What is the current setting of nation-state monetary dependency, and where could Bitcoin take us?

Let us consider the nations of the world, their standing as monetary powers, as followers, victims, and outcasts. How will these nations use Bitcoin strategically?

There Are Four Kinds Of Countries Today

Monetary Hegemons

These are countries with massive sway over others. Other nations hold their currency as foreign reserves. They control the primary unit of account in global trade. When they print money they earn “seigniorage” profits, not just from their domestic population, but from the many foreigners holding their currency.

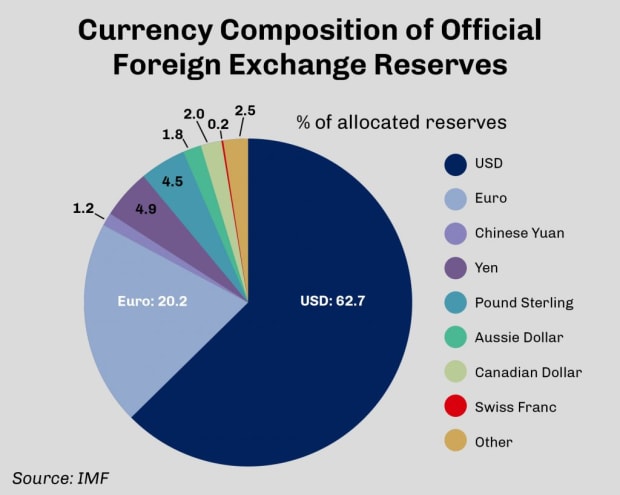

There’s only one true monetary hegemony today: the United States. To some degree the eurozone, and to an even lesser degree, Japan and China, are partial monetary hegemons. Their currencies are held as foreign reserves in smaller amounts. But primarily the U.S. is the overwhelmingly dominant power; it has the world reserve currency and the deepest and safest markets. It controls the numeraire for world savings and trade. It controls the financial infrastructure used in international payments: the Society for Worldwide Interbank Financial Telecommunication (aka SWIFT).

Minor Players

Minor players are countries that do have their own currency and can extract some degree of seigniorage profit from the issuing of more currency. But unlike the full-fledged monetary hegemon countries, their currencies are not really held by foreigners. Thus the profits of printing money are extracted solely from the domestic population, with little external impact. Turkey, Mexico, and indeed most large nations are minor players by this definition.

Vassals

Some countries are dependent on the currency of another, typically one of the monetary hegemon countries. These countries are at the whim of the hegemon. They do not receive the profits of seigniorage. Indeed, as holders of the money of a monetary hegemon, they pay the costs of inflation without receiving any of the benefits, since typically printed money is spent domestically. Nations pegged to the dollar, or using the dollar or euro as legal tender are effectively vassal states. The African CFA currency unions are in this way vassals of the eurozone. Other nations, such as Saudi Arabia, are pegged to the U.S. dollar, and because the U.S. dollar constitutes a dominant fraction of world currency reserves, most countries at least partially bear the cost of U.S. seigniorage.

Being a vassal means surrendering the ability to extract seigniorage, and indeed, to instead offer that value up to another power. Frequently states assume vassal status because either A) they tried to be minor players but entirely lost credibility or B) they have some other strategic reason to request protection from the U.S. or eurozone (hegemons).

Excluded Nations

Some nations are entirely shunned by the monetary hegemon countries. Iran is completely disconnected from the SWIFT network, denying it access to U.S. dollar-based financial rails. North Korea and Cuba are in a similar situation. As with being a vassal, exclusion is not binary. Financial sanctions have been levied against many countries and individuals to different degrees. Russia is a minor player that is in a state of partial exclusion.

Some nations may not be currently excluded, but may expect to be in the future. Russia is currently facing U.S. sanctions over the Russo-Ukrainian crisis. If conditions deteriorate, Russia can expect to be ejected from the SWIFT system: a dramatic escalation of its excluded status. As a result, Russia is preparing now for exclusion by reducing dollar holdings, acquiring gold, and setting up trade deals denominated in non-U.S. dollar currencies. To be a fully independent world power, a nation must prepare to be resilient in the face of financial exclusion from the U.S. Exclusion is the extension of war to the monetary realm: A country that cannot survive exclusion is not a power that can act independently.

