Over a million people actively participate in the GameFi market every day, playing the thousand or more games currently on the market and driving interest for dozens of new ones launching almost every week.

The sheer number of players and the total number of games on the market shows that the interest in this relatively new but fast-growing segment of the crypto industry is definitely on the rise.

However, there is another metric we can look at to understand how the institutional part of the crypto industry sees GameFi—funding.

In this series of reports, we dive deep into one of the fastest-growing sectors of the crypto industry and analyze the funding it received in Q1 2022.

Analyzing GameFi funding

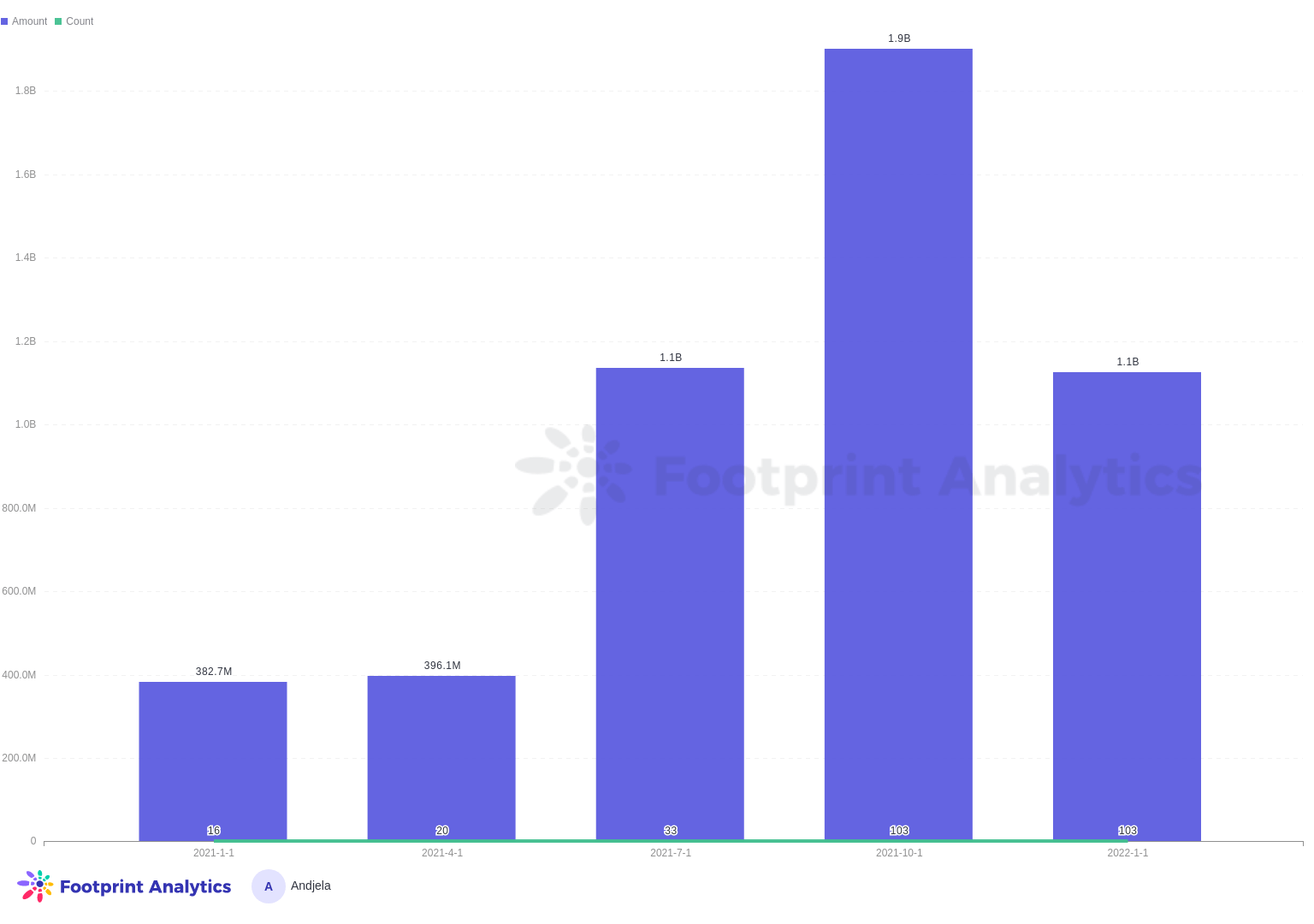

According to a joint report from Footprint Analytics and DeGame, the GameFi received $1.13 billion in funding during the first quarter of 2022. This funding represents a 194.19% year-over-year increase and an 18% increase from the quarterly average funding volume of $954 million recorded in 2021.

The number of funding rounds GameFi saw last quarter also outperformed previous quarters. The 103 funding rounds it saw in the first three months of the year represent a 139.54% increase from the quarterly average of 43 raised throughout 2021.

However, the $1.1 billion represented a 40.78% decrease from the sector’s overall funding in the fourth quarter of 2021, when it saw its highest funding volume ever — $1.9 billion.

