While the crypto industry never had a shortage of innovation, it’s safe to say that the past couple of years has been turbocharged. Beginning with the DeFi summer, the industry has seen an unprecedented pace of growth that culminated last November when the market reached its peak.

And while prices have largely consolidated since, development certainly hasn’t.

One of the main driving forces behind this innovation has been decentralized autonomous organizations (DAOs).

The novel organizational structure has been around since 2016 but began to gain prominence last year when many large decentralized protocols began adopting them as a go-to governance solution. According to a report from Kraken, there are currently at least 188 DAOs that exercise control over $12.8 billion in their respective treasuries. The growth of the DAO ecosystem has been so extreme that they began to generate value that puts them on part with the TradFi markets.

But, despite their tremendous growth and immense value captured, DAOs still remain in their infancy. The organizational structure is largely a mystery to the broader market and even a large portion of the crypto industry remains wary of them.

In its latest report, Kraken Intelligence broke down the essence of DAOs in a bid to make the new crypto paradigm more accessible to everyone.

What makes a DAO?

Kraken defines a decentralized autonomous organization as an internet-native entity that is collectively owned and managed by its members. This kind of informal foundation sources its assets from a wide range of contributors, which then vote on how to utilize the funds. These assets are stored in the treasury, which splits the private key between multiple parties to prevent unsanctioned use of the funds.

To decide how to utilize the funds and govern the organization, members of the DAO publish proposals which are then voted on. Most DAO governance processes take place on forums like Snapshot, where proposals and votes are discussed through public discourse.

And while DAOs can exist on any smart-contract enabled blockchain, the majority of them currently operate on Ethereum. Kraken Intelligence believes that this is due to Ethereum’s first-mover advantage as the first widely used smart contract Layer-1 blockchain, as well as its vast network effect and high liquidity. However, the huge growth seen in Layer-2 scaling solutions such as Polygon, other Layer-1 EVM compatible chains such as Polkadot, and networks such as Solana, Fantom, Cardano, and Harmony, means that DAOs will slowly begin transitioning to other blockchains as well.

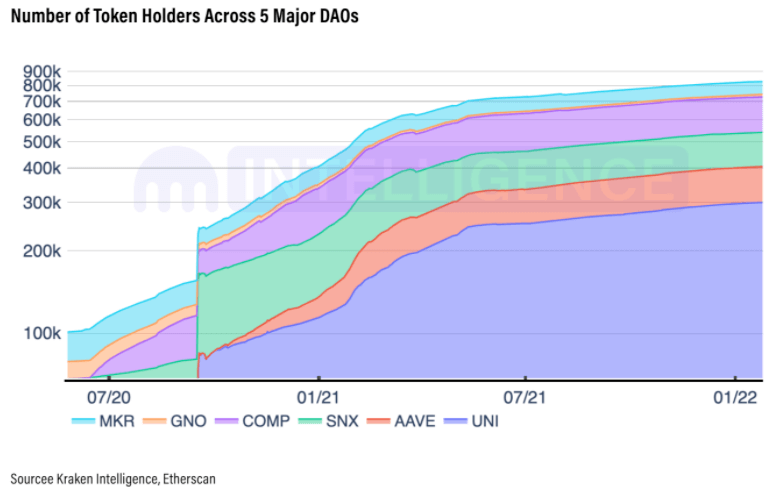

ƒmemThis is a natural progression of the rapid growth in the number of DAO members. The increase in the number of DAO members is measured through the number of governance token holders—Kraken Intelligence found that there has been a steady increase in the number of token holders across five major DAOs and noted that the growth was also visible in other, smaller organizations as well.

