By Grace ([email protected])

Data source: The Sandbox Dashboard

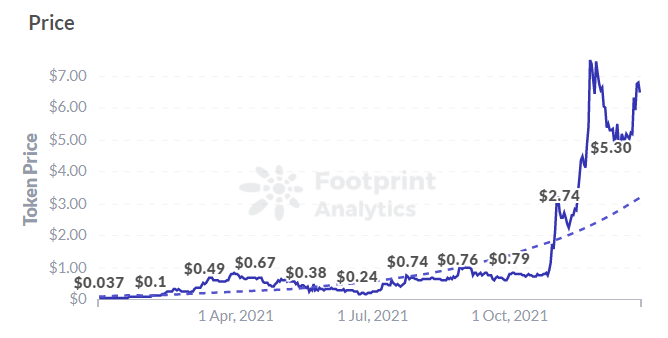

The Sandbox is one of several major GameFi projects whose token jumped by a couple of thousand percent in October and November.

As household names like Facebook, now Meta, make moves in the metaverse and virtual plots of land see astronomical sale prices—last month, a virtual plot of land in The Sandbox sold for a record $4.3 million—users and investors need to determine how different games are unique.

This will prove increasingly important as dozens of new games pop up, with early entrants no longer being able to grow based on the novelty of the metaverse alone. In this article, we’ll examine The Sandbox.

What is The Sandbox

The Sandbox is a blockchain-based game based around virtual real estate. It is deployed on Ethereum and its native token is SAND, an ERC-20 token. SAND can be used to play games, trade, provide pledges for liquidity mining and participate in DAO governance.

How to Make Money in The Sandbox

Play-to-earn is the main economic model for GameFi projects, including for The Sandbox. Players can start earning SAND via three tools:

- Game Maker: Players create their own 3D games, deploy them on their plots, attract other players, and charge entrance fees.

- VoxEdit: Players can create their own voxel-based NFTs to sell in the marketplace.

- Marketplace: Players can buy and sell wearable NFTs, land, characters (called “entities”), and more.

Assets in The Sandbox

The three assets of value in the Sandbox are:

- LAND/Estate: The smallest parcel of in-game real estate is a LAND, and many LAND taken together make up an Estate. Players with LAND can deploy games, host events, showcase their NFTs, and more.

- NFTs: Players without LAND can still create their own NFT assets, which include “entities”, equipment, wearables, and art.

- SAND: To buy LAND of NFT assets, players must have SAND, which is the currency of The Sandbox. SAND also buys gems and catalysts to infuse into some assets.

