The price of bitcoin is down 16% over the last 30 days and since the crypto asset’s all-time high (ATH) on November 10, 2021, bitcoin has lost more than 38% since it surpassed $69K per unit that day. Meanwhile, crypto advocates are furiously debating whether this is a bitcoin bear market or if the bull market is still intact. To many observers bitcoin’s current market cycle is not complete, as no solid peak had formed, and speculators still expect another bubble to come to fruition.

The Four Phases of the Price Cycle — Bitcoin Traders Debate Cycle Position, Trader Insists ‘Early February Will Be the Move’

Many digital currency traders pay attention to tops and bottoms and the four stages of the market cycle. The stages include the accumulation phase, the uptrend phase, the distribution phase, and the downtrend or capitulation phase. One could say that the accumulation phase took place 666 days ago on March 12, 2020, when the price of bitcoin slipped below the $4K per unit zone. On that day in March, the World Health Organization (WHO) announced the world was dealing with the Covid-19 outbreak and dubbed it a “pandemic.”

If you were wondering why this cycle’s bull run looks a little different from the previous ones. It’s just the beginning. 🚀 #Bitcoin pic.twitter.com/q3X3z51x6X

— Bitwatch 🟠 (@TheBitwatch) January 3, 2022

On that day, otherwise known as ‘Black Thursday,’ global markets worldwide were roiled and the crypto economy shed billions in a matter of no time, but the crypto economy recovery and accumulation phase started the very next day. The price of bitcoin (BTC) continued to uptrend and moved steadily into the markup phase as BTC had finally surpassed the $20K 2017 all-time high. By January 7, 2021, BTC’s price touched $40K for the first time in history. In mid-May, BTC’s price made it to the $66K zone for the first time and slipped below that region shortly after.

Bitcoin’s price slid below the $40K zone around September 21, 2021, and people claimed that the price top was not in yet. They were correct as 50 days later, the price of bitcoin (BTC) hit a lifetime price high at $69K per unit on November 10, last year. Still, crypto advocates believe that the bull cycle is not over and one more parabolic uptrend may be in the cards. Most bitcoiners try to measure cycles by leveraging the time between BTC’s halving cycle.

In the 1st and 2nd #Bitcoin halving cycles, price hit a linear 4.236 fib extension before finding support near linear 2.618 and moving higher.

In the 3rd #Bitcoin halving cycle, price has hit a linear 4.236 fib extension and is trying to find support near linear 2.618. pic.twitter.com/7EbsaaXRAA

— TechDev (@TechDev_52) January 5, 2022

Typically, because of bitcoin’s scarcity, the price rises before the reward halving, and the next halving is expected 850 days from now on May 6, 2024. That’s still more than two years away and people wholeheartedly believe that the bull market that led BTC to $69K is still in play. Bitcoiners are still expecting a double-bubble similar to 2013 where the price exceeds the $69K zone and peaks higher. Crypto market pundit Bobby Axelrod thinks that in early February observers will witness the next big move.

“This next leg up, this next 60-day cycle beginning,” Axelrod tweeted. “Early February will be THE MOVE. Where bitcoin’s price ends up after the next move should be the cycle top IMO. At least I will be treating it as such.”

Crypto Advocates Expect a Bitcoin Price Rebound — ‘Price Crash Means the Upside Surge Is Sooner to Come’

Crypto supporter Colin, host of the Youtube show “Colin Talks Crypto” thinks the market cycle has been lengthened. “Because of the apparent lengthening cycle of this bull run, I now think it is *more likely* for us to see a $300,000 bitcoin price than a mere $100,000 bitcoin price,” the Youtuber said on January 5. The same day, Colin tweeted:

I’m happy that the bitcoin price is crashing— not because I like the price to go down, but because it means the upside surge is sooner to come. It’s like, ‘let’s get this crash over with so we can move into more bullish territory!’

Many other crypto supporters feel the same way. The Twitter account dubbed “Wicked Smart Bitcoin” wrote: “Perfect place to bounce IMO. Rekt everyone who longed at $43k and now everyone short (expecting a break down to $40k) will get rekt. Choppity chop chop. Don’t trade or use leverage. Just buy spot, self custody, and HODL for a cycle or two. Let hyperbitcoinization do its thing.”

