If you believe Bitcoin represents the future, then you should want women to get ahead of the adoption curve to better their lives.

Intro

If you could inspire one group of people to embrace Bitcoin, which would it be? A whole country? Bond traders? Family office managers?

While any of these groups would have a major impact if, say, 5% of its population invested a portion of the assets under their control into bitcoin, there’s an even more important group to inspire: Women.

While a capitalist motivation seeks to engage women to lower the available bitcoin supply and raise the price over time, a more humanitarian motivation to engage women sees financial and technological (fintech) literacy, of which Bitcoin sits at the intersection, as a way to increase opportunities for women and their families, just as it does for anyone who adopts Bitcoin.

Whichever view you relate to most, an important question is, how much do you believe that Bitcoin is the future?

If you believe that bitcoin is just another financial asset with potential for asymmetric upside, it’s probably not important to you that women engage with it because you may end up with the financial gains you seek whether or not they adopt on a large scale.

However, if you believe that Bitcoin represents the future in the same inevitable way that the internet did in the 1990s, then you hopefully want women to get ahead of the adoption curve to better their lives and the lives of those around them.

Regardless of your view, it is imperative that those of us who are men reflect on our motivations because they will contribute to the culture we develop as Bitcoiners, and therefore will either empower or devalue women in the Bitcoin space.

“Like all sciences and all valuations, the psychology of women has hitherto been considered only from the point of view of men.”

–Karen Horney, pioneer in feminine psychology

This is an uncomfortable topic. As a man and husband of a feminist, I am well aware of my inability to see and speak from a woman’s point of view. But this issue is too important to be left alone so I write about it from an empathetic point of view.

A Social Problem

If you spend enough time studying the Bitcoin (and crypto) ecosystem, you will almost surely notice the minority of female-led companies, podcasts and social media accounts.

The content waters are difficult to sail when searching for high-quality material that is intentionally inclusive of women. In my experience, the unintentional, male-heavy connotations in the daily dose of Bitcoin-related content that an interested observer consumes are vast. I don’t fault anyone or the community as a whole for this. But rather, I think it is a natural result from the majority of voices in the Bitcoin space coming from men.

As a reflection exercise, ask yourself the following regarding Bitcoin Twitter:

- Out of the people who indicate their gender, what percentage are female?

- On the average Spaces that you join, how many profiles identifying as women are there versus those identifying as men?

- How many anonymous accounts are run by men versus women?

Though the answers are impossible to know, this line of questioning aims to lead those willing to be honest to the realization that women are underrepresented in Bitcoin. This is at least on the platform that is widely agreed upon as the place to be in the Bitcoin ecosystem (no one is exchanging meta account names at Bitcoin conferences).

Does any of this really matter? Yes. Why? Please read on.

A Global Problem

Before attempting to diagnose the cause of this condition, let’s zoom out and look at the available research to see its symptoms more clearly. The following facts highlight the results of a world in which women are excluded and devalued, especially in the fintech sectors. This will help us understand the macroeconomic context in which this phenomenon is unfolding.

Consider this statistic: 90% of U.S. household financial decisions are made by women. Let that sink in for a moment.

In light of this fact, why isn’t there a bigger effort to engage half of the world’s population?

According to a U.S-based survey conducted by CNBC and Acorn in August 2021, 16% of men invest in cryptocurrency versus just 7% of women. Although the distribution of women who are engaged in the Bitcoin community is higher now than at any point since inception, there is a 72% gender gap with 86% men and 14% women engaged in the Bitcoin community, according to coin.dance via google analytics.

The gender wage gap for full-time, year-round workers in the U.S. is 17.7%, with the median annual earnings of $47,299 for women and $57,456 for men.

More specifically, Black women in the U.S. are paid 37% less on average in comparison to their white male counterparts. Similarly, Latinas in the U.S are paid an average of 45% less than white men and 30% less than white women, even when adjusted for equal education and job roles.

Globally, there is a 9% gender gap in people who have bank accounts with men more likely to have a bank account than women in developing nations.

Such facts beg the questions: Why? What are the causes of such disparities?

A Cause

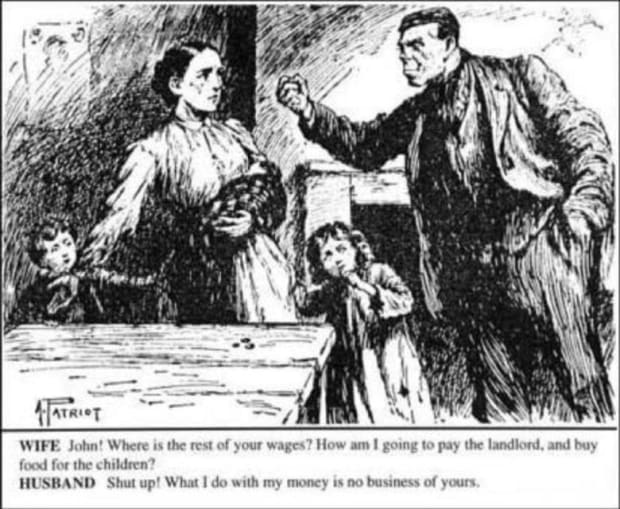

Globally, the oppression of women dates back to the earliest recorded writings.

“Oppression is the inequitable use of authority, law, or physical force to prevent others from being free or equal… In much of the written literature of the ancient and medieval world, we have evidence of women’s oppression by men in European, Middle Eastern, and African cultures. Women did not have the same legal and political rights as men and were under control of fathers and husbands in almost all societies.”

