Inflation is arguably out of control globally, with rates hitting as high as 9% in the U.K. while the M1 money supply grows. The stock markets have taken a massive hit, with over $7 trillion wiped off the Nasdaq in the last four months.

A senior analyst at Bloomberg Intelligence, Mike McGlone, said:

“If stocks are going limp, Bitcoin, Gold, and Bonds could rule.”

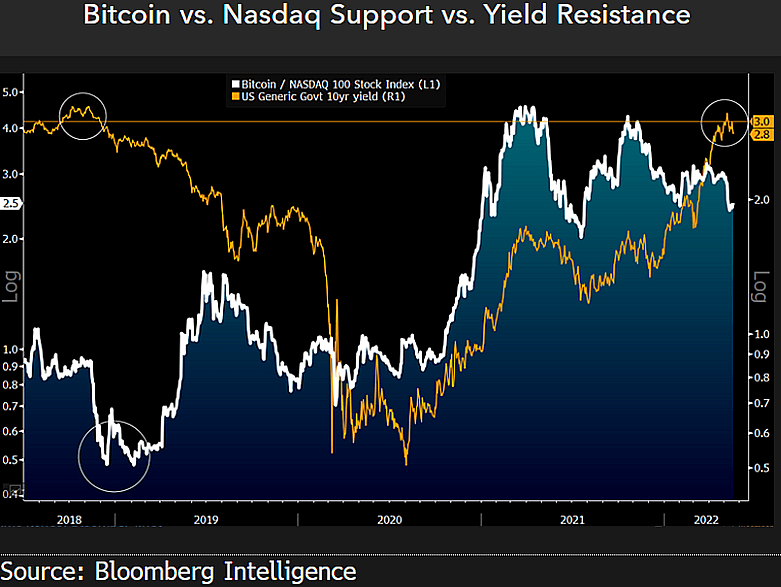

McGlone shared the chart below to support his claim.

This spread chart shows the U.S. Treasury 10-year bond yield in orange and the price of Bitcoin against the NASDAQ 100 over the past four years. At the bottom of the Bitcoin bear market, around 2018, the chart shows a double bottom ratio of 0.5 before rising to 2.0 in early 2021.

The ability of Bitcoin to hold the 2.0 ratio since January 2021 indicates that it is performing well amid its first potential recession. The last extended global recession occurred due to the 2008 financial crisis, which was a year before the birth of Bitcoin.

Since its inception, Bitcoin has flourished in a thriving global economy. The COVID-19 hurdle of early 2020 was surpassed due to trillions of dollars flooding into circulation, much of which made its way into cryptocurrency. As the world deals with the impact of the rapid increase in money supply, Bitcoin appears to be holding firm compared to other risk-on investments.

McGlone states that “Greater Risk in About a Year May Be #Deflation.” However, his overall sentiment continues to focus on the ability of Bitcoin and Gold to outperform the market in the near future.

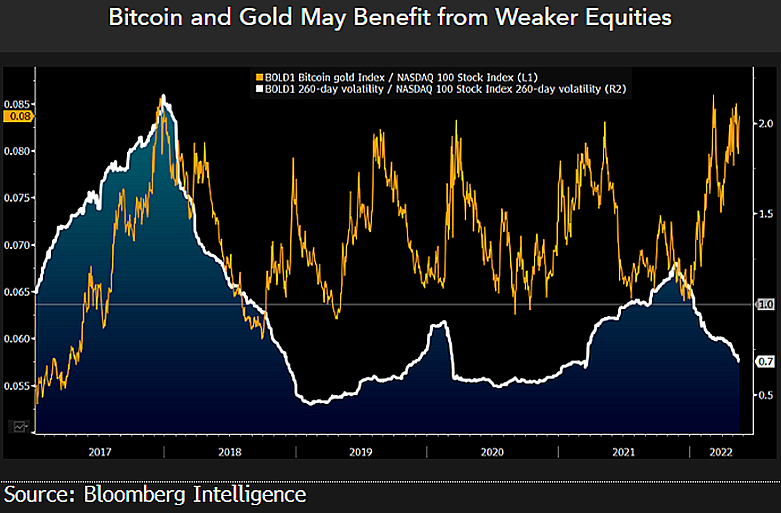

“Following an extended period of outperformance, an underperformance period may be overdue for the #stockmarket, which may shine on #gold and #Bitcoin. The BOLD1 Index (gold, bitcoin combo) has kept pace with the Nasdaq 100 Stock Index in a bull market and with lower volatility.”

The supporting chart shows the declining volatility of BOLD1 against the NASDAQ 100 index since 2019.

The post Bitcoin, Gold and Bonds could dominate 2022 – Bloomberg Intelligence appeared first on CryptoSlate.