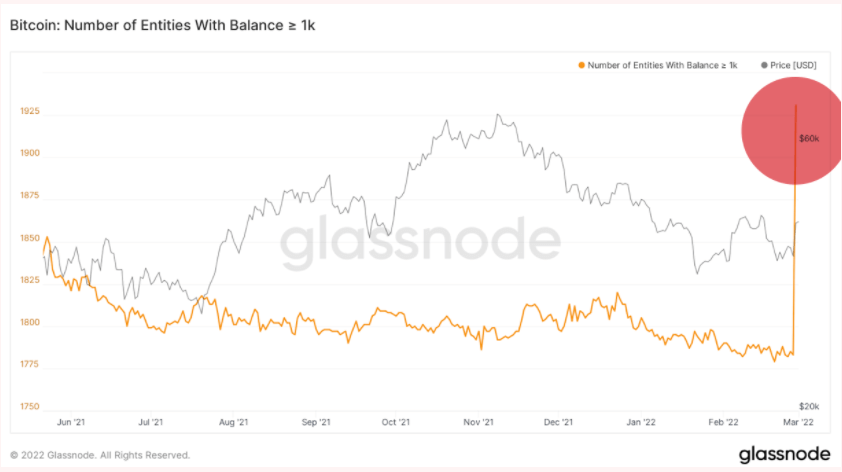

Addresses holding more than 1000 Bitcoin, also known as whales in the community, saw a significant increase on February 28th.

The number of whales rose by roughly 148 addresses on the day, according to Glassnode data.

The spike was initially considered to be whale accumulation, however, analysis by Numbrs shows that the increase was in fact caused by a WBTC, or Wrapped Bitcoin, custodian moving their BTC into newly-created addresses.

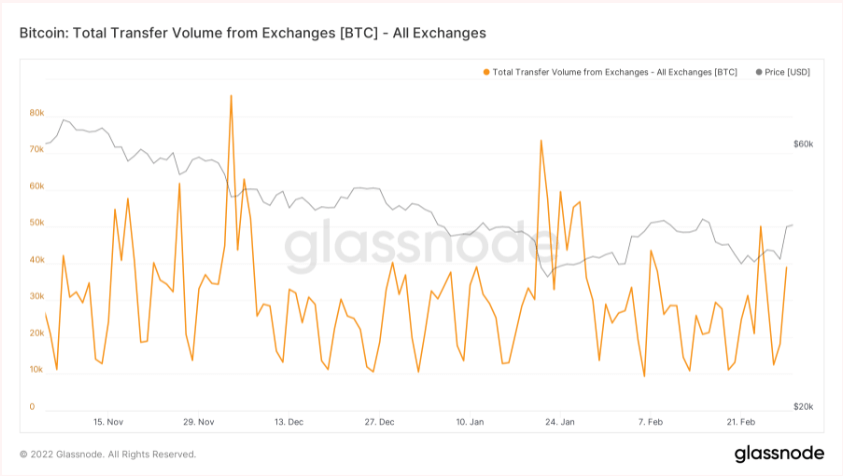

The Numbrs report added that there had not been a correlating rise in BTC leaving exchanges, which further implies that the spike in new addresses was caused by a major player “shuffling wallets.”

Wrapped Bitcoin

WBTC is an ERC20 token backed by Bitcoin at a 1:1 ratio. The on-chain ratio is managed by WBTC custodians and they must ensure that for every WBTC created they hold an equivalent amount of BTC.

ERC20 is an Ethereum-based standard that is used to create and issue smart contracts. Some other notable ERC20 tokens are the Basic Attention Token (BAT), Maker (MKR), and OmiseGo (OMG).

WBTC allows BTC holders to participate in Ethereum-based DeFi protocols such as lending and staking. Essentially, it makes BTC compatible with the Ethereum blockchain.

The significance of whales

Whale movements have historically had a significant influence on the cryptocurrency market. Players that hold vast amounts of coins often affect price movements and market capitalization with even the simplest of moves since their trades usually involve hundreds of millions of dollars.

Whales accumulating is generally considered a great buy sign, while whales selling can often lead to fear, uncertainty, and doubt among traders and the overall market.

Notable individual whales are Bitcoin’s original creator Satoshi Nakamoto, who is said to own around 1 million BTC; as well as the Winklevoss twins who founded the Gemini exchange and currently hold BTC in the hundreds of thousands.

Meanwhile, companies and groups are also considered whales as they collectively control a vast amount of BTC. Known whale companies are Fortress Investment Group and Pantera Bitcoin Fund.

The post Spike in addresses holding more than 1K Bitcoin attributed to WBTC custodian appeared first on CryptoSlate.