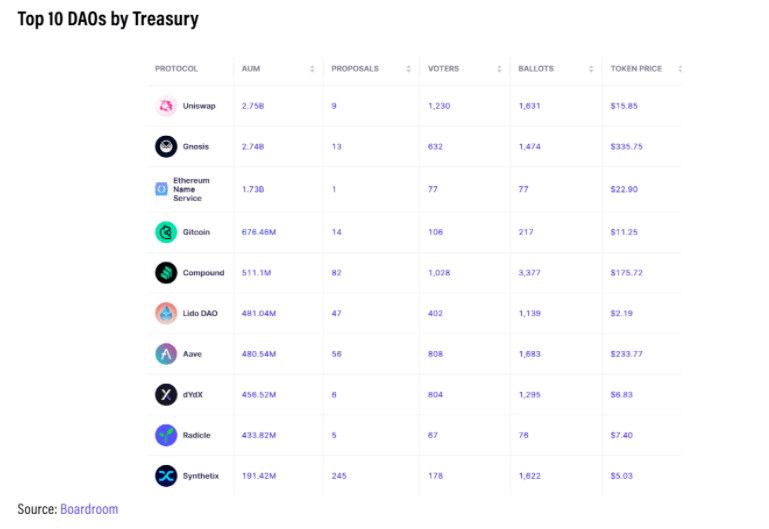

The ten biggest DAOs account for nearly 80% of the $12.8 billion in AUM locked in the entire DAO ecosystem. And while this number doesn’t account for the market capitalizations of any DAO governance tokens, it’s a good representation of the size of the DAO ecosystem.

There are many uses for the $12.8 billion in assets that have been pooled so far in the DAO ecosystem. While Kraken Intelligence identified five major categories of DAOs, its report noted that they continue to innovate with more applications such as play-to-earn (P2E) gaming and insurance.

The most common use cases for DAOs are NFT collection and incubation, protocol governance, investment management, social membership, and grant development.

NFT DAOs

The latest addition to the DAO ecosystem, NFT-focused DAOs are art curator collectives created to advance NFTs and art culture. What makes NFT DAOs unique is the fact that their members aren’t that concerned with the profitability of their holdings. Instead, their main interest lies in driving cultural impact and drawing community and media attention to the NFT space.

Some of the most notable NFT DAOs include PleasrDAO, Fingerprints DAO, Flamingo DAO, and Jenny DAO. While the total treasury balances of these DAOs remain unknown, they gained significance in the space by advancing the NFT market through the collection and fractionalization of prominent blue-chip NFTs. They have also set floor values for sought-after NFT collections, establishing a role as market drivers.

Protocol Governance DAOs

As their name implies, protocol governance DAOs exist primarily to govern their protocol’s policies. They focus on steering the development and offerings of a DeFi protocol and work on providing a structured improvement process when necessary.

