Is crypto already putting down CBDCs? The European Central Bank (ECB) has been researching and discussing a CBDC project called the Digital Euro for a while. They launched a public consultation to understand common needs & expectations for a Digital Euro. The feedback has been extremely negative.

Unwanted

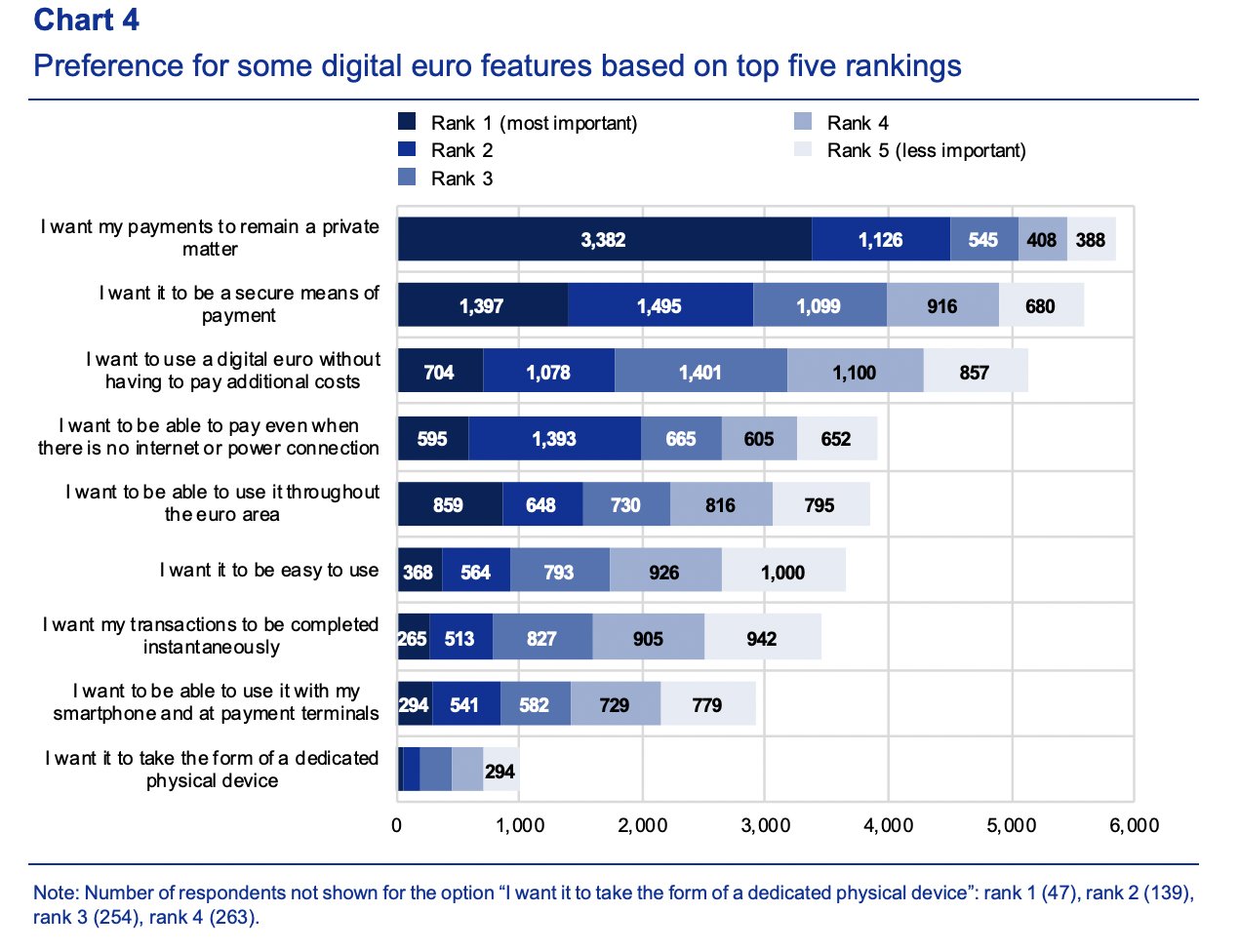

This is the second consultation launched by the central bank. The first one already reflected a common worry: people want their payments to remain private. To which the bank stated that “A completely anonymous digital euro is not desirable.”