‘The Midpoint Puke’

The Twitter account called @therationalroot shared a chart of all the bitcoin price cycles and the all-time high (ATH) price positions that were recorded within the cycles. “The 2021 cycle so far gave us 32 blue dots (ATH’s),” the bitcoin advocate said. “We had 72 in the 2017 cycle and 52 in the 2013 cycle. Let the fireworks for 2022 begin.” The trader, entrepreneur, and investor Bob Loukas described the cycle as a “midpoint puke.” Loukas said:

Day 31 of the bitcoin Cycle, the midpoint puke. The overlay is the Cycle from May 23rd – July 20th 2021. Not a fan of overlays, I don’t trade off them, but similar conditions. I think $40k was always the more important level. More important is the early [February] timing.

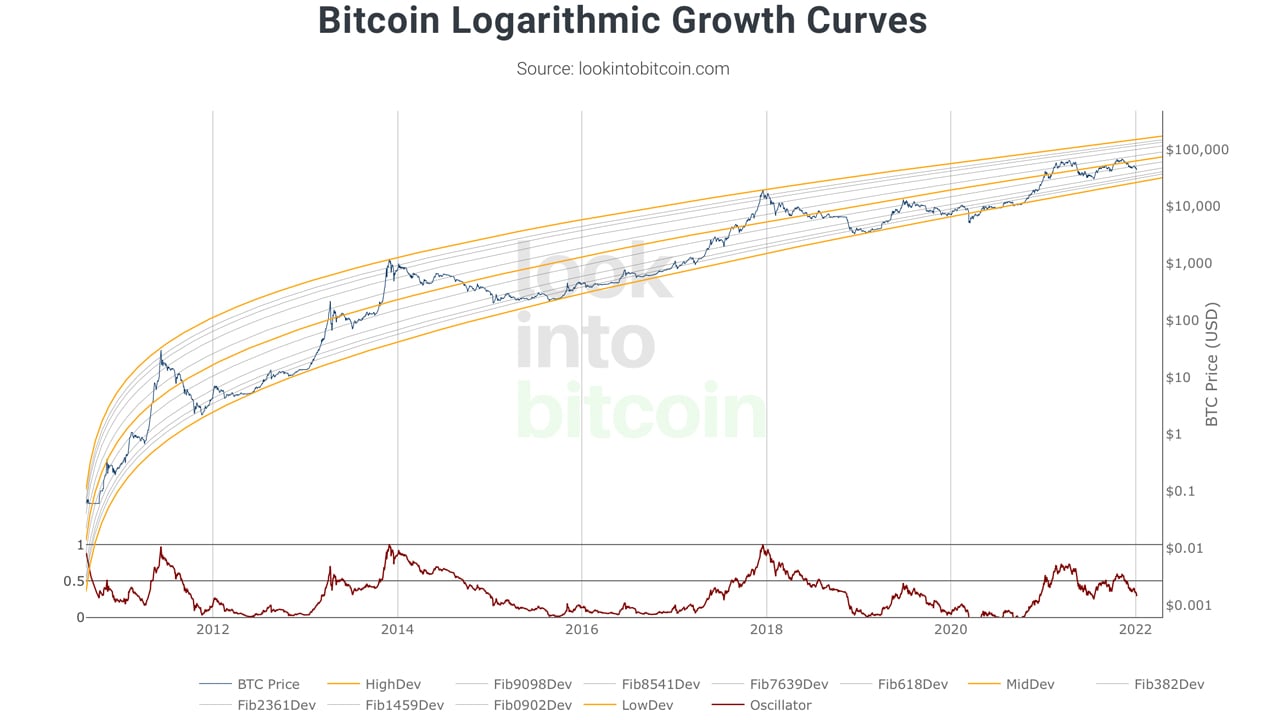

Currently, bitcoin’s logarithmic growth curve shows three bull runs with extreme peaks yet the current cycle looks incomplete and almost undecided. The chart shows that there have only been two times in bitcoin’s price history where it slid below the yellow low dev line, and the last time it happened was on March 12, 2020 (Black Thursday). The end of the chart and the yellow low dev line indicates that BTC’s price won’t go lower than $25K if it maintains the power-law corridor model without deviation.

It’s safe to say that most bitcoiners even with the most advanced technical analysis skills are unsure of where bitcoin’s price is headed. Tai Zen, the crypto trader, entrepreneur, and CEO of the trading web portal cryptocurrency.market says people should wait until the bear market to acquire altcoins.

“Bitcoin is on sale under $50K (laser eye price),” Zen tweeted. “We do not recommend buying any coins during the middle of a bull market. However, if u have extra cash & itching to jump into crypto, then the only coin I would buy is BTC [and] nothing else,” Zen added.

What do you think about bitcoin’s current price cycle? Let us know what you think about this subject in the comments section below.