While the concept of NFTs has been around since 2014, they were mostly under the radar until last year, when they suddenly commanded headlines around the world. Just as DeFi brought capital into the crypto market, NFTs are bringing people in—with puzzling artwork, lucrative games, and even some practical use cases.

What is an NFT?

NFTs, or non-fungible tokens, are unique, non-splittable tokens that can represent ownership of a digital asset in a decentralized way. Their inherently counterfeit-proof nature, and the transparency of the transaction process, makes them a landmark internet innovation.

What Happened in 2021?

Last year was a wild ride for NFTs as they first gained attention from crypto enthusiasts then institutional investors. Let’s look at NFT data from 2021 to see which projects performed the best.

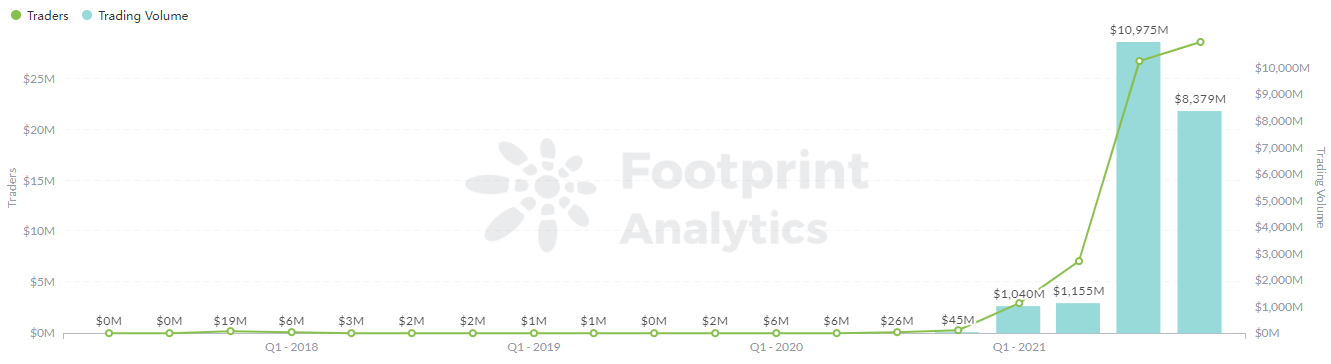

According to Footprint Analytics, the cumulative trading volume of NFTs was $21.5 billion by the end of 2021, compared to $120 million before 2021, a 200x jump in cumulative trading volume. The number of traders has also doubled from less than 1.3 million to 65.4 million by 2021, a 50x increase.