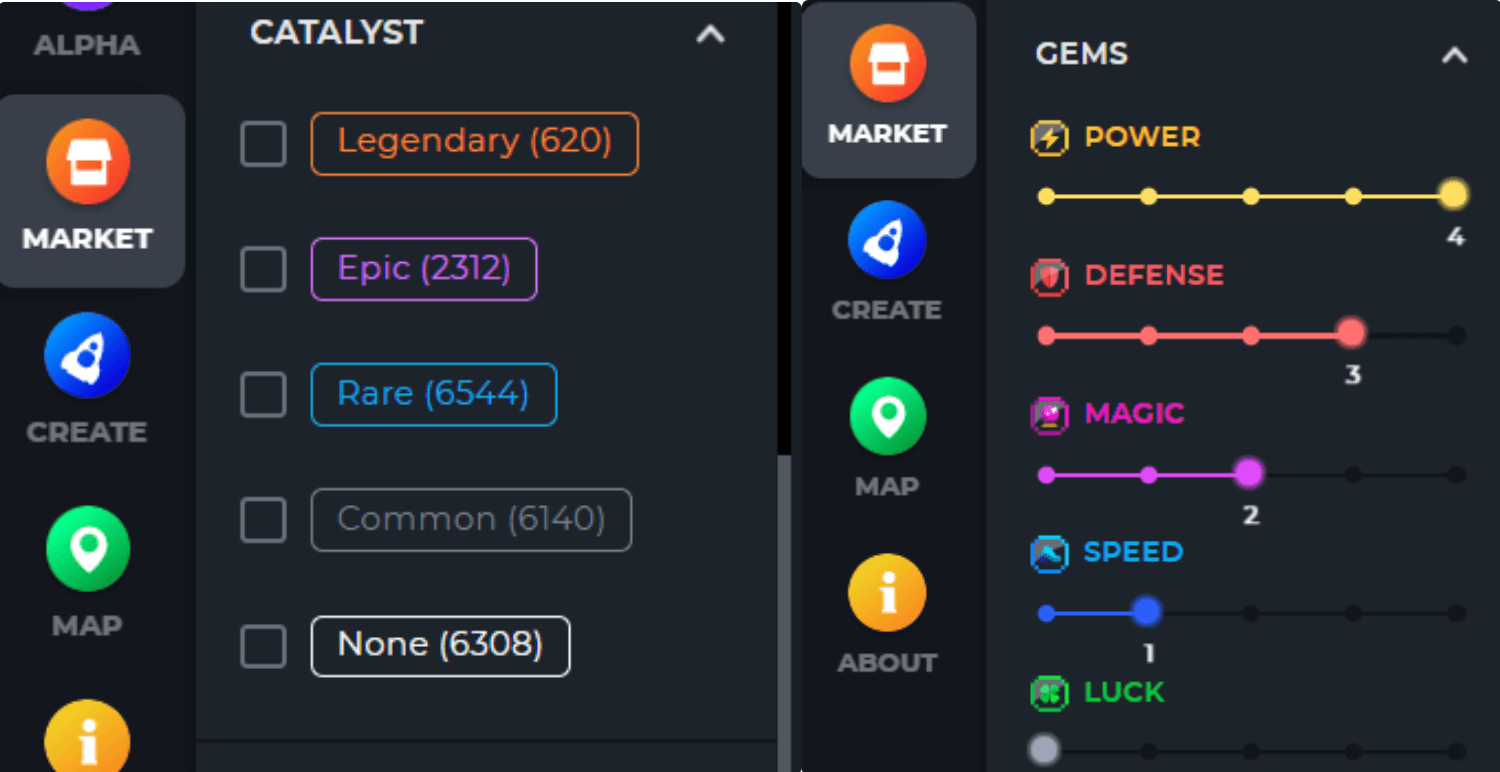

Catalysts and Gems

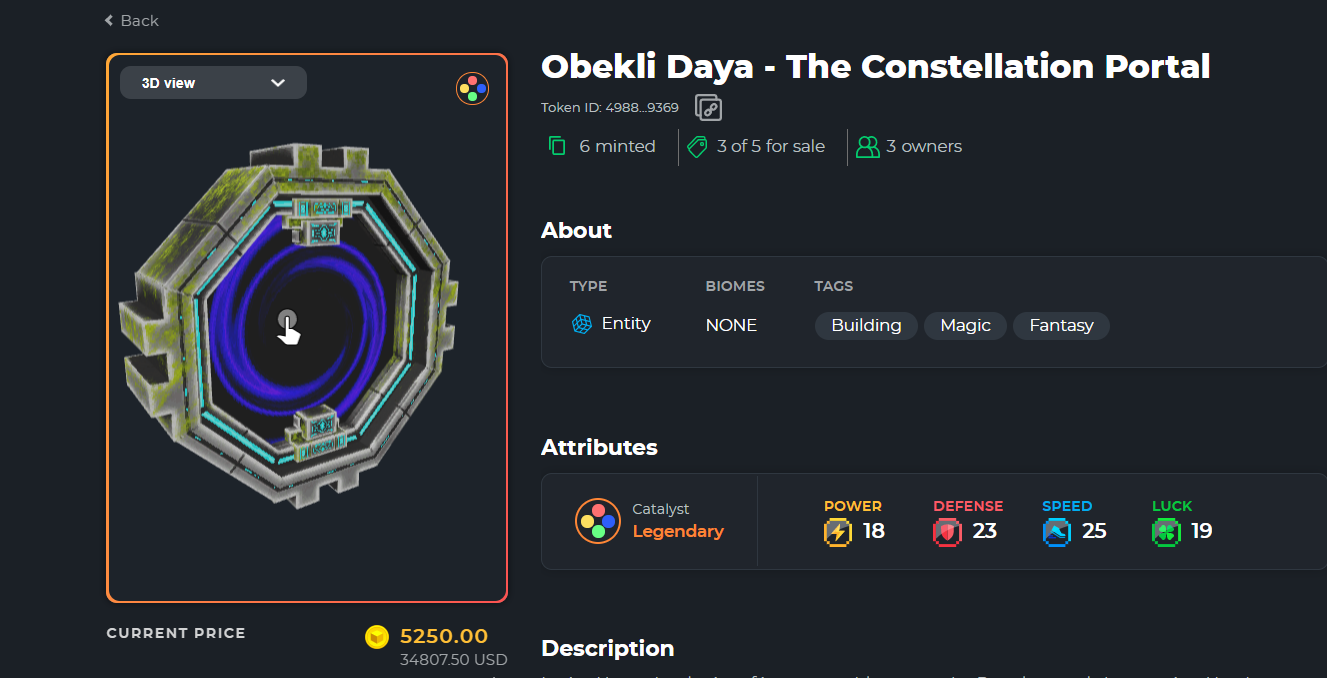

Catalysts and gems give some in-game assets, namely “entities” and “equipment”, their characteristics and properties. The five characteristics which items can have are power, defense, magic, speed, and luck.

The higher the level of catalysts and gems in the asset, the higher the scarcity and price. The highest price ever paid for an object in The Sandbox was 5,250 SAND, or approximately $35,000.

Wearables and Art do not require the addition of catalysts and gems and are generally priced according to their scarcity.

The most anyone has ever paid for a piece of in-game art in The Sandbox was Lululand at 122,400 SAND, or approximately US$810,000.

How to Participate in The Sandbox

To take part in The Sandbox, you can play and earn SAND, create your own games, rent your LAND for a commission, create assets, or become an investor who buys and sells the game’s assets without ever playing.

The Sandbox has already developed a fairly sophisticated economy that supports many types of roles.

Fund Incentive Plans and Funding