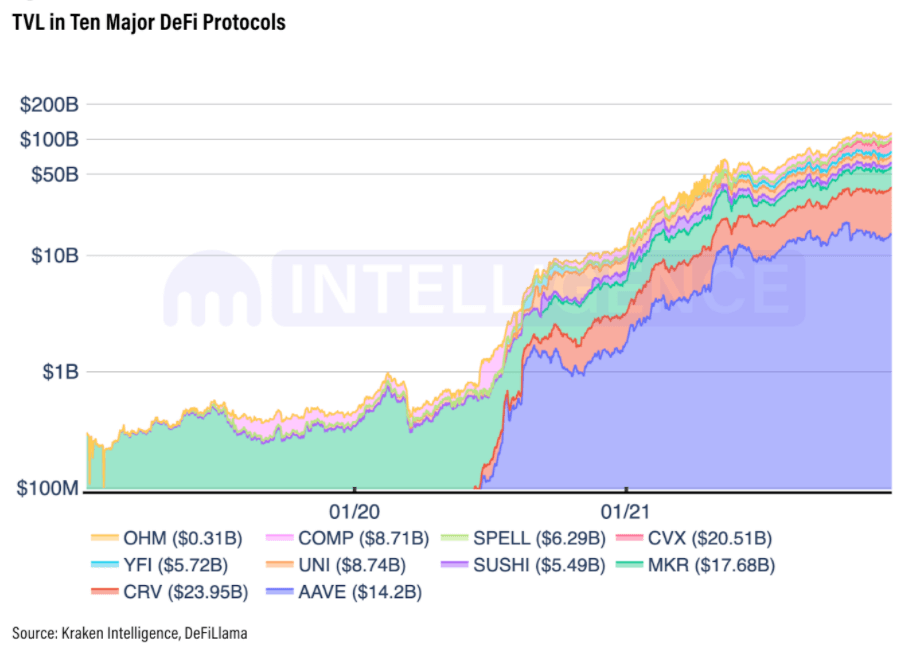

These are the largest DAOs by scale, and as such often attract the most media attention. There are several multi-billion dollar DAOs, including SushiSwap, Curve Finance, MakerDAO, Compound, and Audius. These DAOs offer token holders the right to vote on protocol policies and provide them with various monetary rewards to incentivize their participation in governance.

All of this has led to a significant increase in the total value locked (TVL) across many of these protocols governed by DAOs.

Investment DAOs

Investment DAOs were the first type of DAO to emerge in the DeFi space. Back in 2016, The DAO emerged as the first community investment DAO, crowd-sourcing capital among contributors to invest in its brand and portfolio.

And while The DAO’s short-lived success ended in an infamous smart contract exploit that caused the network to split into Ethereum and Ethereum Classic, the category continued to thrive to this day. Kraken Intelligence recognized the potential of investment DAOs to drive innovation in the crypto ecosystem. These DAOs have so far done a very good job of providing proper funding and resources to ambitious Web3 developers and protocols.

Investment DAOs function almost exactly like traditional venture funds. However, they give more accessibility to retail investors, provide better scalability as the fund continues to grow, require almost no overhead costs, and offer unprecedented speed in decision-making and autonomy.

The two most notable investment DAOs to emerge in the crypto market are Venture DAO and LAO. Both have provided crucial funding to promising early-stage startups such as Rarible, and have collected tens of thousands of ETH in contributions.

Social DAOs

As self-governing, decentralized social platforms, these DAOs exist to foster a community of like-minded individuals and enable them to interact with each other. Members gain access to the community through a token, which can be both fungible and non-fungible. Many communities choose to grant memberships through NFTs, as they’re both an indicator of social status and an easy way to differentiate members.

Social DAOs that grant membership through tokens offer users a much more tangible monetary benefit—as the community begins to gain more traction, the price of its token increases.

However, these financial incentives represent a very small part of social DAOs. Social DAOs have so far had more success in fostering a sense of community and vision among like-minded individuals than in providing wealth.

Grant DAOs

Unlike investment DAOs, which are essentially for-profit organizations, grant DAOs exist to fund various development initiatives. They often serve as hubs for contributors to learn, develop, and connect, as well as incubate emerging or growing projects in a decentralized way.

Kraken Intelligence notes that grant DAOs have the potential to be the biggest market movers and are often responsible for pushing the frontier of cryptocurrency space across many different initiatives.

The biggest and best example of a grant DAO is Gitcoin, which has distributed over $53 million in grants to thousands of projects and developers working on Web3. Gitcoin has also funded and organized hackathons and bounties within the DAO, providing work to developers and supporting communal projects.

The future is bright for DAOs

The crypto industry is cursed with trends. Like it or not, hype is what’s responsible for the rise and fall of most projects and is the main driving force of the market.

However, that doesn’t mean that real utility has no say in the market. While it can be hard to pick out true value from the hype, it’s safe to say that DAOs are more than just a passing fad. Ambitious projects like the Consitution DAO show that the market sees immense value in organizations providing autonomy and decentralization, even if they eventually fail to accomplish their goals. The success of SushiSwap and Curve also shows that protocols can see immense financial success even if they’re governed by a community.

The eyes of the market are pointed at DAOs.

The post DAO 101: Everything you need to know about decentralized autonomous organizations appeared first on CryptoSlate.