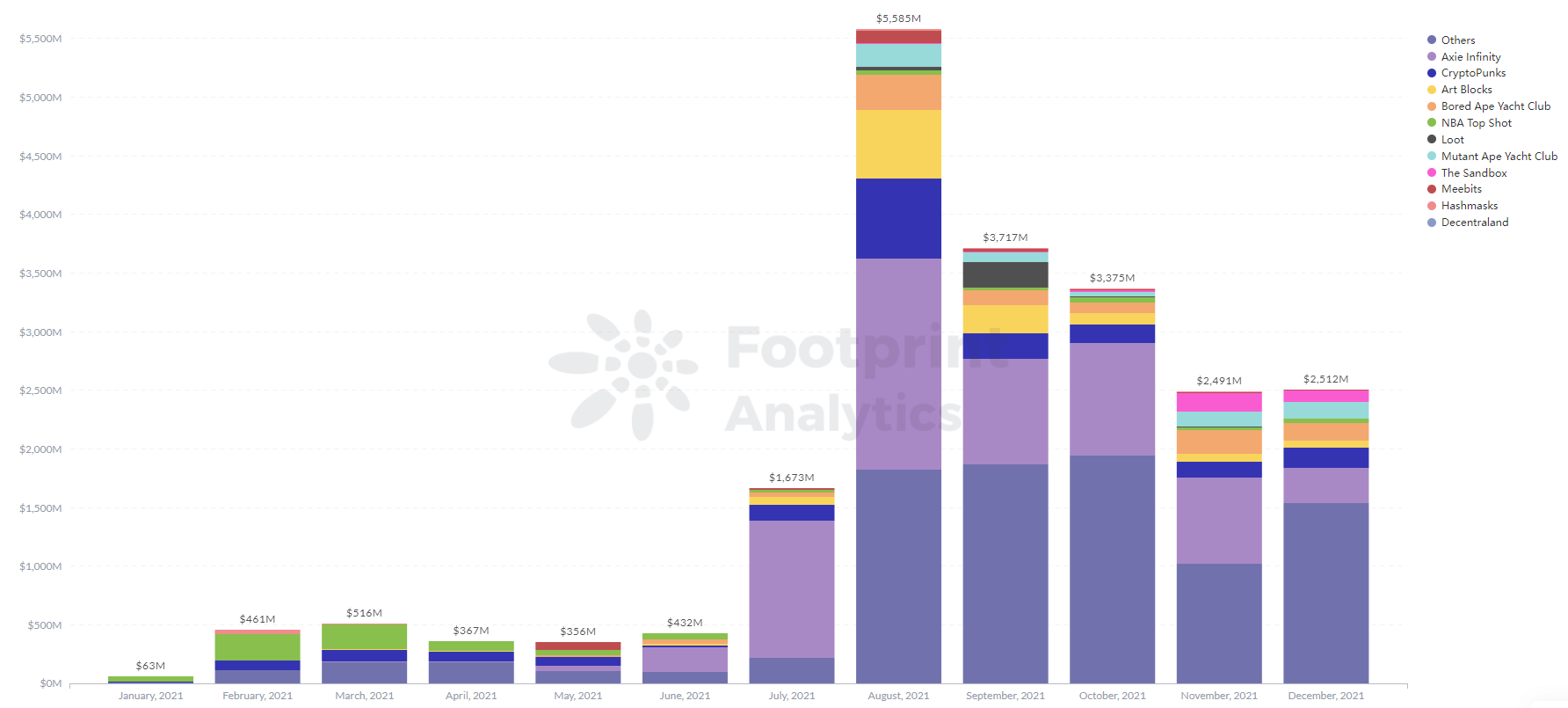

- In Q1 and Q2, NFTs Started Growing with Adoption by Sport Leagues, Artists and Celebrities

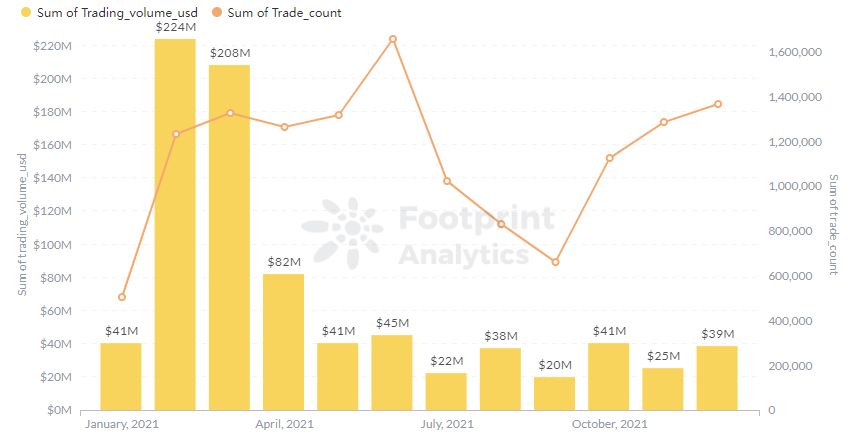

In February, Dapper Labs’ NBA Top Shot sold video highlights as NFTs, generating $226 million, more than the entire NFT market over the previous year. This made crypto investors from other categories notice.

