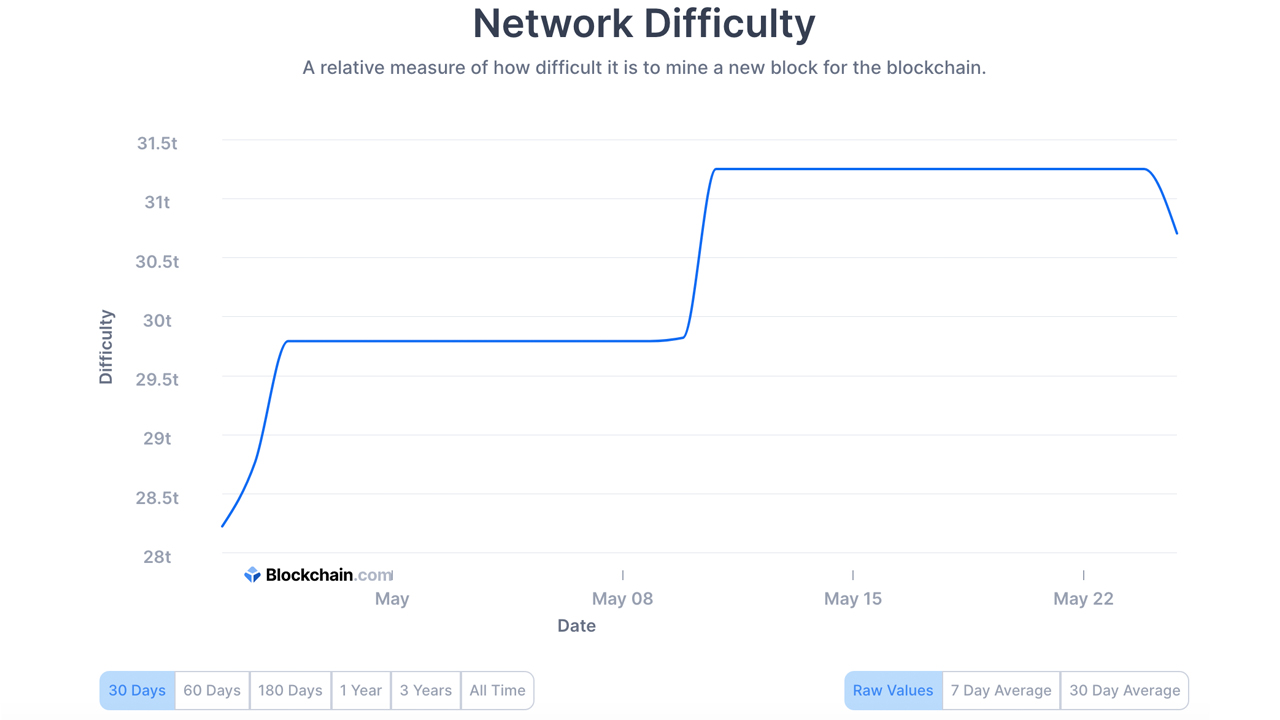

It’s now 4.33% easier to mine bitcoin over the next two weeks as the difficulty adjustment algorithm (DAA) dropped from 31.25 trillion to today’s 29.85 trillion. It’s the largest DAA drop since July 17, 2021, when the difficulty dropped 4.81% at block height 691,488.

Bitcoin Mining Difficulty Dips 4.33% — The Largest Drop Since July 2021

- Mining bitcoin is a lot less difficult than it was before May 25, 2022, as Bitcoin’s difficulty adjustment algorithm (DAA) saw a 4.33% reduction in difficulty.

- Prior to the drop, Bitcoin’s difficulty was approximately 31.25 trillion and today, it’s approximately 29.85 trillion after the largest drop since July 2021. The DAA change occurred at block height 737,856 on Wednesday.

- Bitcoin’s USD value has been lower in recent times, so a downward difficulty adjustment helps miners recoup some of the losses by making it 4.33% easier to find bitcoin block rewards. Currently, a Bitmain Antminer S19 Pro+ Hyd. with 198 terahash per second (TH/s) in hashpower can get an estimated $9.24 per day in BTC profits.

- Bitcoin’s global hashrate has been consistent and above the 200 exahash per second (EH/s) region for quite some time now. On May 2, 2022, Bitcoin’s hashrate tapped an all-time high at 275 EH/s at block height 734,577.

- Right now, there are 1,864 bitcoin (BTC) blocks left to be found until the next DAA change on June 8, 2022, and 101,992 blocks left until the next reward halving. There will be roughly 51 consecutive DAA changes every two weeks before the block reward halving occurs.

- Bitcoin’s current difficulty, the USD value, and a cost of $0.12 per kilowatt-hour (kWh) makes it so machines that produce 30 terahash per second (TH/s) are not very profitable, unless the miner pays less than $0.12 per kWh. For example, the Innosilicon T3+ (52 TH/s), gets around $0.21 per day in BTC profits if electricity costs $0.12 per kWh.

- Three-day mining pool statistics indicate that there are 12 known mining pools today dedicating SHA256 hashpower to the BTC chain. Approximately 1.44% of the global hashrate is operated by unknown or stealth miners with roughly 3.04 EH/s of hashpower.

- Metrics over the past 72 hours show Foundry USA has been the top bitcoin mining pool in terms of global hashrate and blocks found. At the time of writing, Foundry’s hashrate is approximately 24.28% of Bitcoin’s global hashrate or 51.10 EH/s. The pool found 101 BTC block rewards out of the 416 blocks found during the past three days.

- Bitmain’s Antpool managed to find 61 blocks out of the 416 found in three days, making it the second largest pool in terms of computational power. Antpool’s 30.86 EH/s of hashrate equates to 14.66% of the global aggregate.

- With BTC’s difficulty running at 29,850,529,410,160 estimates currently show another reduction is in the cards, but 13 days can change the estimation a great deal. At the time of writing, the DAA is estimated to reduce roughly 0.16% lower.

What do you think about the downward difficulty change on May 25 at block height 737,856 on Wednesday? Let us know what you think about this subject in the comments section below.