Honduran officials announced on April 8 that the country will now accept Bitcoin (BTC) as legal tender but only in the special economic zone called Honduras Prospera.

As reported by CryptoSlate in late March, the Central American country of Honduras had signaled its intent to adopt Bitcoin as legal tender. At the time, President Xiomara Castro said neighboring El Salvador could not be the only country to free itself from dollar hegemony.

The announcement is a win for cryptocurrency adoption. However, it remains to be seen whether Honduras will expand the law beyond its special economic zone to the rest of the country.

What is Honduras Prospera?

Honduras Prospera was established in 2020 as an economic development hub to attract investment and entrepreneurial opportunities.

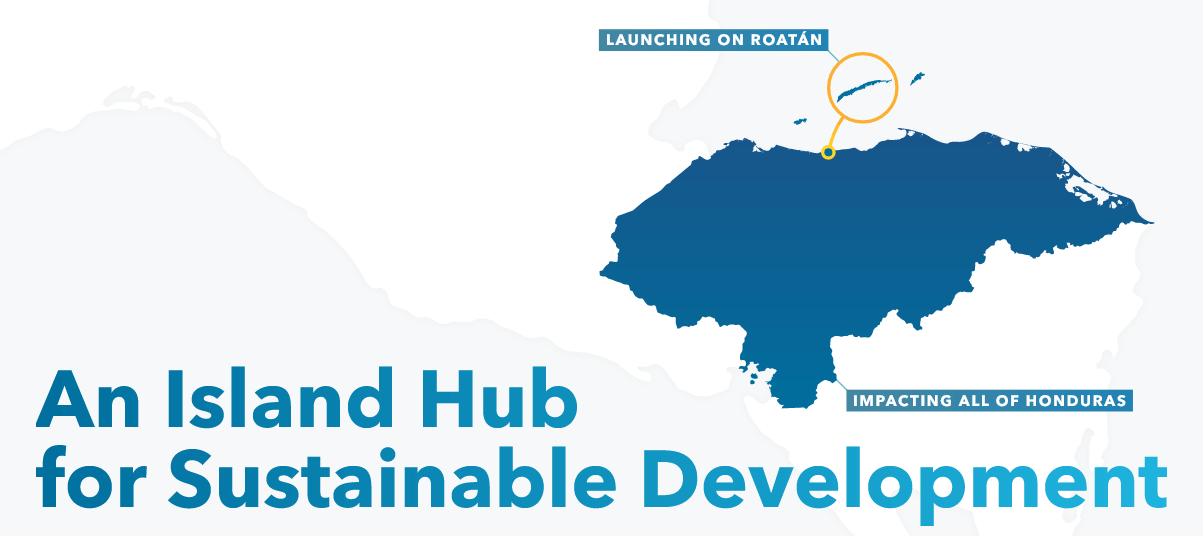

Located on the island of Roatán, about 65 kilometers off the northern coast of Honduras, it boasts a tropical climate and a burgeoning infrastructure with plans to turn the area into a futuristic enterprise paradise.

“This hub enables a new model for economic development that is locally sustainable and globally integrated on one of the Caribbean’s most beautiful islands. Roatán Próspera offers new opportunities for growth in Honduras to businesses and individuals.”

Roatán is the first of many planned development hubs in Honduras to follow the Prospera blueprint. Such projects may push the adoption of Bitcoin as legal tender across Honduras as new development breaks ground.

The Central Bank of Honduras is cautious about Bitcoin

On adopting Bitcoin as legal tender, Honduras Prospera officials said the zone’s fiscal and administrative autonomy “enables crypto-innovation,” and allows for the use of Bitcoin by all entities established there.

“Prospera’s flexible regulatory framework enables crypto-innovation and the use of Bitcoin by residents, businesses, and governments.”

However, the elephant in the room is that Honduras Prospera is a geographically small area within Honduras and not the country itself. Established in 2020, Roatán is still in the early stages of development and has not yet built the first residential units.

A statement by the Central Bank of Honduras points to friction among the country’s chain of command. As a result, the central bank says it cannot back cryptocurrency, and activity of this type is solely the individual’s responsibility.

“Any transaction carried out with this type of virtual asset falls under the responsibility and risk of the person carrying it out.”

Even so, what’s happening with Honduras Prospera represents a broader uptrend to do with global cryptocurrency adoption.

The latest Chainalysis data shows that global adoption has grown by 881% for the year to Q2 2021. Much of this growth comes from emerging markets as locals turn to crypto to combat currency devaluation and access cheaper, more frictionless remittance services.

The post Honduras adopts Bitcoin as legal tender but there’s a catch appeared first on CryptoSlate.