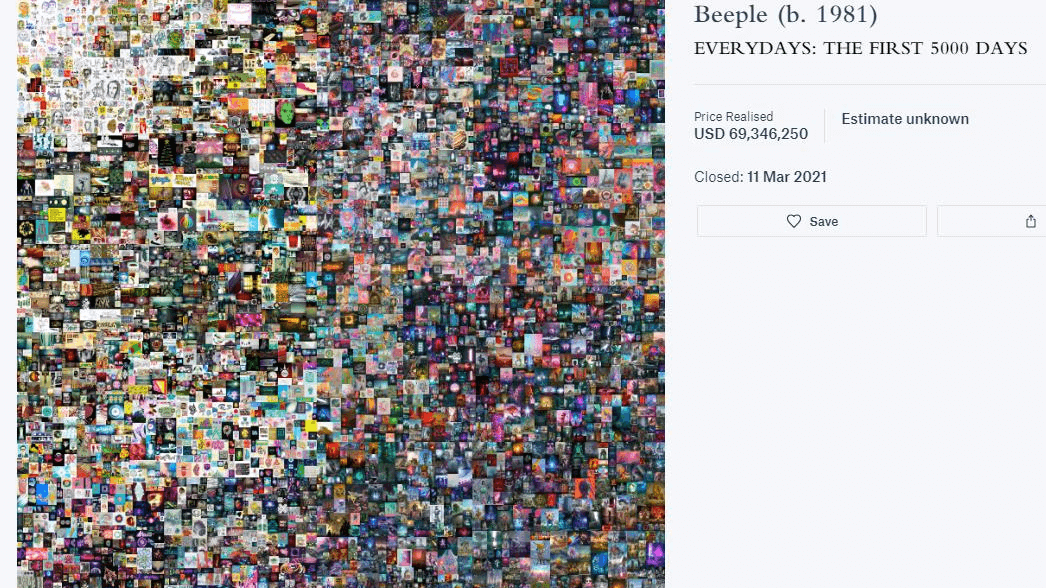

On March 11, Beeple sold his digital work, First 5000 Days, for $69 million in a Christie’s auction, the 3rd largest single auction for a living artist.

On March 23, Twitter CEO Jack Dorsey’s first tweet from 2006 sold for over $2.9 million as an NFT, further driving the boom.

Other avatar projects, like Larva Labs’ 2D CryptoPunks and 3D Meebits, have gained recognition in the media and among the general public.

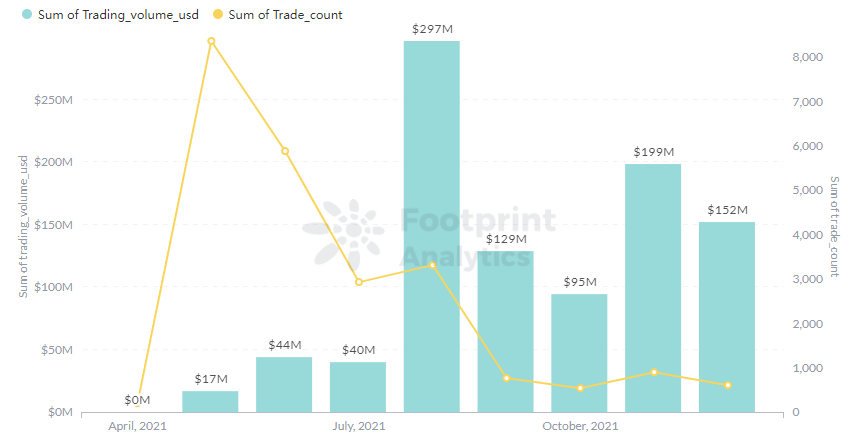

- In Q3, GameFi Started Dominating the NFT Space

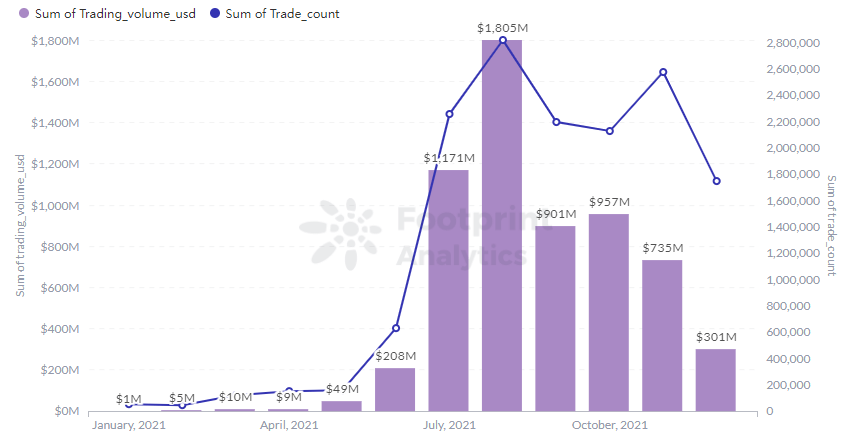

Axie Infinity, the original breakthrough play-to-earn blockchain game, reached a transaction volume of $1.8 billion in August, a 1,500% increase compared to January 2021, with 2.8 million traders.

