The Ethereum Virtual Machine (EVM) is the core of the Ethereum network and the heart of smart contract deployment and execution. EVM to Ethereum is like a CPU to a computer.

Currently, 80% of the top 10 chains are compatible with the EVM, and even Non-EVM chains like Terra and Solana are making EVM-compatible solutions or can already operate with Ethereum’s account system (NEAR’s Aurora, Solana’s Neon, Polkadot’s Moonbeam, etc.)

Why Is EVM compatibility so Important?

For developers, an EVM-compatible chain creates a code execution environment similar to the EVM. It means that Ethereum developers can easily and quickly deploy protocols to the chain without having to write code from scratch.

For users, the advantages of an EVM-compatible chain include lower gas fees, faster settlement, and the same address format as Ethereum, making for a more user-friendly environment.

Apart from that, EVM compatibility can drive traffic acquisition and ecosystem expansion because Ethereum users can quickly migrate to new chains.

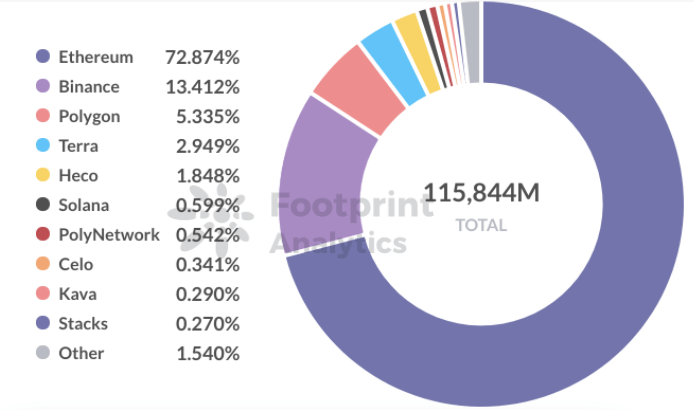

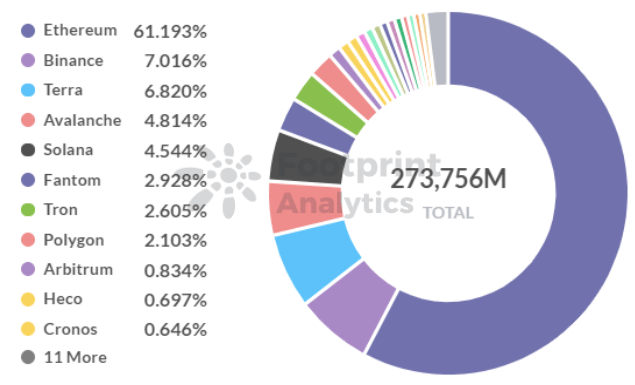

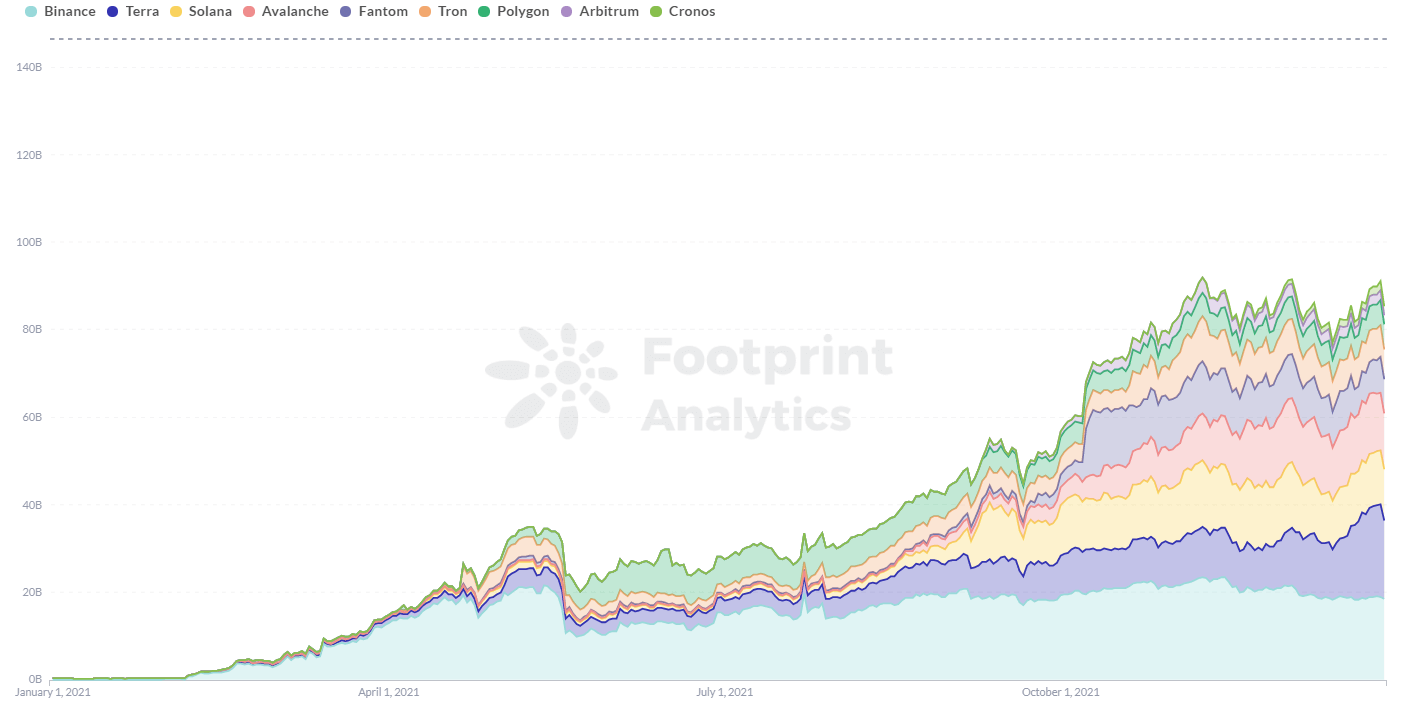

Footprint Analytics’ data shows that, although Ethereum is still the leader among public chains, its market share dropped from 72.87% to 61.19% in the past six months—more than 10% in absolute terms. Emerging chains are growing rapidly and replacing Ethereum.

Ethereum is the most active chain for DeFi projects and users, and is also a gathering place for cutting-edge projects, e.g. NFT ecosystems. The fastest way for new chains to grow is to attract Ethereum traffic, and EVM compatibility is the most convenient solution. In this way, developers can quickly “copy and paste” contracts from Ethereum to other chains.

What Is the Difference Between EVM and Non-EVM Chains?

Top 10 public chains and their categories:

| EVM | Ethereum | Binance | Avalanche | Fantom | Polygon | Tron | Arbitrum | Cronos |

| Non-EVM | Terra | Solana |

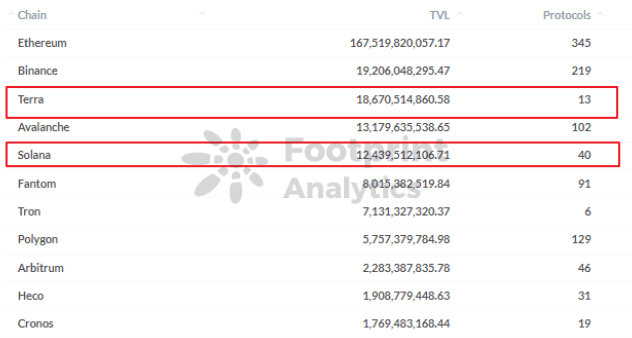

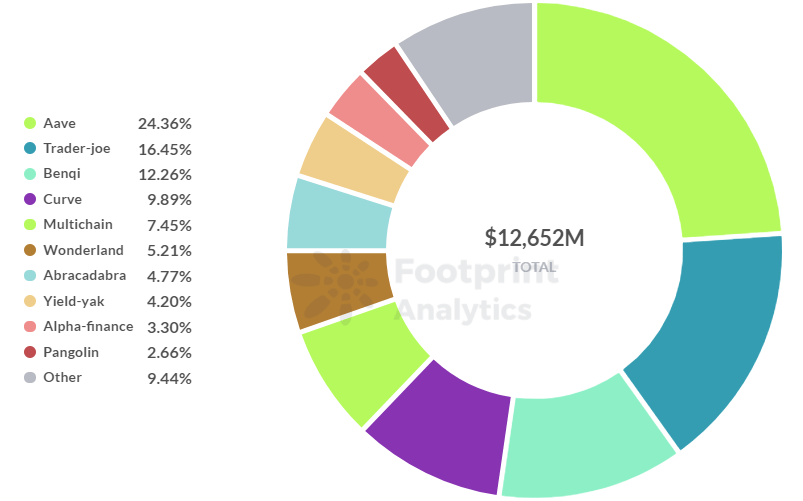

From the chain TVL data, while the number of non-EVM compatible public chains is small, Solana and Terra account for over 11% of the overall TVL in 2021.

Let’s compare two popular EVM-compatible chains, Avalanche and Arbitrum, with two non-EVM compatible chains, Terra and Solana.

Compatible Ecosystems Are More Prosperous

Looking at the on-chain project data from Footprint Analytics, there are significantly more projects deployed on EVM-compatible public chains.

There are no less than 40 projects on Avalanche and Arbitrum, while there are relatively few projects deployed on Solana and Terra.

As mentioned above, developers want EVM compatibility to replicate and deploy to new chains quickly, and the disadvantage of non-EVM compatible chains is obvious in terms of the number of projects.

Among the EVM-compatible chains, AAVE is the project with the highest TVL on Avalanche and Curve has the highest TVL on the Arbitrum chain, both of which were migrated from Ethereum.

Non-EVM Chains Give Projects More Room for Innovation

Breaking away from the limitations of Ethereum, heterogeneous chains have more room for innovation.

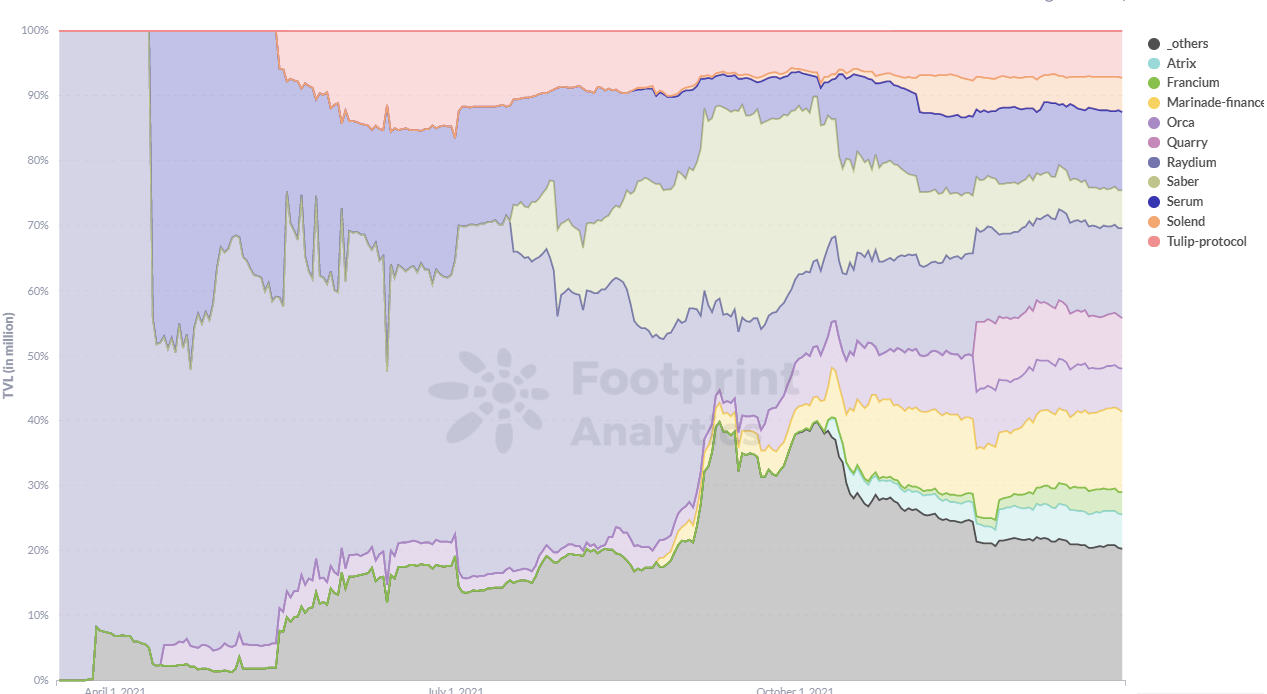

For example, projects like Raydium and Serum in the Solana chain are unique to Solana. On the other hand, Terra is a special public chain that focuses on connecting on-chain and off-chain payments.

Overall, the advantages and disadvantages of EVM and non-EVM are clear.

EVM Compatible

- Pros: Scalable and easy to migrate from the Ether ecosystem; projects have easier access to users.

- Cons: Less innovative due to Ethereum and EVM rules.

Non-EVM Compatible

- Pros: More differentiated and innovative applications can be generated; high user migration costs and more opportunities to build ecosystem barriers.

- Cons: High cost for developers with entry barriers, difficult to migrate projects and users from other chains.

EVM or Non-EVM?

EVM compatibility is the primary condition for evaluating a public chain platform.

EVM-compatible public chains can quickly gain customers and grow in the early stages with the advantages of Ethereum. However, they need to compete with many other chains in the Ethereum ecosystem. Therefore, they will have advantages in terms of user experience, developer friendliness and ecosystem incentives.

Non-EVM compatible chains are more likely to grow in trending categories and niches where new ideas are emerging. NFTs, GameFi, and payments are all areas where heterogeneous public chains can thrive. With their application scenarios, innovation can also be successful in the DeFi market.

It’s impossible to conclude that EVM or non-EVM chains are better as a whole. Rather, each case is different and developers must choose a public chain that fits their project’s development path.

For DeFi users, it is more important to evaluate the potential of the project from a different perspective based on the model.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

The post Will a non-EVM overtake compatible chains in 2022? appeared first on CryptoSlate.