Unprecedented times with unwinding credit are increasing market volatility. Bitcoin will eventually benefit, but it won’t be smooth sailing.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The Larger Macro Picture

Last night, Dylan shared an extensive thread on Twitter covering the current macro picture across stocks, bonds and volatility in the market. In today’s Deep Dive, we’re expanding on some of those ideas and charts more in-depth as these are some of the more important market dynamics that will affect all markets in 2022, bitcoin included.

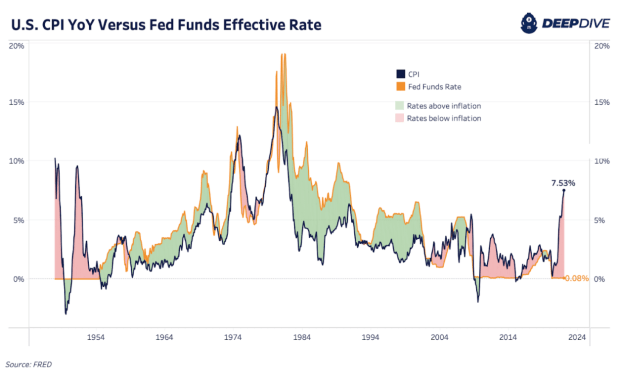

The overall ethos of the thread and a thesis we’ve discussed many times in the Deep Dive is that we’re in unprecedented times with over a decade of negative real rates contributing to the everything bubble we’re in today. The market now has to face the second order effects.

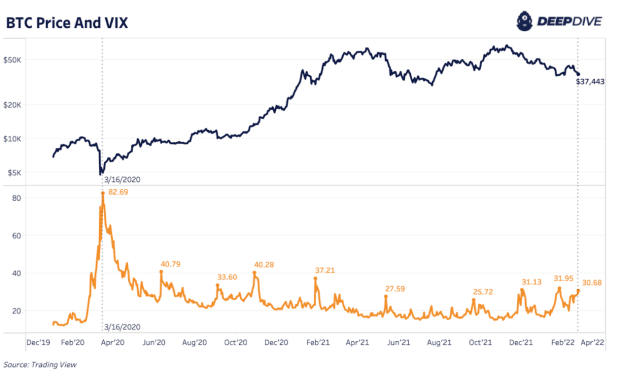

Second order effects, such as higher periods of volatility, have been more frequent over the last few months. Higher volatility is a direct result of lower credit market liquidity. Looking back at an extreme period of volatility during March 2020, markets violently sell-off in the face of a credit unwinding. Like most risk assets, bitcoin is severely affected in these higher periods of market volatility and rising U.S. dollar strength as told through the VIX relationship. We’re likely due for more market volatility going forward.

Yet in the aftermath, this is the opportunity for bitcoin. Is bitcoin a beneficiary of the massive credit bubble around the world? Undoubtedly. If credit markets continue to unwind will the price of bitcoin face headwinds? Almost assuredly.

“In the end, policy makers always print. That is because austerity causes more pain than benefit, big restructurings wipe out too much wealth too fast, and transfers of wealth from haves to have-nots don’t happen in sufficient size without revolutions.” – Ray Dalio

Bitcoin is the answer to the conclusion of the long-term debt cycle.