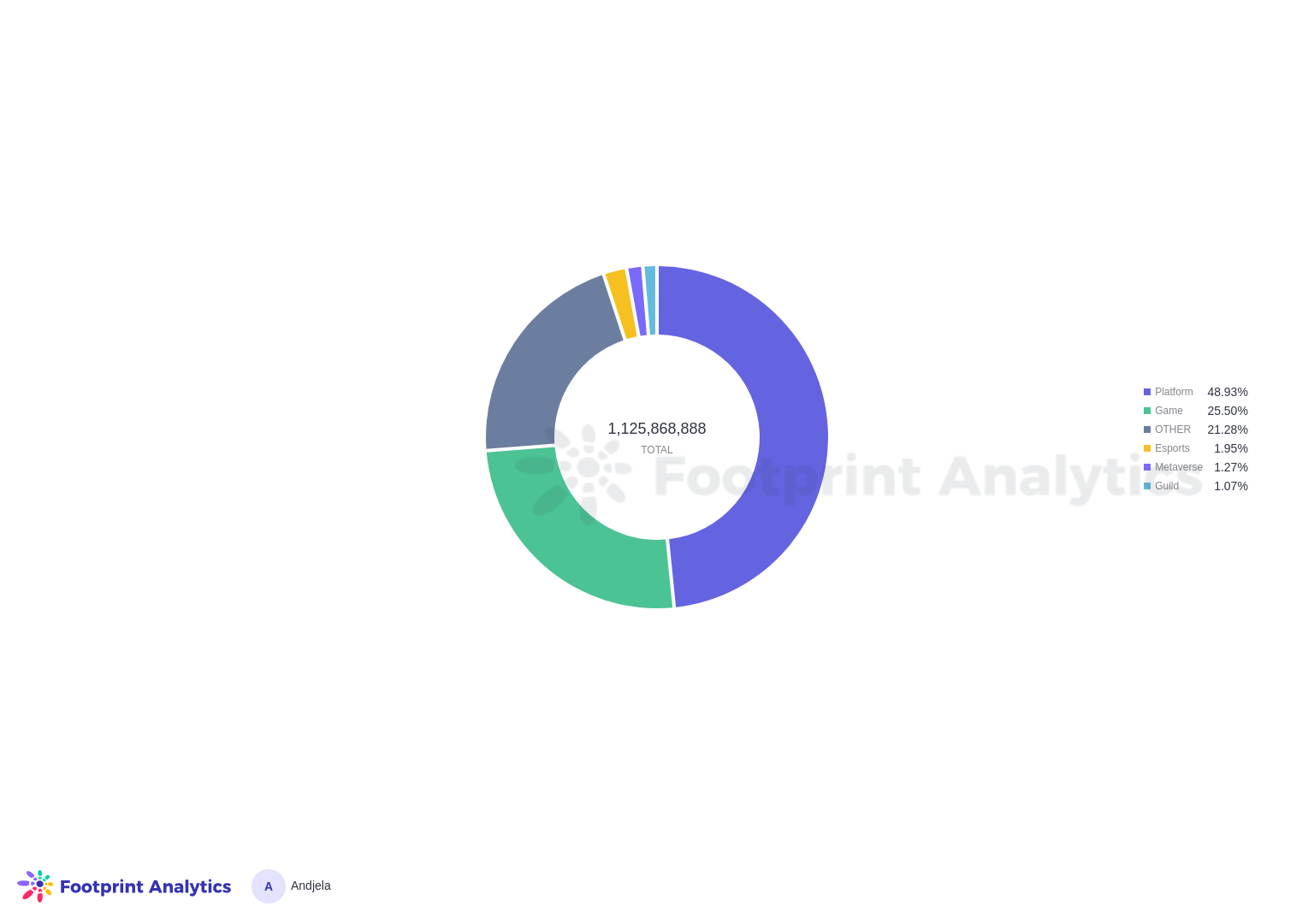

Regarding the type of projects that got the most funding, game platforms led the way, receiving $551 million in investments in Q1. This represents just under half of the funding amount the GameFi sector received last quarter, as independent games received $287 million in funding, or 25.5%.

