Miners are at the core of the Bitcoin network, providing security to the whole ecosystem of users, businesses, and hodlers. Bitcoin (BTC) mining companies aim to serve as bitcoin investment vehicles, helping to give investors bitcoin exposure without holding the asset directly. Therefore, they intend to build up bitcoin treasuries to be more correlated with the bitcoin price.

Also, since mining is a capital-intensive business, and miners are constantly looking for expansion opportunities, they want to keep a liquid balance sheet. As bitcoin bulls, it makes sense for them to keep the bitcoin they earn instead of storing it in fiat currency. By tapping into public markets and debt financing, these miners can hodl the bitcoin they earn and use fiat to pay their costs.

Top miner is holding 8,956 BTC

According to newly released research by Arcane Research, the bitcoin mining business Marathon owns the most bitcoin of all public miners, currently holding 8,956 BTC. Half of Marathon’s bitcoin is self-mined, but they also bought 4,813 BTC in January 2021. While some other miners aim to be vertically integrated and own their own data centers, Marathon only invests in ASICs and bitcoin.

Core Scientific is the second-largest bitcoin hodler of the public miners, with 7,355 BTC. Hut 8 with 6,115 BTC comes in third place, and Riot in fourth place with 5,783 BTC.

According to bitcointreasuries.net, Marathon has the third-largest bitcoin treasury of any company, only behind MicroStrategy and Tesla. Their findings also show that six of the ten companies with the largest bitcoin treasuries are miners.

Crypto markets have experienced highly volatile months, even by crypto’s standards. The year began with rising inflation shortly followed by the Russian and Ukraine war, causing Bitcoin’s price to retrace significantly from the $50k level at which it stood by the end of 2021.

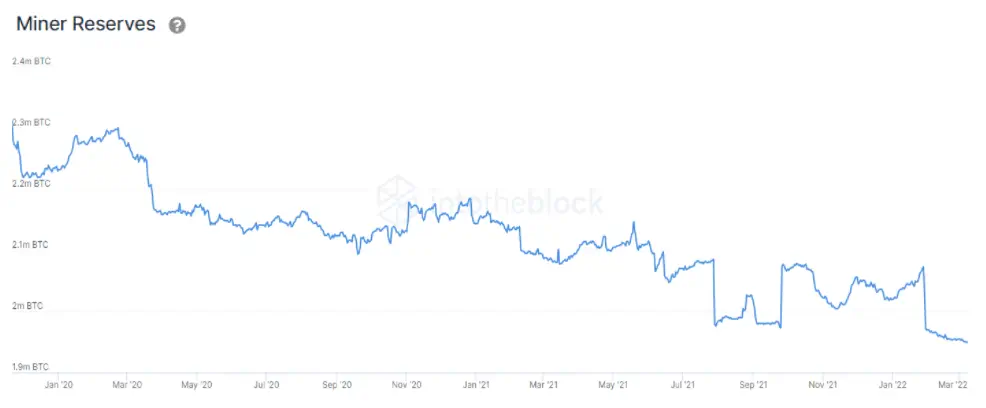

Bitcoin held in miner’s addresses has dropped considerably

This recent series of events have negatively impacted the mining industry.

The industry has grown tremendously boosting competition and elevating hash rate to sustained levels not seen before. These low prices have affected the mining industry profitability and as a consequence miner reserves have decreased, likely to cover companies day to day costs.

Miner Reserves track the balance of addresses belonging to mining pools. Bitcoin miners appear to have been selling and decreasing the amount of Bitcoin in their addresses, which has dropped considerably from the beginning of 2022. Currently at the lowest since 2011, miners’ total amount of Bitcoin sits at 1.95 million BTC.

As shown above, Bitcoin miner reserves have decreased significantly, probably in direct relation to the hash rate’s robust growth. An increase in hash rate means a more competitive environment, lowering profits for miners. Similarly, Bitcoin’s decreasing price puts further pressure on miner margins.

Due to these reasons, it is likely that miners are decreasing their Bitcoin holdings to cover their short-term operational costs.

Energy consumption concerns the EU and others

Meanwhile, bitcoin- and other proof-of-work miners in Europe, just experienced a near-death experience as EU regulators proposed legislation that may have banned Bitcoin mining altogether in the region. The European Union regulators have since removed a section from proposed legislation that may have banned Bitcoin mining in the region.

Recently, the so-called ECON committee of the European Union voted against a de-facto ban on cryptocurrencies that rely on the proof-of-work consensus protocol, like Bitcoin, that was included in the latest draft of the MiCA, or Markets in Crypto-assets Regulation.

However, the issue highlights the multifaceted, sometimes conflicting, objectives faced by regulators. After all, regardless of where you stand on proof-of-work (PoW) mining, there’s little doubt it has an impact on energy resources.

In an attempt to disprove much of the criticisms of Bitcoin’s high energy use, Galaxy Digital has released a report which states that the purported “high” energy usage of BTC is extremely low when compared to other industries like that of the banking industry and gold.

According to the report, the annual energy use of Bitcoin sits at around 113.89 terawatt-hours (TWh). At the same time, its counterpart from traditional finance (banking industry) consumes more than double the amount of the asset (263.72 TWh) annually.

Carbon footprint and renewable energy resources

As previously reported by CryptoSlate, according to a study run by Bankless Times, the carbon footprint created by Bitcoin mining globally accounts for 0.19%, which is the same amount the Czech Republic emits as an entire country.

Data collected since 2018 shows that there will be a 150% surge in Bitcoin mining energy consumption during 2021. As of February 2022, the total energy consumed for Bitcoin mining is 200 terawatt-hours.

However, Bitcoin Mining Council (BMC), recently announced the results from its quarter fourth survey highlighting how Bitcoin mining is steadily adopting sustainable power usage. Reported earlier by CryptoSlate, as per the latest Q4 survey report, the percentage of the global Bitcoin mining industry deploying renewable resources to mine Bitcoin has increased from 1% to a notable 58.5%.

The post Corporate treasuries: These mining outfits hodl the most bitcoin appeared first on CryptoSlate.