Bitcoin As Part Of National Strategy

Let us examine how each group is likely to view Bitcoin, in reverse order.

Excluded Nations

Excluded nations are likely to embrace Bitcoin, probably quite soon. Bitcoin solves an enormous problem for them; how to transmit value in the face of hostile global institutions. Bitcoin was explicitly designed to be hardened against attack from powerful nation-states, and can therefore be trusted by states like Iran. This is why other cryptocurrencies likely would not be suitable; they are not decentralized enough to survive intense scrutiny from the monetary hegemons. North Korea cannot realistically hold large amounts of value in ETH or SOL because the U.S. would likely influence those protocols to confiscate that value. Bitcoin, on the other hand, is so hard to change; a country like Iran could openly acquire it, and the U.S. would be effectively powerless to confiscate it or interfere in their ability to transact

In 2020 Venezuela needed to pay Iran for assistance in restarting its ailing oil sector. Since both nations are sanctioned, their solution was to actually fly physical gold bars from Caracas to Tehran. This was quite onerous. A much better way for these nations to transact would be via bitcoin, as no trust is needed between parties, and the neutral, apolitical nature of Bitcoin is extremely appealing. Even for shunned nations, using the ruble or the yuan isn’t particularly appealing, as no one wants to trust Russia or China with their monetary unit either. No, something independent of any nation is needed because financial settlement between nations is inherently low-trust. In a competitive global environment, powers are wary of each other; the fate of one’s savings cannot rely on trusting someone else. So neutral money is very desirable. Gold is neutral, but far more costly and inconvenient than bitcoin to transfer.

Excluded nations are likely to embrace Bitcoin quite soon. The more eagerly the U.S. and the eurozone wield the cudgel of financial sanctions, the faster they will drive excluded nations to Bitcoin as a workaround. These are not nations with a particular ideological attraction to Bitcoin. Basically all of them are brutal dictatorships: no friends of liberty. Instead of embracing Bitcoin because they love its libertarian roots, they will be driven to use it because they are barred from the traditional alternatives. The speed with which this happens is entirely a function of how much financial sanctions are applied by the hegemons.

We are already seeing this trend take place. Dictators like Vladimir Putin and Turkey’s Recep Erdogan are rumored to be paying close attention to cryptocurrencies. While Bitcoin would interfere with their ability to extract seigniorage rents from their domestic populations, they would be enabling units of value in international exchange if relations with the West deteriorate further. A scheme could arise whereby local currencies are enforced on the domestic populations, but bitcoin is used as an international settlement tool between nation-states. This would mirror the dual-currency scheme of the U.S.S.R. and other Soviet bloc countries, in which a hard currency is used for foreign trade, but local people are forced to use a weaker, far less hard form. From a dictator’s perspective, this is convenient; you can trade with foreigners who will not accept your local fiat, but preserve the ability to extract local seigniorage rents. Such a dual-tier system could easily arise in authoritarian states like Turkey, Iran, Russia, etc, with bitcoin as the hard, externally-facing money.

Vassals

As a vassal, Bitcoin is an exit opportunity. You are paying seigniorage costs to your overlord. They are capturing value from you. Adopting Bitcoin is a way to break free and establish independence. Unlike a large country, a vassal probably cannot set up a global financial infrastructure alone. But conveniently, the Bitcoin network is already up and running. New entrants can simply sign up and inherit that global value transmission system.

Adopting Bitcoin means you no longer pay the cost of the debasement of the overlord’s money. But they are not likely to be happy about that. El Salvador was previously a vassal state to the U.S. in this sense, since its legal tender was the U.S. dollar. To be clear, the dollar is still legal tender in El Salvador, but it coexists with bitcoin, which makes up an increasing fraction of its reserves. El Salvador now benefits from the hardness of bitcoin; it has reduced the ongoing debasement cost inherent with holding U.S. dollar reserves.

