Blockchain analytics firm, Chainalysis, has released a report on cryptocurrency Gains by country in 2021, and investors in the U.S. are topping the charts.

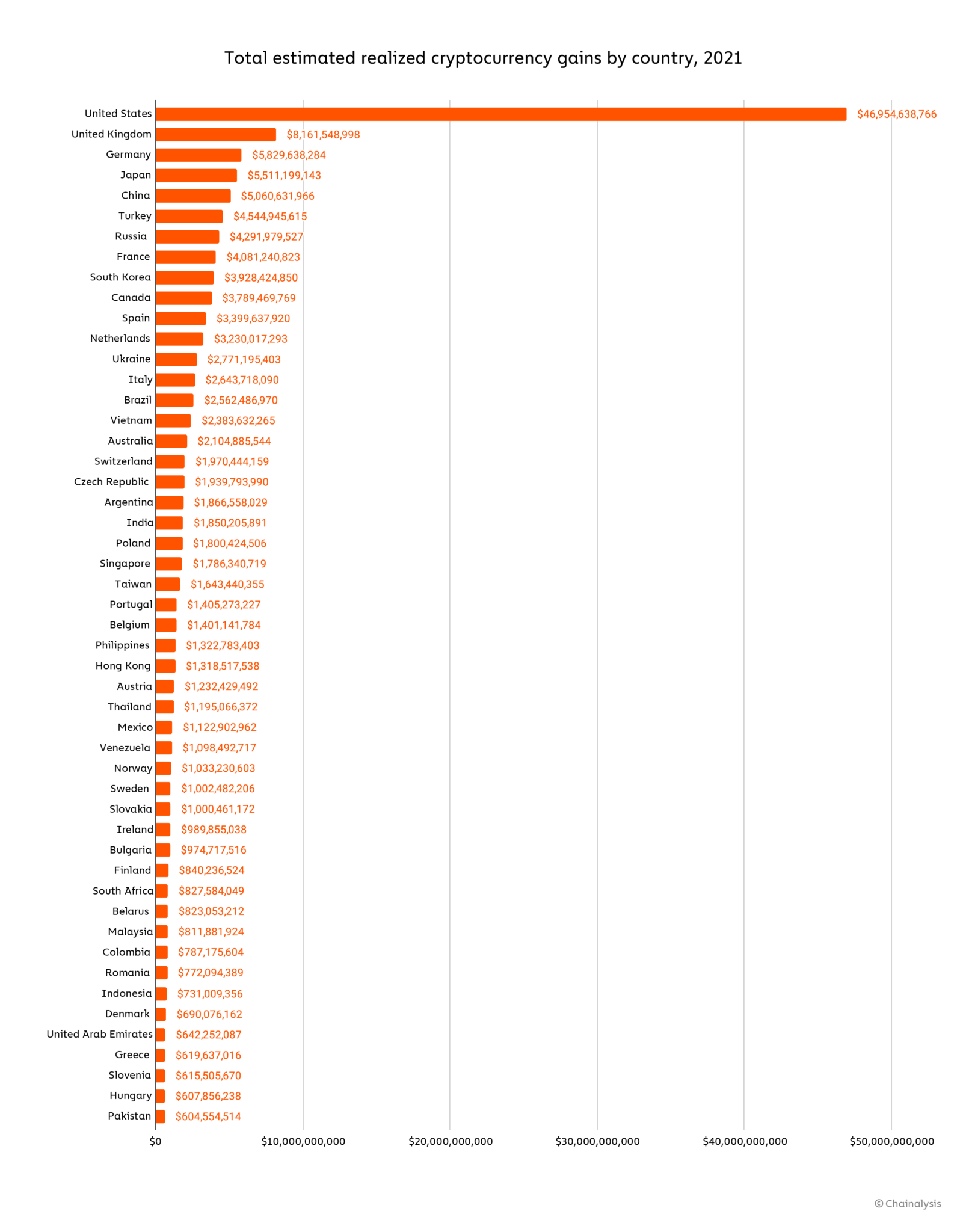

In a year that was far more productive than the previous, investors worldwide saw a total gain of $162.7 billion, with those in the U.S. making up about $47 billion.

US investors see biggest gains

The margins between the U.S. and other countries are pretty broad, with the U.K. coming second with $8.8 billion in gains. Germany completes the top three with $5.8 billion gains. Japan and China also posted crypto gains above $5 billion.

However, some countries seem to be performing better in terms of their crypto investments when compared with their rankings using traditional metrics.

For example, Turkey ranked 6th with $4.6 billion in gains even though it’s 11th in terms of GDP worth $2.7 trillion. Meanwhile, with a 25th position GDP worth $1.1 trillion, Vietnam ranked 16th for cryptocurrency gains.

Countries with similar performances include the Czech Republic, Ukraine, and Venezuela. The trend shows the rapid adoption of cryptocurrency in emerging markets as a response to the devaluation of fiat currencies.

In 2020, China saw gains of $1.7 billion, while its cryptocurrency gains were $5.1 billion in 2021. Compared to the growth other countries saw during the same period, China seems to be lagging.