Now, the public feedback shows angry comments against the Digital Euro page after page. Just like the first time, the consultation has been driven by Germans.

So far, over 11,000 European citizens have participated, and the general feeling is that a digital euro would be a tool for totalitarian measures and “a further restriction on citizens’ rights” because “it will be possible to disconnect anyone from the source of the money, as they have recently shown us in Canada,” in words of a user.

Most comments fear that the CBDC would eliminate cash, and say that “Cash is a partial sign of independence” or that they want to be able to spend their cash, “Cash means freedom, digital currency represents control over EU citizens” adding that “Every citizen has the right to cash payment and has the right to stay offline.”

The fixation on cash is a bit weird. Firstly because the ECB has already clarified the following:

“No, a digital euro would be complementing cash, not replacing it. Cash will continue to be available in the euro area.”

However, some people did express that they simply do not believe in the bank’s promises and see this as a sign of a systematical overpowering and prohibition of other currencies in the continent, eventually turning into the complete eradication of cash.

But what is truly weird about some of these comments is how mechanical many of them sound. A few turn on a bot alarm, then others do things like this:

An anonymous signed comment? Huh?

Needless to say that 11,000 is not even close to a number that represents the European population.

Regardless of the sketchy comments, several are quite clever and raise important points.

Pro Libertate, Institute of Law and Civil Liberties from the Czech Republic, wrote a statement:

“Introduction of digital Euro makes no financial or other economic sense. In a way, it is a return to the ECU system, which was abandoned before the introduction of the Euro. This step will logically require the adoption of further repressive EU norms that will control and regulate, under penalty, the possession and use of other countries’ currencies. The only real purpose and objective is thus to strengthen the Union’s controlling and repressive role over the financial market, which was inherent in the totalitarian communist states before 1989.”

And others questioned democracy: “Are we still in a democratic society that you are making such fundamental changes?”

That’s a key point. The bank claims that “A digital euro must be able to meet the needs of Europeans,” so what are they going to do with these responses? And how will they obtain a legitimate representation of what most Europeans think?

Some users were already pessimistic enough to add that the ECB will ignore their comments against it and do as they please.

Related Reading | India Thumbs Down Crypto, To Launch CBDC Instead

What About Crypto?

Many comments seem to oppose the transition of payments to the digital world. One might wonder what their thoughts are on crypto. Do they remain skeptical or rather find in cryptocurrencies a tool to avoid what they fear about governments?

One user expressed:

“If the digital euro is generated in a similar way to bitcoin or ETH, I see it as something very necessary. But if they are going to get euros out of nowhere like the Fiat, then better to leave it be and spend time on something else. […] I believe that money should be a means of exchanging value and only that, hence its anonymity (except for illicit cause) and generating € with value support is essential.”

That’s a few mixed concepts. But most definitely the CBDC would be nothing like bitcoin. It would make no change to the monetary policy and its issues, nor would it be decentralized.

Recent studies indicate that Germany is the most crypto-friendly country so far in 2022. Gemini’s report states that 53% of Germans are “crypto curious,” and 43% of high-income Germans already own digital assets.

Given that Germans are the ones driving the consultation’s feedback, that could signal that they rather adopt crypto and avoid CBDCs.

However, if fair research by the ECB were to be made, we could know more about what citizens are thinking.

But it’s hard to imagine the ECB would announce that Europeans rather use Bitcoin than CBDCs if that were the case.

Related Reading | Honduras Central Bank Chooses CBDCs Over Bitcoin, Breaks Everyone’s Hearts