out ban on bitcoin mining certainly hurt the overall hash rate at the time, so the price dropped accordingly. Alarms were sounded. Articles were written. The death of bitcoin was yet again declared.

Not so fast. Many bitcoiners knew this would actually be a good thing. It may not have been obvious from the outside looking in, but it was clear as day to those who get it. A mass exodus of bitcoin mining from China would result in a greater distribution of global hash rate. This is a huge deal. Not to mention that this does away with one of the most prominent anti-bitcoin arguments — that China has too much control of Bitcoin infrastructure or might co-opt the network by a hostile miner takeover.

As is evident in the below visual, many countries benefited from the China mining ban: Russia, Kazakhstan and the United States chief among them. The U.S. started the year with roughly an 11% share of the global hash rate. This number (as of August, per the most recently available data) sits at 35%. What are the odds this number continues to grow? When does it go from something to celebrate to a point of concern?

As an American, I was happy to see miners coming to the U.S. However, stepping back and recognizing just how fast the U.S. tripled its hash rate, I believe there’s some cause for concern. I wouldn’t want any one country to lay claim over China’s vacated throne of the dominant player in global hash rate. Is it possible that 75% of the hash rate being in the U.S. would actually be worse than when that same concentration was in China?

The U.S. might be behind the EU in terms of sustainability regulation, but it seems intent on closing that gap fast. With so many corporations leaning into ESG, the topic of ESG and Bitcoin is certainly not going anywhere. This would call into question bitcoin’s fungibility if “green bitcoin” were to be priced at a premium. It would also be in direct conflict with the free market ethos that Bitcoin naturally promotes.

While the Chinese regulatory environment was uncertain and oftentimes really harsh toward bitcoin, it ultimately decided to push miners out as opposed to co-opting them. Since miners benefit from economies of scale, they’ll likely trend toward centralization over time. This makes regulatory capture more of a concern, whether it be in China, the U.S. or another other country. The next time a major geopolitical move is taken by a global mining power, it might take the form of state control rather than a ban. Even though El Salvador mining bitcoin with geothermal energy is undoubtedly really cool, state-owned bitcoin mining facilities is not a trend I want to see emerge.

This might be a bit farther out than 2022. It might be unrealistic altogether. Maybe it’s even one of those chances bitcoiners would be willing to take, as it might not arise until we’re at or near hyperbitcoinization. Still, it’s worth some consideration as we look ahead to the short- and long-term futures of bitcoin.

Adoption

Bitcoin adoption has exploded over the years and is now estimated to be north of 100 million users. Bitcoin users include institutional and retail investors, humanitarians, bankers, government officials, large and small businesses, refugees and everyone in between. Even if we were to say “that 100 million seems really low” and infer it might be closer to double that, we’d only be at roughly 4% to 5% of adults owning bitcoin globally. That’s comparable to the internet in 1999.

If we continue the trends seen in Bitcoin adoption over the past couple years, the number of global users will reach one billion sooner than we know it. Trying to predict what will happen to bitcoin’s price, hash rate or adoption in the short term is a fool’s errand, but we can say with near certainty that Bitcoin’s user base will expand over longer periods of time.

It’s impossible to know exactly how many users there are, but below are some trends that clearly illustrate how adoption is rapidly increasing:

- Six percent of U.S. investors (defined as those with $10,000 invested in stocks, bonds or mutual funds) say they own bitcoin, up from 2% in 2018.

- Institutional investors are beginning to favor bitcoin over gold.

- Bitcoin’s use for everyday savings, peer-to-peer transactions and remittance payments is becoming more prevalent in the places that need it most (for example, adoption shot up 1,200% year-over-year in Africa).