China’s performance shows a year-over-year growth rate of 194%. That’s low compared to the US at 476%, Germany at 423%, and the UK at 431%. But China’s growth rate isn’t surprising given the crackdown on crypto-related activities in the country.

Other countries that made the top 50 gainers list include India, Brazil, the Netherlands, South Africa, UAE, and Switzerland.

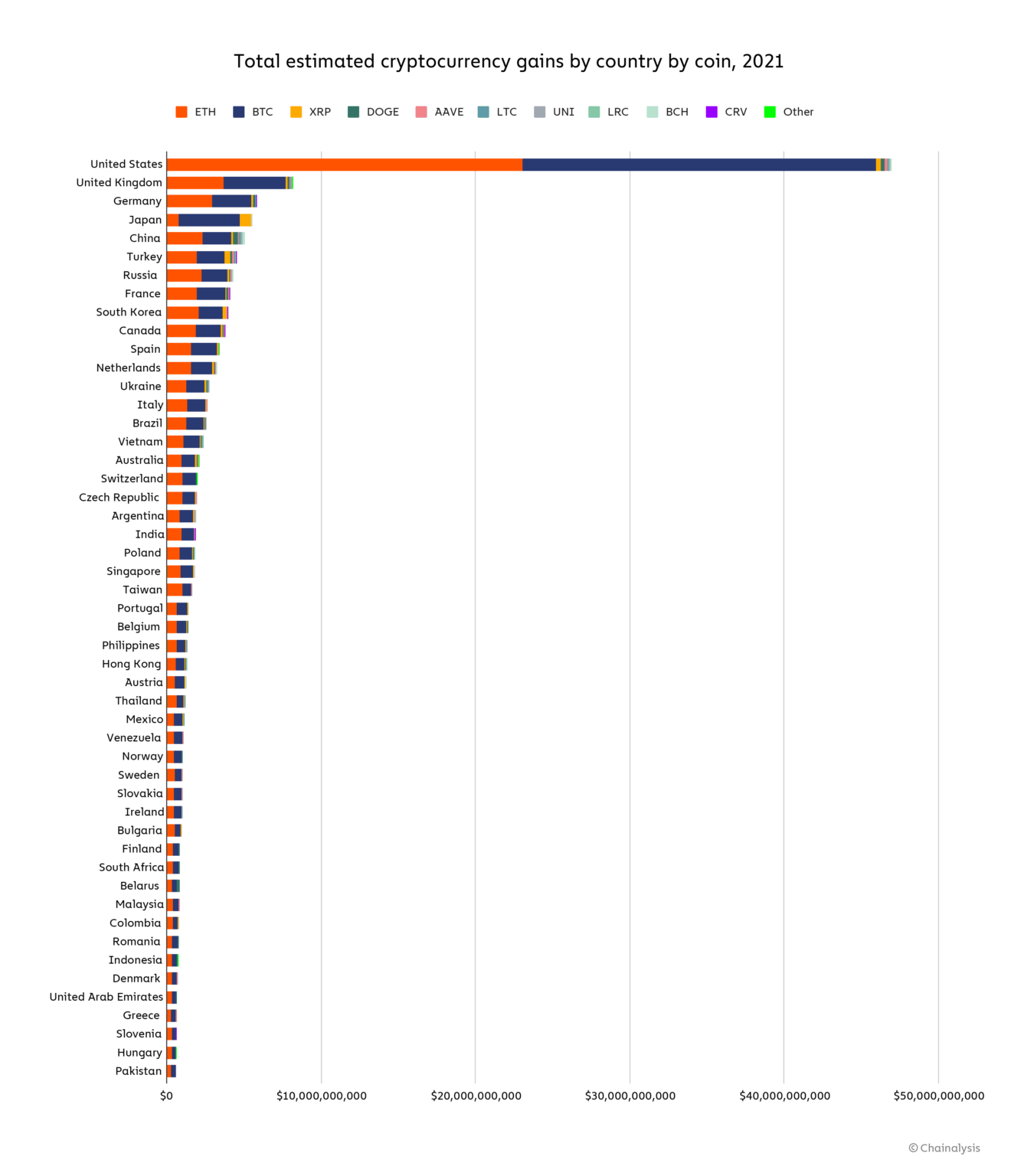

Ethereum tops crypto gains

It’s also noteworthy that Ethereum saw the most gains of all crypto assets with $76.3 billion, edging out Bitcoin with $74.7 billion. According to Chainalysis, this is likely due to the higher demand for Ethereum amid the rise of DeFi in 2021.

However, not all countries recorded more Ethereum gains in the tradings. Japan, for example, saw $4 billion in Bitcoin gain against the $790 million profits traders recorded in Ethereum.

The Chainalysis report concluded that though

There are still risks the industry must work to mitigate, the data not only shows that crypto asset prices are growing, but also indicates that cryptocurrency remains a source of economic opportunity for users in emerging markets.

The post US investors, Ethereum dominate crypto market gains in 2021 appeared first on CryptoSlate.