The cryptocurrency market has responded well to the Federal Reserve’s rate hike this week. Having stood at $1.83 trillion on Wednesday, its total cap now stands at $1.9 trillion. This is a 3.8% rise in a couple of days, with stock markets also rising in response to the Fed’s decision to increase interest rates for the first time since 2018. It seems that investors have been reassured by the central bank’s resolve to deal with inflation. And with the cryptocurrency market at its highest level for a week, the momentum could continue over the next few days. As such, we’ve compiled a list of the 5 best cryptocurrency to buy for the weekend rally.

5 Best Cryptocurrency to Buy for the Weekend Rally

1. Lucky Block (LBLOCK)

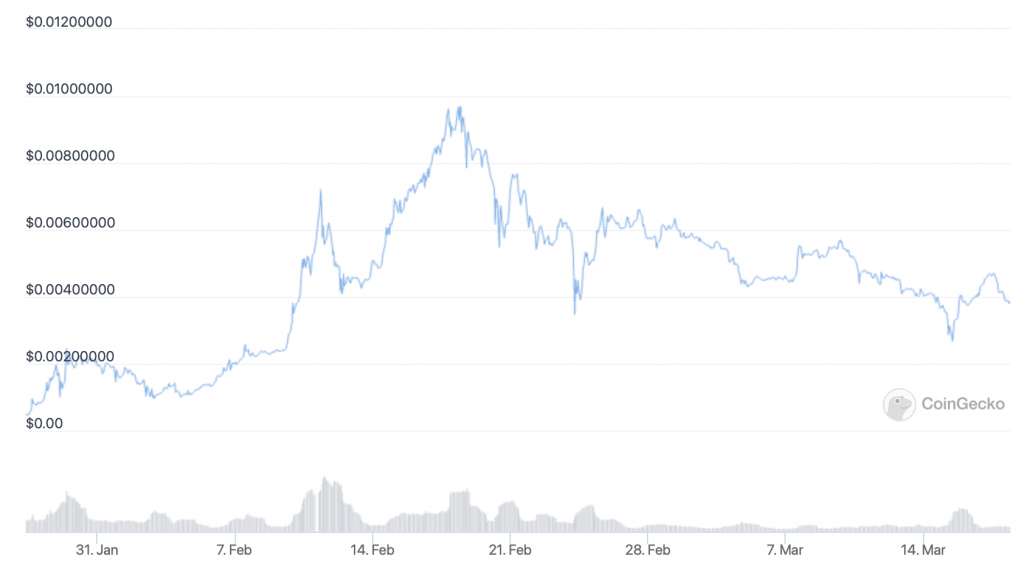

LBLOCK is currently priced at $0.00383275. This represents an 18% fall in the past 24 hours, as well as a 47% drop in the last month. However, LBLOCK is up by 780% since launching at the end of January, making it one of the best-performing coins in the market over this timeframe.

The native token of the Lucky Block lottery platform, LBLOCK runs on the Binance Smart Chain. It now boasts around 45,000 holders, with the coin reaching a $1 billion market cap in around three weeks.

📊LBLOCK token holder growth of 147% crushes the competition – Feb. 2022

📉 #Sandbox 16%

📉 #Matic 9%

📉 #CRO 7%

📉 #Decentraland 6%

📉 #FTX 5%

📉 #ShibaInu 3%

📉 #Cake 3%

📉 #BitcoinCash 2%

📉 #Uniswap 2%

📉 #Aave 1%

📉 #Avalanche 1%

📉 #Chainlink 1%

📉 #Dogecoin 1%

📉 #BTC 0% pic.twitter.com/cnsq6Hntsi— Lucky Block 🤞 (@luckyblockcoin) March 3, 2022

The platform’s first draw is taking place on March 25th. From then draws will take place on a regular basis, with users able to use LBLOCK to enter each draw. Entrants have the opportunity to win 70% of each lottery’s jackpot fund, while holders of LBLOCK will equally share 10% of each pot.

The platform’s app launched as a beta for iOS and Android on Wednesday, setting the stage for a full launch in the coming weeks. Lucky Block is also due to mint its first ever non-fungible tokens (NFTs). These will be limited to 10,000, and will grant holders entry to a special NFT-based draw. The fund for each of these NFT draws will be around 2% of the main Lucky Block, with estimates suggesting that this will work out to around $10,000.

On top of this, the platform is launching an Ethereum version of its LBLOCK token. This will facilitate trading on more centralised exchanges, and by extension should boost its liquidity (and price).

🚨Lucky Block V2 #ETH Token and Bridge to V1 Explained 🚨

Please read to learn more about the upcoming $LBLOCK ERC20 ⬇️

— Lucky Block 🤞 (@luckyblockcoin) March 14, 2022

LBLOCK is currently tradable on PancakeSwap and LBANK Exchange, but with its V2 ETH token coming soon, expect more listings to follow.

