The world’s biggest stablecoin has just released its quarterly transparency report a day before the deadline of May 20.

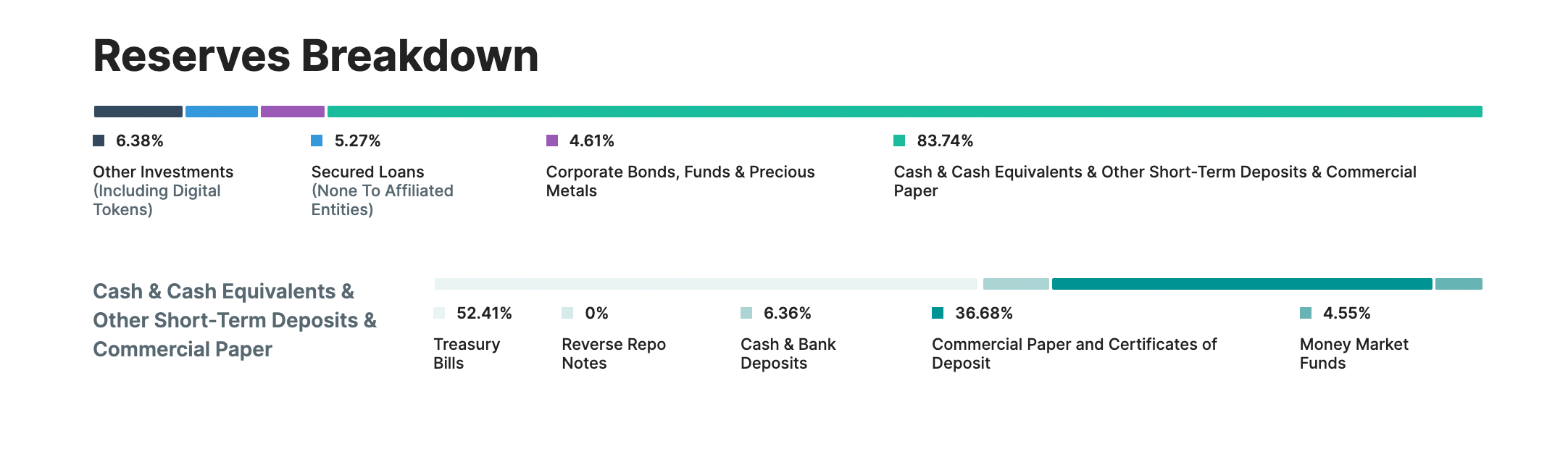

The report indicates that Tether’s reserves were $82.4 billion as of March 31, which “exceeds the amount required to redeem the digital tokens issued.” It is important to note that this report does not cover the past few week’s volatile events.

Tether CTO Paolo Ardoino commented:

“This past week is a clear example of the strength and resilience of Tether. Tether has maintained its stability through multiple black swan events… it demonstrates a commitment by the company to reduce its commercial paper investments.”

Tether continues to commit to “a further reduction of 20% in commercial paper” amid concerns that the short-term loans may be linked to Chinese real estate. Ardoino remarks that “Tether’s growth in the market continues to validate the business.”

However, recent data suggest that there has been an 11% reduction in Tether’s market cap since the Terra attack. The report’s release is a part of Tether’s “ongoing commitment to transparency.” The transparency reports result from a court case requiring it to release attestation information through a third party four times per year.

Reduction in commercial paper

The report indicates that the commercial paper used to back Tether’s issuance of its stablecoins has been reduced by 17%, from $24.2B to $19.9B. It also claims to have reduced this amount by a further 20% since April 1, a period not covered within this statement.

The total commercial paper allocation could be as low as $15.92B. However, market data shows the total market cap of Tether has decreased by over 11% since the start of May. The reduction is partly due to a decrease in confidence in the stablecoins sector following the collapse of UST.

Ratings of debt

The average rating of commercial paper & certificates of deposit has gone up from A-2 to A-1 since the last report. These represent the fifth-highest class a debt instrument can be awarded.

According to a report by Latham & Watkins, A-1 is the highest rating for short-term debt instruments suggesting that Tether may hold the highest quality liquid instruments available.

The rating is equivalent to companies like Goldman Sachs, GlaxoSmithKline, and Walt Disney. The report portrays that not only is Tether fully backed, but it holds more capital than is required to redeem all the Tether tokens in existence, and it is investing in companies equivalent to those that make up the S&P500 or Dow Jones.

The post Tether’s $82.4B reserves exceed market cap of USDT appeared first on CryptoSlate.