Blockchain data analytics firm Chainalysis has found that the total cryptocurrency gains worldwide amounted to $163 billion in 2021, which was 5x the previous year or a 400% increase.

Chainalysis on Crypto Gains Worldwide

Blockchain analysis firm Chainalysis published a blog post last week titled “2021 Cryptocurrency Gains by Country: Ethereum Leads as Gains Skyrocket Around the World.”

The firm explained that its estimates are based on a combination of web traffic data and its transaction data, including “on-chain, macro-level flows of all crypto assets” it tracks.

Noting that “2021 was another strong year for cryptocurrency,” the firm wrote that for all cryptocurrencies it tracks:

Investors around the world realized total gains of $162.7 billion in 2021, compared to just $32.5 billion in 2020.

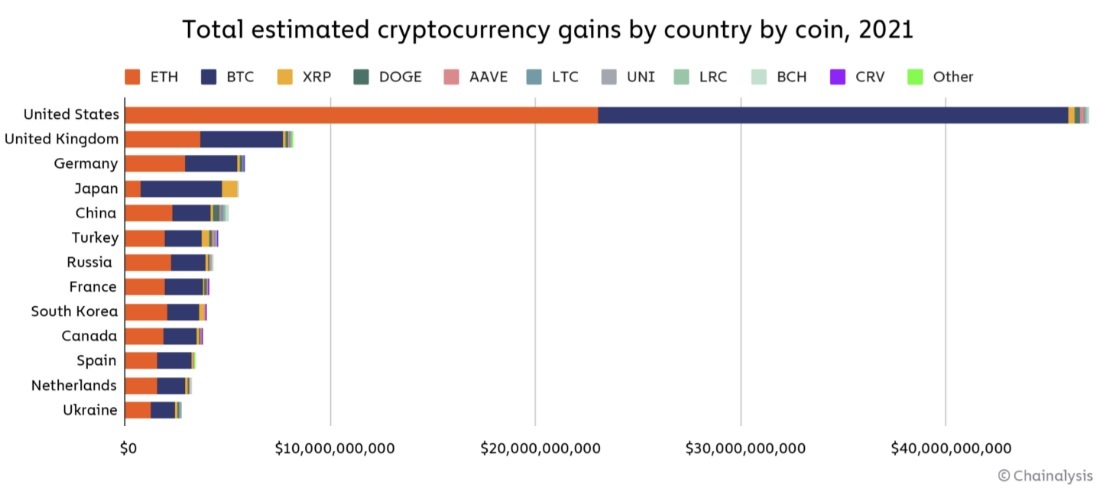

The U.S. leads by a wide margin at nearly $47 billion in realized cryptocurrency gains, followed by the U.K., Germany, Japan, China, Turkey, Russia, France, South Korea, Canada, and Spain.

Chainalysis also provided estimated cryptocurrency gains by country by coin. The blockchain data analytics firm described:

The most notable trend here involves Ethereum gains. Ethereum just edged out bitcoin in total realized gains globally at $76.3 billion to $74.7 billion.

“We believe this reflects increased demand for Ethereum as the result of defi’s rise in 2021,” the firm continued, emphasizing that most decentralized finance (defi) protocols are built on the Ethereum blockchain and use ETH as their primary currency.

Nonetheless, Chainalysis noted: “While most individual countries follow this pattern, there are some notable exceptions. Japan, for instance, received a much higher share of realized gains from bitcoin at just under $4.0 billion, compared to just $790 million in realized Ethereum gains.”

What do you think about Chainalysis’ findings? Let us know in the comments section below.