However, breaking free of one’s overlord is not without costs. The U.S., and to a lesser extent the eurozone, are extremely powerful and influential and can punish dissent. For its act of rebellious independence, El Salvador earned condemnation from the U.S. and the IMF. Nations that need U.S. support to survive will not discard vassal status anytime soon. Countries like Taiwan and Poland that have strategic reasons to desire friendship with the U.S., are unlikely to drop their dollar reserves. Their subservience to U.S. and eurozone monetary hegemony is calculated and fully rational based on their situations. But each vassal will perform its own calculation, asking, “Am I getting enough from the hegemon to justify the seigniorage rents I pay?” The greater those rents, i.e., the greater the monetary debasement in the U.S. and eurozone, the more stress that will be imposed on that relationship. If the dollar’s depreciation accelerated, many U.S. dollar reserve holders could question their allegiance and potentially dump dollars.

Minor Players

Minor players are caught midway between vassals and hegemons. They enjoy some seigniorage, so are probably reluctant to lose that income by going full Bitcoin. But the advantages of Bitcoin as savings technology will be clear. I don’t see a clear story. Probably some nations will try the two-tier domestic/foreign currency approach, in which the state tries to monopolize access to bitcoin, as in the U.S.SR. I do not believe this will actually work, as citizens can’t be prevented from accessing bitcoin as they were with 20th century money.

The most likely scenario is that minor players are simply broken. Their currencies are manifestly less desirable than those of the hegemons, let alone bitcoin. Bitcoin’s existence serves as an escape option for the populace. They shall take that option and minor players have no real choice.

Hegemons

The U.S. and the eurozone have the most to lose from the adoption of Bitcoin by other countries. Their sanctions will no longer have teeth. Their inflation will not be so easily exported abroad. Instead money printing will reverberate domestically with low latency. The seigniorage profits of the dollar play a large role in funding U.S. power. Take that away and the hegemon’s power is reduced materially, not just in terms of financial influence, but militarily and diplomatically as well. This could have significant global consequences, akin to the diminution of the British pound after World War II. The debasement and global abandonment of the pound signaled the end of the U.K. as a monetary hegemon. This went hand-in-hand with reduced influence overseas. Previously the U.K. government had been able to convince other peoples to accept their money on preferential terms, usually through moral suasion and influence. British colonies held pounds as reserves even when other countries preferred hard gold or safer dollars. As Britain lost its hegemony status, it had to bear the full brunt of maintaining overseas colonies alone, and could not.