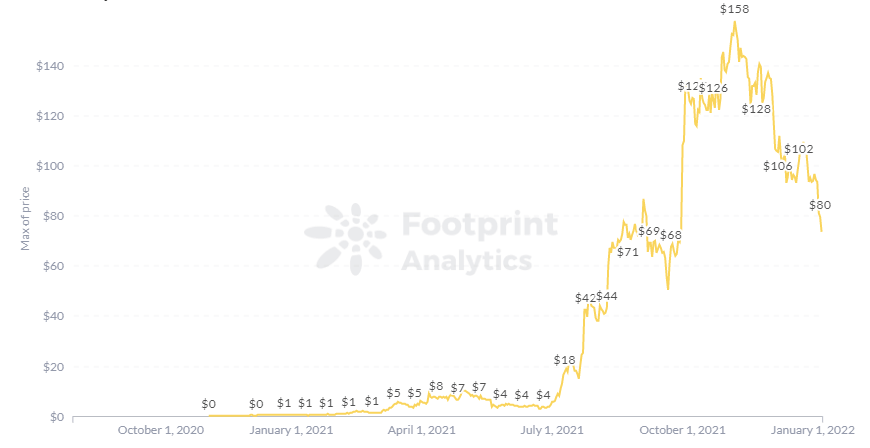

Perhaps more incredibly, the price of the game’s token, AXS, bucked all known crypto trends and broke away from the price movements of BTC.

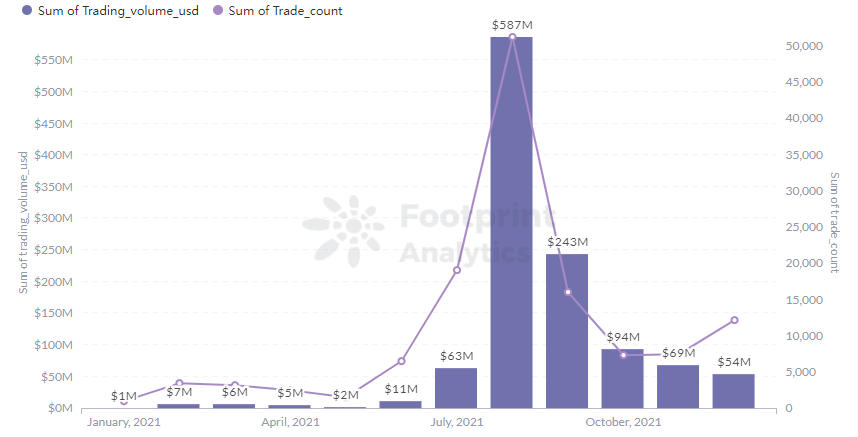

The trading volume of Art Blocks, a generated art project, also reached an all-time high of $587 million in August, and the number of traders exceeded 20,000. It has since become the largest NFT art project in terms of sales.

To outsiders, Loot would seem like the strangest example of a breakout NFT project. Unlike most others, which sell tokenized images, Loot NFTs consists of 8 lines of text that spell out randomly generated pieces of fantasy adventurer gear—war hammers, dragonskin belts, amulets, etc. There is yet no game playable where owners can apply these to.

Bored Ape Yacht Club (BAYC) became particularly popular among celebrities. In August, NBA star Stephen Curry paid $180,000 for a Bored Ape. Other owners include Jimmy Fallon, Logan Paul and Shaquille O’Neal.