2. ApeCoin (APE)

A freshly launched coin, APE has risen by 45% in the past 24 hours. It is, however, down by 6% in the last hour, but still 139% above its opening price of $6.21.

As a new altcoin that launched barely a day ago, there’s not much to say about APE from a technical perspective. It’s possible that it could continue sinking from its peak of $17.17, yet the hype surrounding a new coin launch may push it higher over the next few days.

ApeCoin is the native token of of the Bored Ape Yacht Club NFT series. It’s a governance and utility token that grants holders to right to vote on how the Board Ape’s ApeCoinDAO uses its funds. Limited to only 1 billion tokens, it also grants users access to certain parts of the Bored Ape ecosystem.

Given how popular the Bored Ape Yacht Club has become, APE could take off in a big way. Indeed, the trading volume for Bored Ape NFTs has reached $23 billion over the past 12 months. This makes it the biggest NFT collection in crypto, and it’s why APE is one of our 5 best cryptocurrency to buy for the weekend rally.

3. Bitcoin (BTC)

BTC is flat in the past 24 hours, at $40,590. It’s also up by 3% in the past week, but down by 9% in the last 30 days.

BTC’s technical indicators have come back to life a bit after the Fed’s rate hike. Its relative strength index (in purple above) reached 70 yesterday, before coming down to a moderate 50. Its 30-day moving average (in red) is just about to overtake its 200-day average (in blue). This suggests that could be about to begin a rally.

Regardless, BTC’s fundamentals remain as strong as ever. It continues to attract more adoption and use, including the Swiss canton of Lugano, which made BTC (and also USDT) legal tender last week. There are also reports that more people in Ukraine and Russia are now buying bitcoin, largely as a result of sanctions and withdrawal restrictions.

On top of this, around $61.9 billion in BTC is held by companies and institutions right now. More banks are also turning to it, with State Street rolling out its own “mega” custody service. This is why BTC remains one of our 5 best cryptocurrency to buy for the weekend rally.

4. Aave (AAVE)

AAVE is up by an impressive 7.5% in the past 24 hours, reaching $153.30. It’s also up by 28% in the past week, but down by 11% in the past month.

AAVE’s indicators are very strong at the moment. Its RSI passed 85 yesterday, and remains above 70. Likewise, its 30-day average has surged past its 200-day average. Together, these two indicators point strongly towards a breakout rally.

And looking at Aave’s recent goings-on, it’s not difficult to see why. The DeFi platform launched the V3 version of its protocol, introducing a range of enhancements that make it more efficient and decentralized.

1/ Aave V3 is here! 👻

The most powerful version of the Aave Protocol to date, V3 brings groundbreaking new features than span from increased capital efficiency to enhanced decentralization. Read what’s new in V3 in the thread below👇or visit https://t.co/H3jTyKRqNs to dive in! pic.twitter.com/LXzn7660nA— Aave (@AaveAave) March 16, 2022

And with Aave already being the third-biggest DeFi protocol, according to DeFiPulse, the launch of V3 is likely to push it even higher. This is why AAVE is one of our 5 best cryptocurrency to buy for the weekend rally.

5. Avalanche (AVAX)

AVAX is up by 2.7% in the past 24 hours. At $79.24, it’s also up by 7% in the last seven days, but down by 15% in the last 30.

AVAX’s indicators are also encouragingly strongly. Its RSI of 60 signals good momentum, as does the fact that its 30-day average has just risen above its 200-day.

More generally, Avalanche is one of the strongest platforms in terms of fundamentals. Most notably, its DeFi ecosystem accounts for $11 billion in total value locked in.

This figure has grown by around 400% since September, making Avalanche one of the fastest-growing networks in crypto. It has attracted growing use due to the fact that it already employs a proof-of-stake consensus mechanism. This makes it more scalable and faster than Ethereum, as well as more eco-friendly.

#Avalanche does more using less, according to research by the Crypto Carbon Research Institute and data from @DefiLlama. Avalanche uses only .0028% of the energy consumed by the Ethereum network and secures $18,454 in TVL per kWh.

Lean more here: https://t.co/DiNcUw9pct pic.twitter.com/QlgTfjyu5C

— Avalanche 🔺 (@avalancheavax) February 14, 2022

Avalanche attracted a $230 million investment in September from Polychain and Three Arrows Capital, which it’s using to fund its continued development. Also, it very recently launched a $290m development fund, which will be focused on scaling the Avalanche network even further by using subnets.

Introducing Avalanche Multiverse, an up to $290M incentive program focused on accelerating the adoption and growth of Subnets. Multiverse is focused on supporting new ecosystems, including blockchain-enabled gaming, DeFi, NFTs and institutional use cases. https://t.co/R5euxSV5hx pic.twitter.com/PHpET78P6L

— Avalanche 🔺 (@avalancheavax) March 8, 2022

Capital at risk

Read more: