Recently, the ultra-rich spent more than $2.6 billion on this 277-year old asset in just 2 weeks.

Why? Because while most investors are focused on the NFT craze, little did they realize there is an estimated $1.7 trillion market gaining popularity because of the mania.

In fact, the WSJ called it “among the hottest markets on earth.” And the ultra-rich is helping to drive this market to record levels:

The Rothschild family sold this amazing asset for over $197 million to the Dutch government.

Oprah Winfrey sold this asset for $150 million (grossing $62 million for herself).

Jeff Bezos recently sold Amazon stock to buy $70 million worth of this asset.

Bill Gates keeps $124 million of this asset locked away in his personal mansion.

And Steve Cohen, legendary hedge fund manager, spent more than $1 billion.

What is this alternative asset? Art. Not digital art like an NFT, but physical masterpieces by famous artists such as Picasso, Monet, Basquiat, Banksy, and Warhol.

There might be a few reasons why the ultra-rich have invested in this asset:

- Contemporary Art price appreciation has outpaced the S&P 500 by almost 3 fold from 1995 to 2020.

- In periods of inflation equal to or higher than 3.0% (now it’s double that), contemporary art grew 23.2% on average and outpaced most other alternative assets (such as real estate and gold).

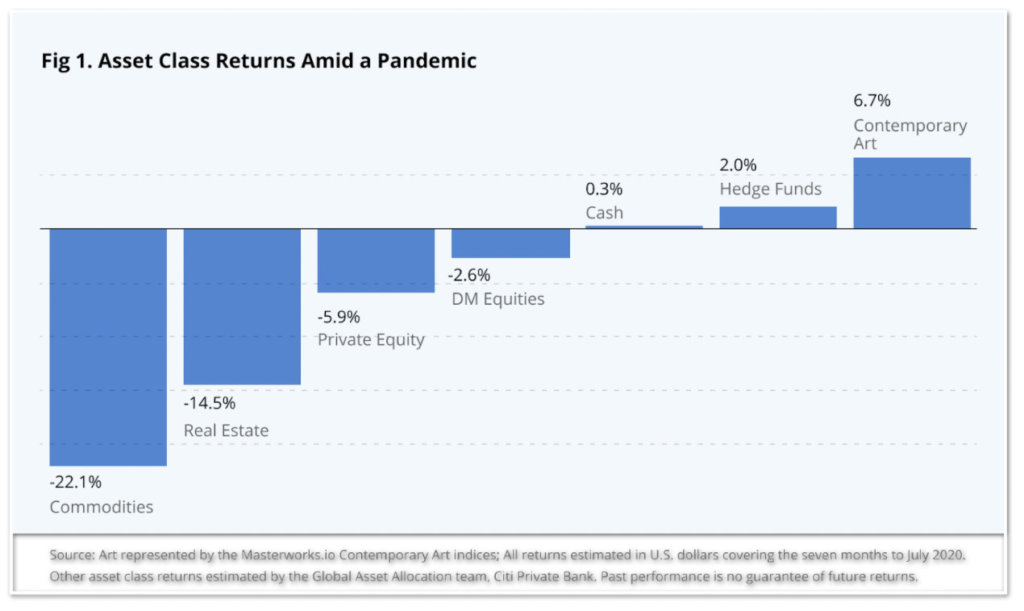

- In 2020 amid the pandemic, art outpaced 10 major asset classes according to Citi, many of which have been considered conventional “safety hedges.”

What makes this asset so attractive?

As a BBC article stated recently, “art has no correlation to the stock market, paintings can go up in value even when the market crashes.”

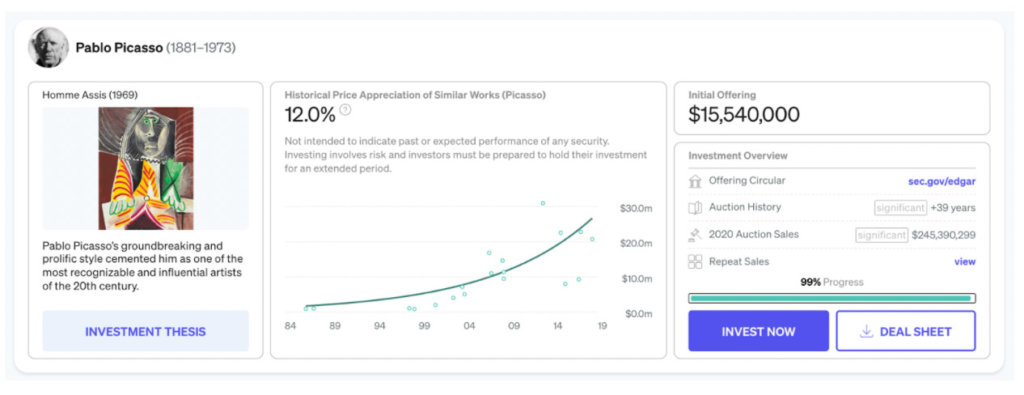

Unfortunately, most people simply can’t afford to invest in a $100,000,000 Picasso.