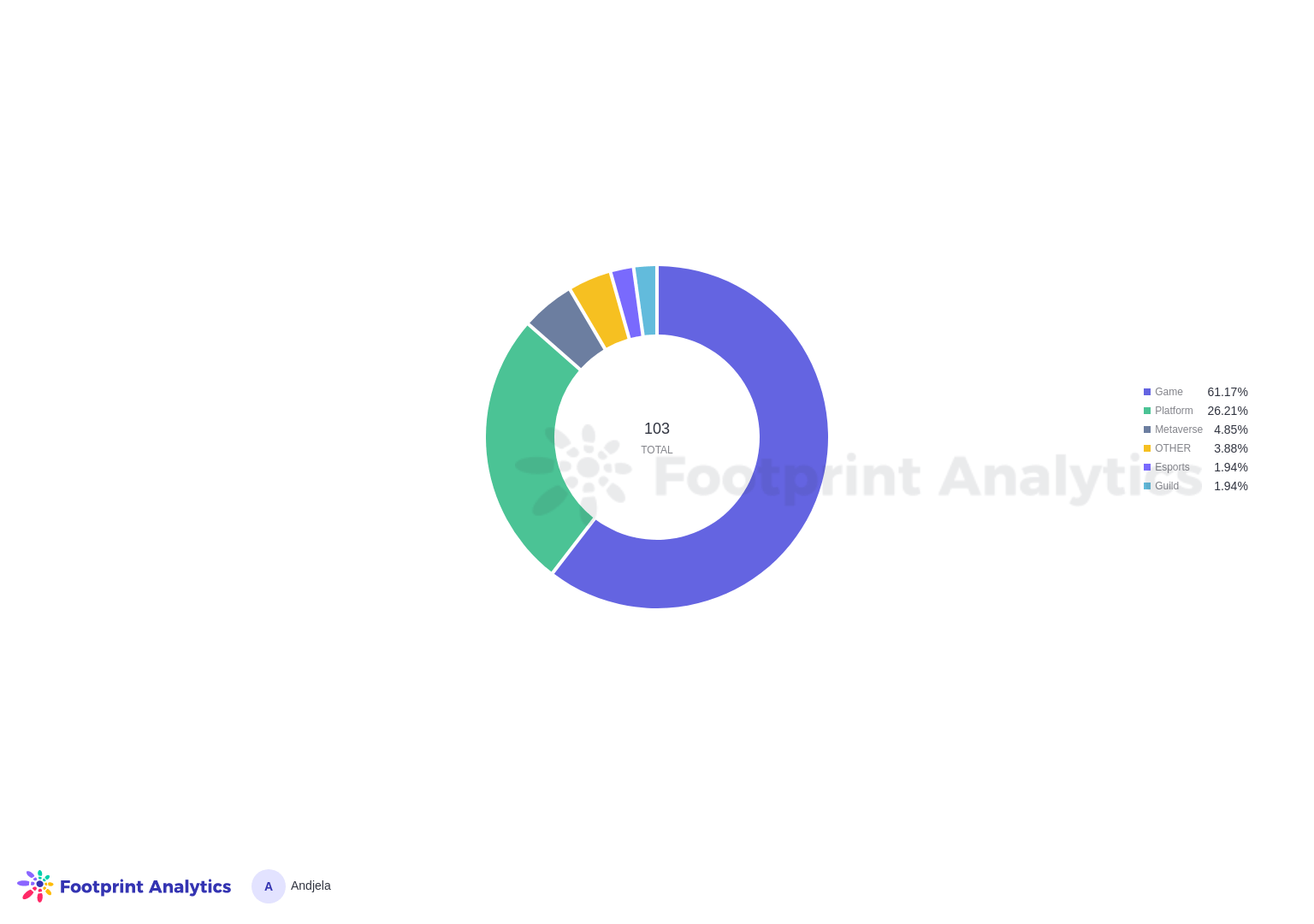

However, independent games led the way with the overall number of funding rounds. Last quarter, GameFi saw a total of 103 funding rounds, with 63 being investments in independent games. On the other hand, gaming platforms received just over 26% of the total number of funding rounds, while the metaverse captured 4.85%.

Nonetheless, game platforms still received an average of $20.4 million per funding round, while independent games averaged $4.55 million per round. Metaverse, guild, and e-sports projects accounted for a small share in the number of funding rounds and the overall amount of funding they got last quarter.

