Crypto YouTuber Lark Davis tweeted that ‘the great DeFi unwind’ is upon us.

The great #defi unwind saw us go from 230 billion at the start of April, to 110 billion sitting in defi now! Life comes at you fast in #crypto! pic.twitter.com/hhojS738SK

— Lark Davis (@TheCryptoLark) May 20, 2022

Davis points out that the Total Value Locked (TVL) in DeFi protocols was $230 billion at the start of April. But outflows since then have tanked this figure to $110 billion – representing a 48% decline in TVL.

The numbers are further confirmation that crypto winter is here. But is it as bad as the numbers depict?

Is DeFi losing its shine?

Decentralized Finance (DeFi) is a broad term to describe peer-to-peer financial services via blockchain protocols.

Ethereum, which has the first-mover advantage, is home to the most value-locked on-chain. Currently, it accounts for 65% (or $72 billion) of the TVL.

DeFi offers an alternative to banking, making it a critical use case for blockchain and cryptocurrency. Through DeFi, users can earn interest, borrow, lend, buy insurance, trade assets, and more, all without the need for a third party overseeing the process.

However, according to Forbes, the DeFi space has become a breeding ground for scammers in recent times. Financial Researcher Rufas Kamau points out that templates exist, enabling anyone, even those without the appropriate knowledge and expertise, to launch a project. And, given the decentralized and borderless nature of DeFi, there is also a lack of accountability.

Accounts of DeFi fraud, not forgetting instances involving vulnerable protocols, such as in the case of Terra UST’s fragile algorithmic pegging system, have undoubtedly unnerved users.

It’s probable that investors flipping risk-off has extended to DeFi, which some perceive as the riskiest bet in cryptocurrency.

Are the events at Terra solely responsible?

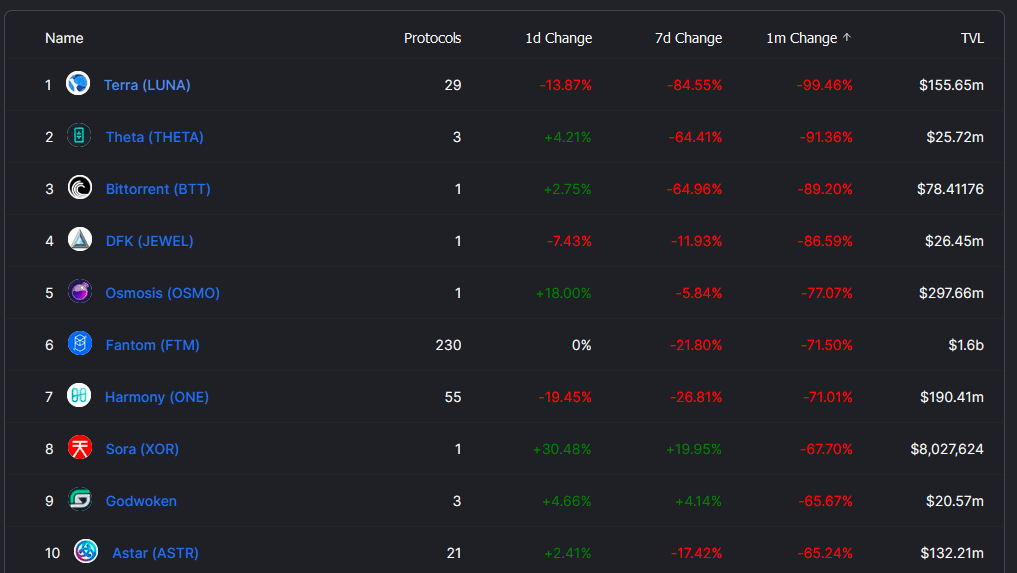

Terra (LUNA) is the biggest one-month loser, having lost 99.5% of its TVL value.

Before the Terra ecosystem implosion, its TVL came in at $29.17 billion. Now, the total value locked is just $156 million.

At the start of April, Terra’s TVL was $28.7 billion. By subtracting this from total outflows — and removing the anomalous event — capital leaving DeFi since April still amounts to $91 billion.

The only conclusion to draw is that DeFi is losing its shine with investors.

The post ‘The Great DeFi unwind’ sees Total Value Locked plummet to 10-month lows appeared first on CryptoSlate.