As hash rate and energy costs grow, bitcoin mining becomes less profitable and equipment is less cost-effective which impacts mining companies.

The below is a direct excerpt of Marty’s Bent Issue #1206: “Hashprice at lowest point since November 2020” Sign up for the newsletter here.

Everyone okay out there? Still licking your wounds from the chaotic price crash? Welcome to bitcoin. There will be many more days like this in the coming decade. This should be expected when the world is introduced to a new world reserve currency that is completely foreign to the average human. The road to a Bitcoin standard is going to be extremely bumpy.

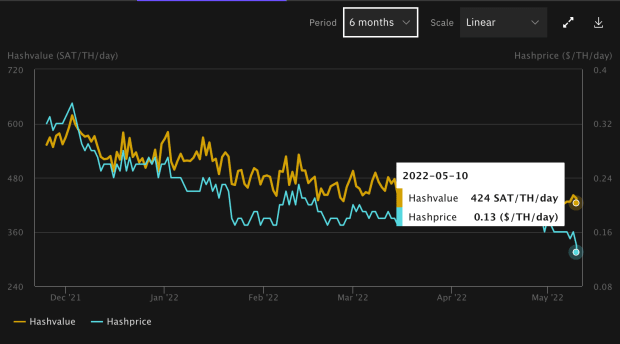

With that being said, I thought I’d draw your attention toward the current hash price, which hit its lowest point since November 2020 when bitcoin was trading around $15,000 and hash rate was about 100 exahashes lower. We warned you freaks a few weeks ago that the culmination of rising energy prices, a rising mining difficulty environment and a stagnant bitcoin price would lead to some stress in the bitcoin mining market. Well, today we find ourselves in an environment where energy prices seem primed to keep rising through the summer, difficulty continues to climb and the price of bitcoin happens to be crashing (and could continue to fall). This should pull forward some turmoil in the mining sector.

Who will survive the storm? I think we’ll be able to tell by the Fall.

If this price action is scaring you, you need to take a deep breath and remind yourself of the fundamental utility bitcoin provides the world. Bitcoin is a distributed, peer-to-peer cash system with a fixed supply of 21 million that provides individuals the world over with a monetary system that is wholly separated from the parasitic system that is wholly dependent on cheap debt and the ability to kick the can down the road. With the potential for stagflation hitting the U.S. economy and the Federal Reserve completely out of ammo, the road is coming to an end. Truman Show style. At some point soon the Fed and the Treasury are going to try to kick the can further down the road and it is going to bounce off a wall with a road drawn on it.

When that happens, Bitcoin will be there waiting. Producing blocks and facilitating peer-to-peer transactions for anyone who can access the software to receive and broadcast transactions. This is a blessing. Never forget it.