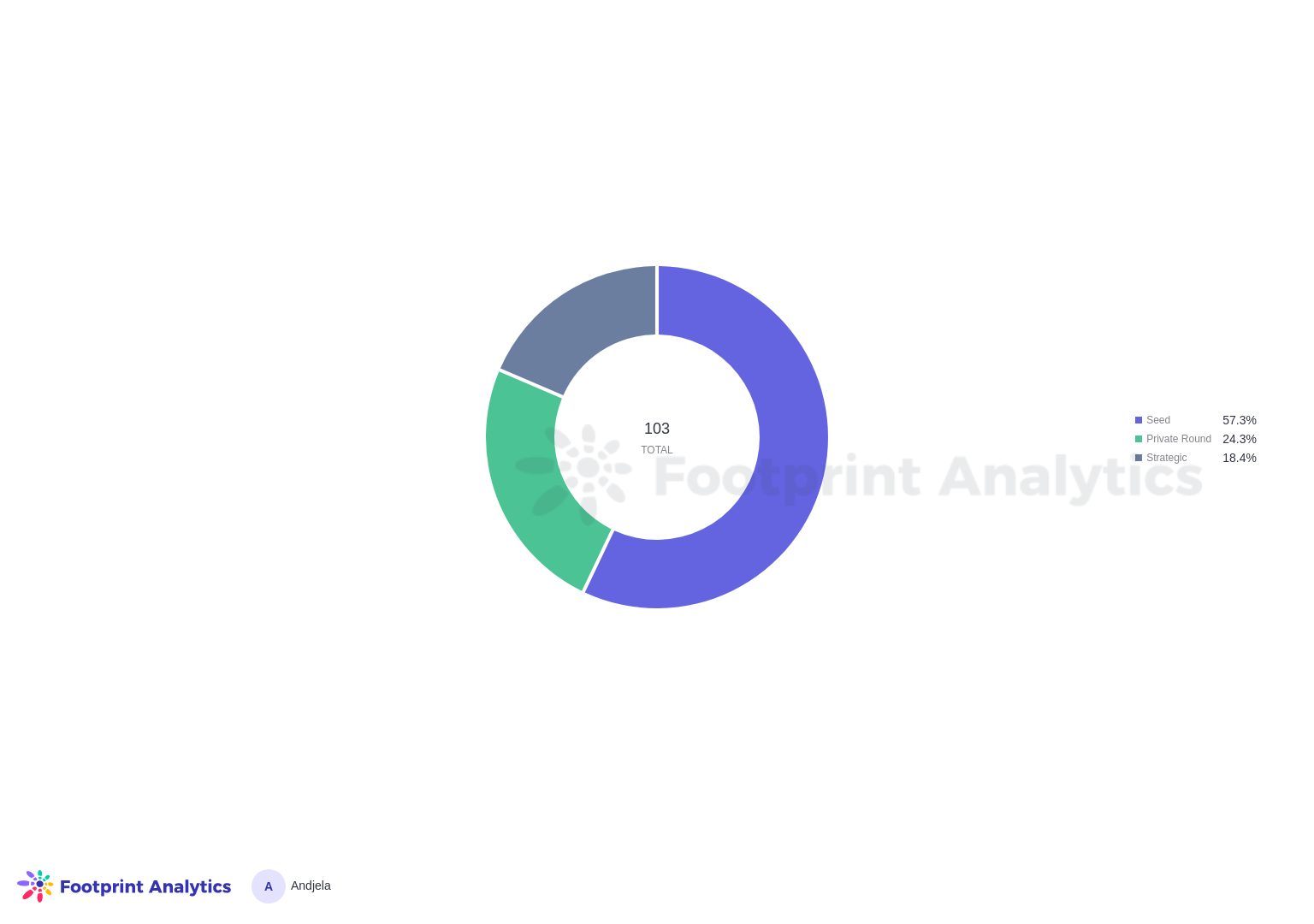

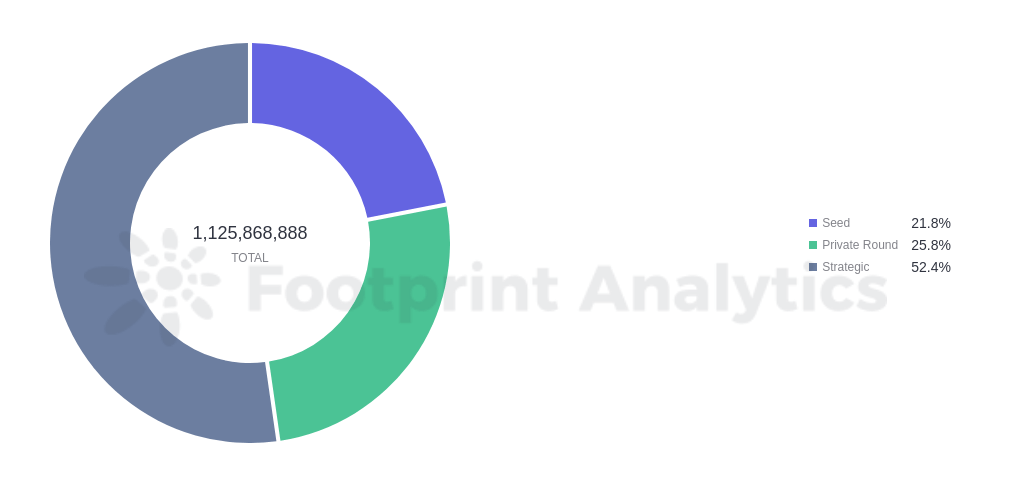

Most of the funding rounds the GameFi market received were seed rounds, but strategic rounds raised more money in total. According to the report from Footprint Analytics, 57.3% of the total number of funding rounds—59 to be exact—were seed rounds.

However, seed rounds accounted for only 20.76% of the sector’s total amount of funding, as the average seed round funding fell just under $5 million per project. On the other hand, strategic rounds accounted for 52.4% of the total amount of funding.