Women’s oppression, according to feminist theory, is primarily caused by patriarchy which is the social system that has dominated since pre-historic times. As we see from the quote above, women throughout history have been treated more as objects of ownership than valuable equals with men in a common humanity. Though many of the past injuries inflicted against women are now illegal around the world, the healing process takes time. With much of the world adopting a capitalist economic system since the Renaissance, women are still catching up in a game they weren’t allowed to play for centuries.

In the U.S., one cause is the discriminatory treatment of women since the country’s birth in 1776. “Coverture” is a little-known word with huge historical significance. It is an important concept on which to build an understanding of the gender gaps we see in America broadly and in Bitcoin specifically.

Coverture was the legal practice which ensured that no female person had a legal identity. This meant that women were not legally allowed to work in businesses, own anything (including inherited property) or even have custody of their children in the event that their husband died.

Over the years, women like Susan B. Anthony fought for women’s rights so that coverture could be dismantled piece by piece. But just because the women of this current generation have gained the rights that should have been theirs all along doesn’t mean they don’t have to work against present-day attitudes in fintech that coverture left behind.

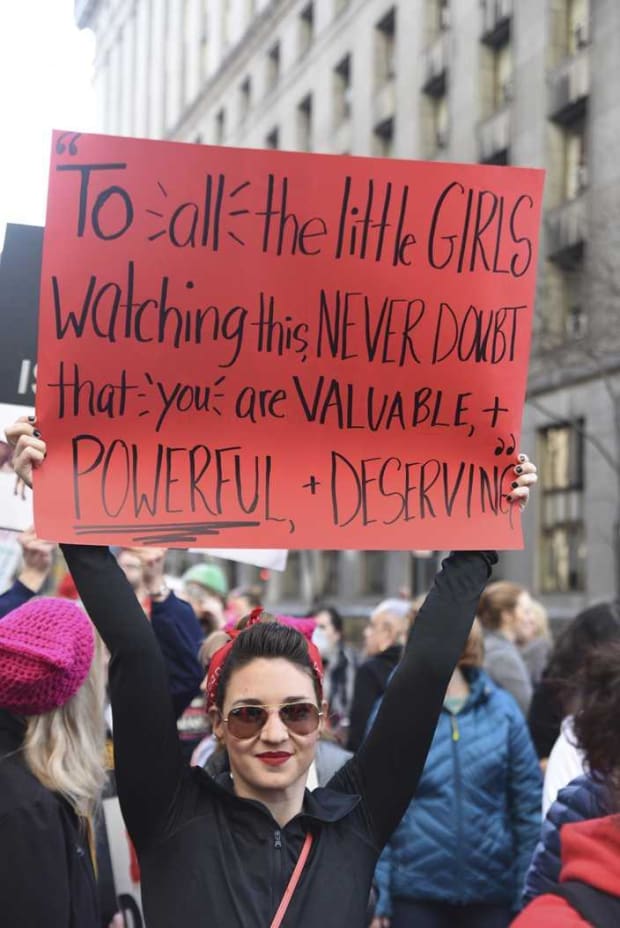

Reason For Hope

Today, just over 13 years after Satoshi Nakamoto published the Bitcoin white paper, its culture is still being defined and can be shaped by diversity and equality. This is an incredibly sensitive and important time in Bitcoin’s history. There is still a big void in the fintech space that must be filled by women and Bitcoin is primed to empower women to do just that. With its roots firmly planted as a protest against financial inequality and corruption, Bitcoin can help topple the tower of elitism and exclusion that has long sat at the intersection of technology and finance, resulting in less women in these industries.

While battles are increasingly being fought in Washington, D.C. and global jurisdictions in efforts to regulate Bitcoin, an equally important battle is being fought in every Bitcoiner’s mind to retain or retire the status quo regarding women. I believe that Bitcoin will be a major catalyst for the changes that the world’s women need in fintech and beyond.

Through the years, leaders such as Roya Mahboob have done groundbreaking work to engage women on Bitcoin and there are many women doing remarkable work in the Bitcoin space, such as Elizabeth Stark, Perianne Boring, Cynthia Lummis, Caitlin Long and Amanda Cavaleri. It will be thrilling to see the countless women who will be added to this list in the coming months and years. They will help reshape the global landscape to one that is more fair and free.

How Do We Change Course?

This article is a call for men (myself included) to reflect and act as we seek to promote the Bitcoin ethos and break the chains of financial oppression. The following suggestions are by no means exhaustive, nor are they remedies for millennia-old wounds. But if we truly believe that Bitcoin fixes this, then we as men must be intentional in establishing a cultural foundation that proves inclusive to all those who have been oppressed by the legacy financial system. The below encourages further exploration for each of us and provides a few small steps toward creating a more equal and inclusive Bitcoin environment for women.

- Reflect on your personal views and motivations as they relate to women adopting Bitcoin.

- Admit to any biases that may usually be subconscious and perpetuated by the history of coverture and other vestiges of women oppression.

- Ask a woman in your circle of family or friends about their thoughts about Bitcoin. Listen to their thoughts with an open mind without trying to convince them of why they should think the way you do.

Become an ally of women by breaking the silence when you see undertones of female oppression and misogyny.

Recommendations for further learning:

- “Half The Sky: Turning Oppression Into Opportunity For Women Worldwide”

- “Emancipation From Financial Patriarchy” with Anita Posch on the “What Bitcoin Did” podcast

Special thanks to my wife Nicole and to Pedro for their great help on this article.

Writer’s disclaimer: This article is not a comprehensive exposé of the lived experience of women in or out of the Bitcoin space. It is merely an attempt to move the conversation forward toward a more equal landscape in fintech and beyond for all women. I recognize there is a lot of gender binary language in this article and apologize if that is offensive to you. My hope is that you learn something useful from it regardless of your views on gender. As a Latino male, I humbly recognize my own male biases which escape me despite my efforts against them.

This is a guest post by Josh Doña. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.