But there is an alternative. A groundbreaking $1 billion app makes it possible to own investments in similar great artworks by famous artists such as Picasso, Basquiat, and Soulages… without the need to invest huge amounts of money.

What is the $1 Billion App?

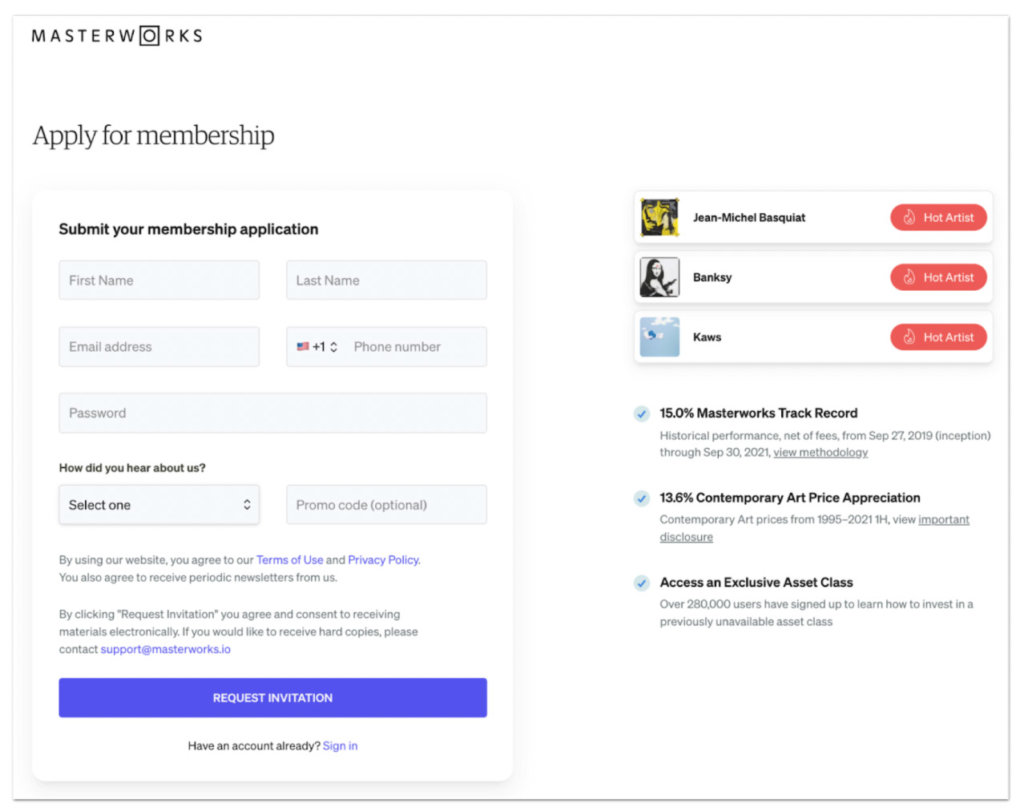

Masterworks.io is a $1 billion art investment startup that allows everyday investors to buy contemporary art. And for just a fraction of the cost of an entire painting.

It provides everyday investors access to some of the same types of paintings collected by wealthy collectors like Jeff Bezos, Bill Gates, and Eric Schmidt.

Every day investors choose Masterworks.io because it allows them to invest in shares representing investments in artworks without spending millions of dollars.

It gives you the chance to invest in a Banksy or Condo painting for as little as $20. And with 295,000 users on the Masterworks.io platform, it’s become very popular.

Why Use This App Now?

According to Citi, art prices have outpaced other asset classes such as equities, cash, real estate, and certain commodities during the pandemic.

That’s because contemporary art has a low average correlation to other major asset classes.

For investors who wish to invest in an alternative asset when the market seems uncertain due to the recent crisis, now they can do so through Masterworks.io.

Investors can choose to invest in artworks from artists like Pablo Picasso, Zao Wou-Ki, and Gerhard Richter on the platform.

However, once certain goals are reached for each artwork, investors won’t have a chance to invest anymore.