To promote the development of games, The Sandbox launched its Game Maker Foundation and Creators Foundation to incentivize game developers and NFT creators, respectively, with prizes up to $30,000. It will give rewards to 1,000 creators and 100 game developers.

According to official sources, The Sandbox is currently sponsoring 18 game developers and over 100 creators.

Additionally, The Sandbox’s parent company, Anomica Brands, has completed three funding rounds in 2021, raising a total of $203 million.

In November, The Sandbox received $93M led by SoftBank Vision Fund 2.

The Future of The Sandbox

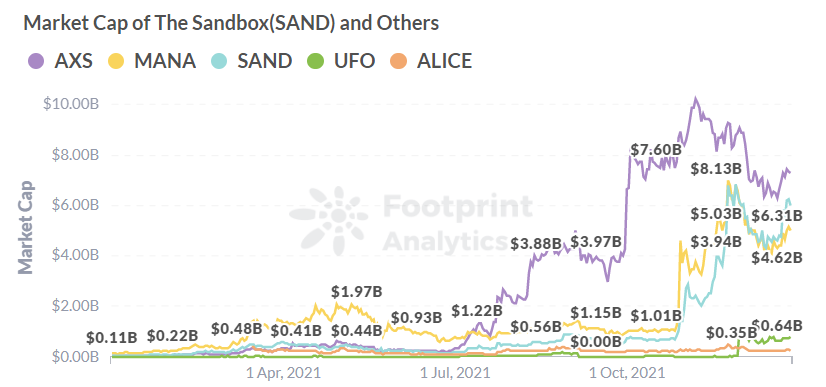

Footprint Analytics data shows that The Sandbox is currently the second most popular play-to-earn game, with a market cap of $5.98 billion, just behind Axie Infinity and slightly ahead of Decentraland.

While The Sandbox is trending upwards, its official roadmap shows no major innovations until 2023 besides the launch of DAO governance in 2022. At the same time, more and more metaverse and GameFi projects are being launched, challenging early entrants like The Sandbox and Decentraland.

What is Footprint Analytics

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Telegram: https://t.me/joinchat/4-ocuURAr2thODFh

The post Footprint Analytics: What Will 2022 Bring for The Sandbox? appeared first on CryptoSlate.