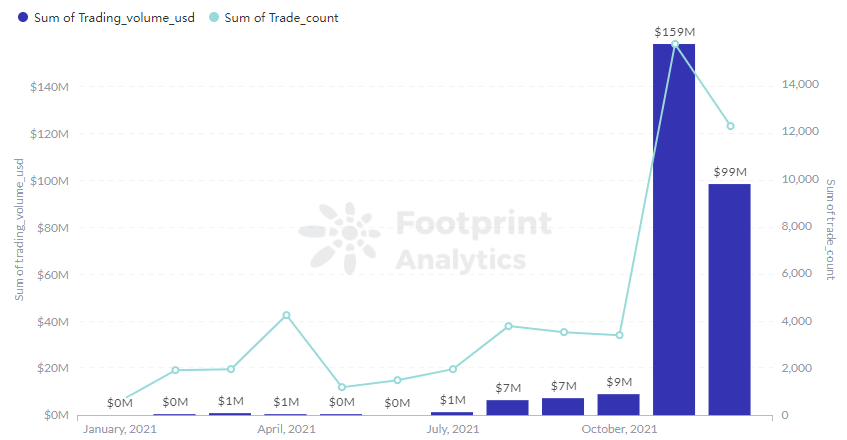

- In Q4, Metaverse Real Estate Became Precious

On Oct. 28, Facebook announced that it would change its name to Meta and go all-in on the metaverse.

This challenged the public’s imagination, causing people to start speculating about the future value of digital real estate. By the end of 2021, more and more investment companies began buying land in virtual worlds like The Sandbox and Decentraland. On Nov. 23, a piece of digital land was sold for $2.43 million in Decentraland.

NFT 2021 Summary: Many Booms With Little Staying Momentum

Collins Dictionary named NFT the 2021 Word of the Year.

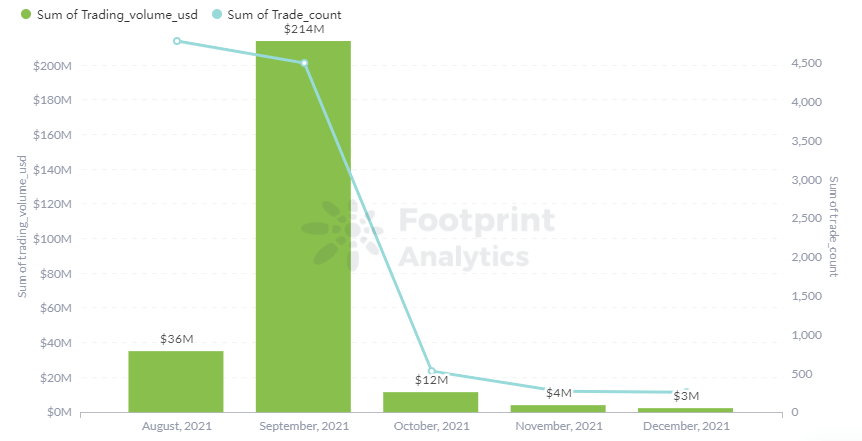

It’s true that price explosions in several NFT subcategories drew significant attention to this emerging digital technology. However, none of them managed to sustain momentum for more than a few months, after which investors found a new promising niche, and trading volume dropped in the previous.

How Will NFTs Evolve in 2022?

- More Industries and Brands

In the second half of 2021, many brands began to participate in the NFT market, including Nike, Adidas, Budweiser, and Disney. It is likely that more brands and companies will join in.

- Creators Will Focus on Solving Real Problems

NFTs are still a very young area of the crypto industry. As the trading volume, asset liquidity, and the number of new users expand—along with Web 3.0 infrastructure—creators will work to solve real-world problems such as copyright claims and digital asset validation.

- NFTs Will Complement Real Assets

Some innovative companies have already started using blockchain technology to issue tangible assets on-chain for a host of reasons. For example, music NFTs are starting to change how artists profit from their work.

Benefits for CryptoSlate Reader

From 11 to 25 January 2022, click this hyperlink on CryptoSlate to get a free 7-day trial of Footprint Analytics! New users only!

Date & Author: 14th Jan, 2022, [email protected]

Data Source: Footprint Analytics – 2021 NFT Annual Report Dashboard

This article is part of our Year in Review series.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

The post The Rise of NFTs | Footprint Analytics Annual Report 2021 appeared first on CryptoSlate.