For instance, recently, a new Banksy artwork called “Exit Through the Gift Shop” was sold out in less than three hours on the Masterworks.io app.

How Does Masterworks.io App Work?

In 2017, CEO Scott Lynn aimed to democratize the art market by securitizing the first painting, Andy Warhol’s ‘1 Colored Marilyn (Reversal Series).

He said “That light bulb kind of turned on four years ago, and it just occurred to me that this is probably the largest asset class that’s never been securitized.”

Masterworks.io has since evolved into having a large collection of famous physical artworks for investors to invest in.

This is how it works:

- The Masterworks.io research team analyzes over 60,000 data points across 70+ years to discover which types of work have attractive price appreciation potential.

- Masterworks.io purchases and securitizes the artwork, and then makes it available to investors on the Masterworks.io app.

- You can list your investments in the artworks to other users on the platform.

- You can hold onto your investments in the artwork and participate in the distribution when Masterworks sells it.

Price Appreciation From Famous Artworks

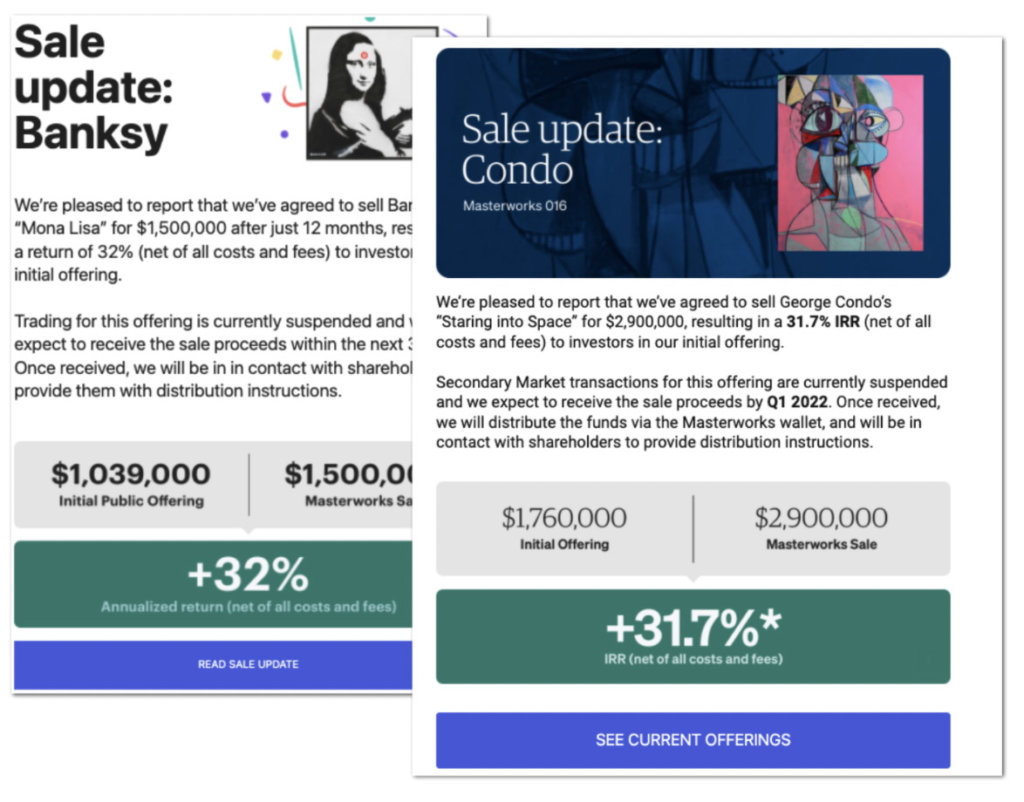

In 2020, Masterworks’ investors saw a 32% annualized appreciation, from the sale of their Banksy painting “Mona Lisa”, net of fees.

And in 2021, investors are set to receive a 31% annualized appreciation from the sale of their George Condo painting “Staring Into Space”, net of fees.

That’s why Kevin O’Leary from Shark Tank tweeted: “ANYBODY can invest in art by names like Banksy, and I love what they’re (Masterworks is) doing.”

How to buy the “billionaire asset” in just a few clicks?

You only need to follow three steps to get started:

- Go to the Masterworks’ signup page.

- Enter your contact information and answer some questions.

- An art investment representative will contact you and help you.

See important disclosures at masterworks.io/disclaimer

The post Revealed: 277-year-old asset class booms thanks to NFTs appeared first on CryptoSlate.