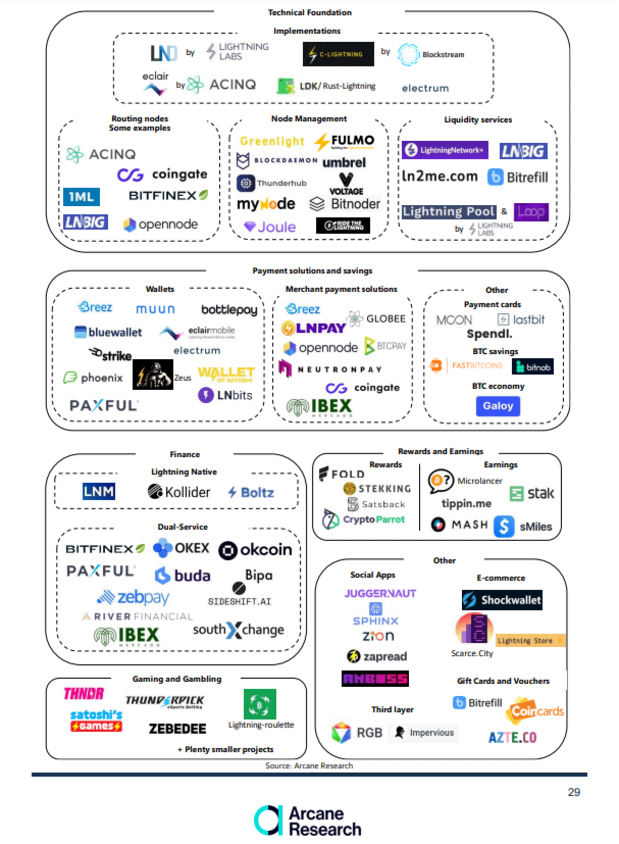

The final bullet point above goes hand in hand with the growth of the Lightning Network. This has been my personal favorite trend in Bitcoin adoption this year. Nation state and institutional adoption will certainly have a greater upward pull on bitcoin’s price, but the Lightning Network is how we onboard millions and eventually billions around the globe, enabling near-instant and zero-cost micropayments. The Lightning Network has more than tripled in capacity this year and the below image shows just how robust development is within the Lightning ecosystem.

The velocity with which Bitcoin is adopted by the average person may have less impact on the price compared to when whales make big splashes, but it is a signal that needs to be closely monitored. The President of El Salvador cited bitcoin’s adoption in Bitcoin Beach as a use case for the country’s legal tender law. Regulation and adoption go hand-in-hand, and often it is assumed that regulation will impact adoption, and not the other way around. That statement might sound logical, but bitcoin has been known to challenge our assumptions.

Places like Nigeria, Pakistan, India and China have all been quite hostile toward Bitcoin and yet, their citizens are among the most prevalent users. Why is that? That’s because bitcoin is freedom money. The need for bitcoin in each of those countries is higher than that in the West.

Bitcoin is not just number go up (in monetary terms) technology, it is adoption go up technology. I’ve heard the phrase “bitcoin is inevitable” frequently used within the community. I’m not one to take things for granted, but that is a statement I agree with given a long enough time horizon. If I game out polar scenarios, one with favorable and one with unfavorable regulation, I end up at the same result of increased adoption.

Many individuals and even more institutions need friendly regulation for them to get on board, whereas financial tyranny, extreme inflation and societal repression will force the disenfranchised to opt-out of their current monetary system.

Closing out this point with one of my big questions for 2022: Will bitcoin adoption explode this upcoming year? Or will it go up at a more controlled pace?

I highly doubt I’ll be looking back at 2022 a year from now and be writing an article about how the number of global bitcoin users actually went down since I wrote this piece. What I’ll be looking out for instead is certain dominos falling that push the rate of adoption to something we’ve never seen before.

Wrapping Up

While I addressed hash rate, adoption and regulation separately in this article, they certainly can’t be separated in real life. Each of these three ideas are inherently linked.

I’m incredibly bullish on bitcoin looking ahead to 2022 and even more so as we look farther out. That doesn’t mean we don’t have anything to be weary of and that doesn’t mean that there isn’t a lot of work left to do, people to onboard, and FUD to fight, but I remain as optimistic as ever. My hope is that 2022 is another great year for Bitcoin and that one year from today I can pen a similar piece as we head into 2023.

This is a guest post by Nick Fonseca. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.