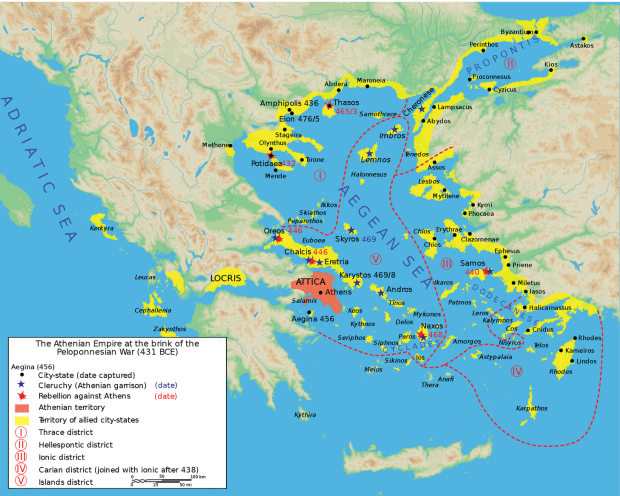

Source: Wikipedia

U.S. global influence could suffer a fate similar to that of Britain’s empire if it loses hegemony in money. The U.S. is still the world’s largest economy, but its power is augmented through the seigniorage rents extracted from all dollar holders worldwide. This is an enormous amount of value. It should be thought of as a tax on vassals in an unequal alliance, not unlike the Delian League of ancient Athens. A coalition of tributaries is led by an overlord. There is some ostensible purpose of self-defense, but in reality each subject nation pays a tax to the leader of the alliance. These are notionally independent states, but they are effectively not independent and are expected to contribute financially. The U.S. does the same, except indirectly through the seigniorage tax rather than through explicit tribute. But it amounts to the same. It is thus no surprise that U.S. allies are expected to hold dollars and to price things in dollars. And similarly, reneging on the dollar, or de-dollarization, is viewed by the U.S. as tantamount to disloyalty and sedition.

So the U.S. and eurozone states will view Bitcoin as a serious threat. Yet the majority of bitcoin wealth will likely be held by citizens in those countries. We can expect the same perception of disloyalty to extend to domestic bitcoin holders. We have seen President Erdogan urge Turks to turn in dollars and gold for local liras, as an expression of patriotism. Similarly, British citizens were urged to turn in their gold for fiat notes during World War I and onwards. In the U.S. it was mandated by executive order. Calls to patriotism, coercion, and other measures will be made to persuade citizens to surrender bitcoin to the state. The effectiveness of these measures is likely to be muted, as prying bitcoin from rationally-incentivized holders will be extremely difficult. Similar coercive measures have been attempted in nearly all hyper-inflationary states in history, and they usually failed. In Weimar Germany there were hapless efforts to convince or force citizens to surrender hard foreign currency. Despite irregular successes, these efforts were hopeless in the long run.

The hegemons will resist an alternative to their power. They will be the last to fall. Rather than suffering from external forces, probably the hegemons will be gobbled up from the inside as domestic citizens turn to bitcoin to avoid hyperinflation, as with the minor players, just later.

Sudden National Accumulation

Unlike gold, bitcoin is ascending to world reserve currency status in full view. We get to watch its ascent, its gyrations, and its gradual normalization. It is volatile precisely because the realization of bitcoin’s suitability as savings technology spreads unevenly. A gradual awareness grows around the world over the course of years. That awareness first grows among mere individuals, but reaches a tipping point and erupts at the level of entire countries. Some countries will arrive at the conclusion before others. El Salvador was very early. But there will be a second and a third and a fourth, spaced out perhaps by years. What does this process look like?

The dawning awareness of Bitcoin’s strategic role will lead to secret accumulation by nations. This is probably underway already. As a central bank or national leader, it makes sense to quietly accumulate bitcoin as a hedge, but without much fanfare. If you are a vassal nation you must acquire them secretly to avoid angering the hegemon. If you are a hegemon, you must do so secretly to avoid undermining one’s own hegemonic money. Probably for this reason the hegemons will acquire much less bitcoin than they ought. Like a non-innovating company resting on its laurels, the U.S. and eurozone do not want to disrupt their own money-maker, even if it is doomed.

Accumulation by the non-hegemonic nations could accelerate very quickly. As states become aware of other’s accumulation, it could become an exponentially intensifying race. Probably a full bitcoin cycle, bubble and collapse will someday be entirely driven by nation-state buying.

A nation-state could apply the Michael Saylor strategy, simply printing money to buy bitcoin. In the recent past China kept its currency intentionally weak to acquire hard foreign reserves, weaken its own currency, and to stimulate exports. Switzerland has printed Swiss francs to buy foreign assets like equities. A similar dynamic could apply to bitcoin; print one’s own currency to acquire it. For a nation, this is a smart trade. The very same trick that Saylor applied with MicroStrategy, issuing low-rate long-term debt to fund bitcoin purchases, could be applied at a much greater scale by nations. It is simple; produce something whose issuance you control to acquire that which no one controls.

I am sure that the strategic repercussions of Bitcoin have not been properly considered, by me or others. It is worth thinking further on the long-term geopolitical effects of hard, apolitical, and neutral money. Nations will use bitcoin as a weapon, fight it, and probably succumb to it.

This is a guest post by Andrew Barisser. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.