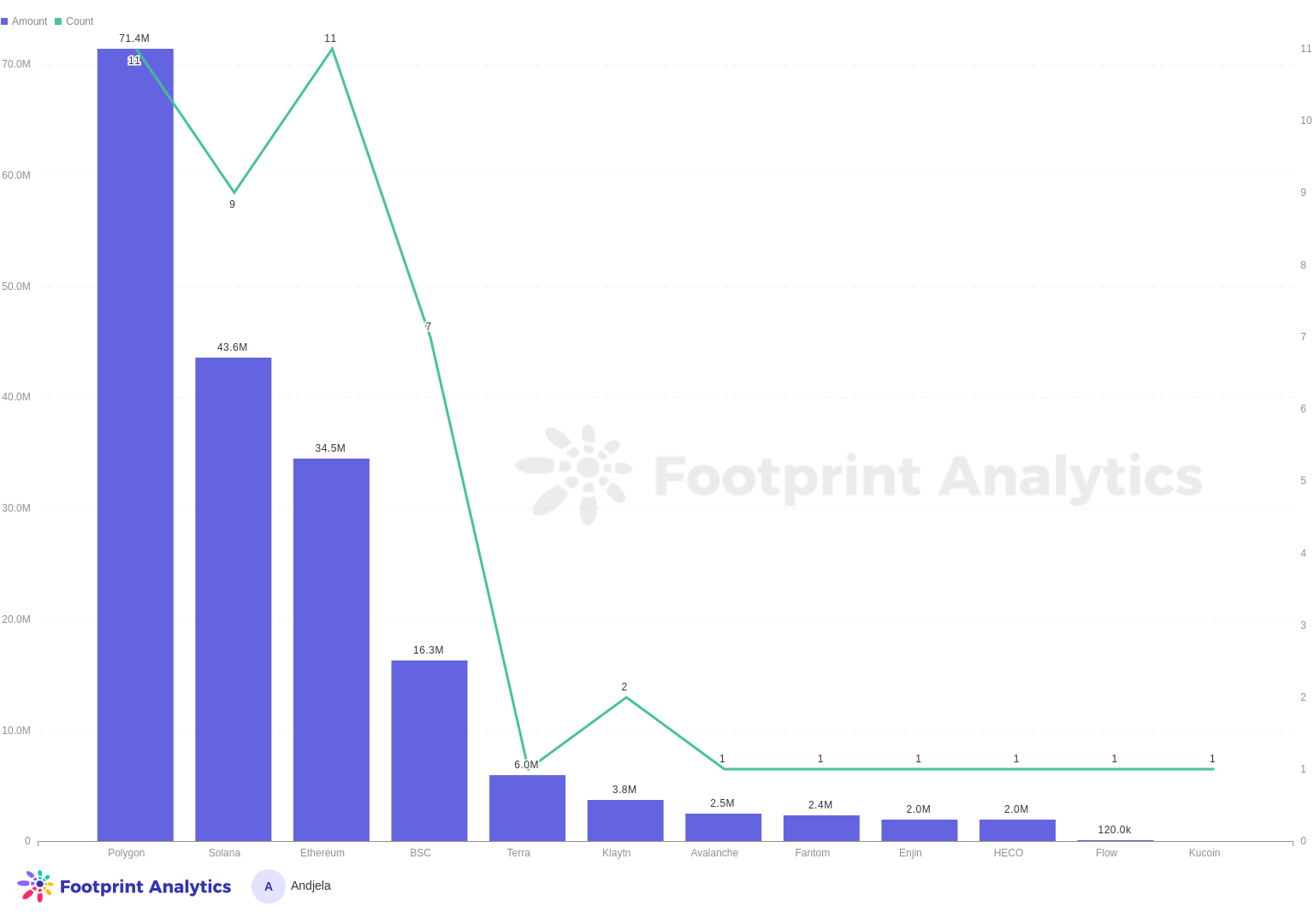

Polygon led the way both in the number of funding rounds it received and the total funding amount it got. The $71.4 million in investments the chain received in Q1 was followed closely by Solana’s $43.6 million, while Ethereum trailed behind with $34.5 million in investments.

Polygon shares the first spot with Ethereum regarding the number of funding rounds it captured, with both chains receiving investments in 11 separate rounds. Solana was close behind with nine funding rounds last quarter, while Binance Smart Chain and GameFi projects launched on it received seven rounds.

Blockchain games launched on Polygon also received the highest average funding—$6.49 million per project.

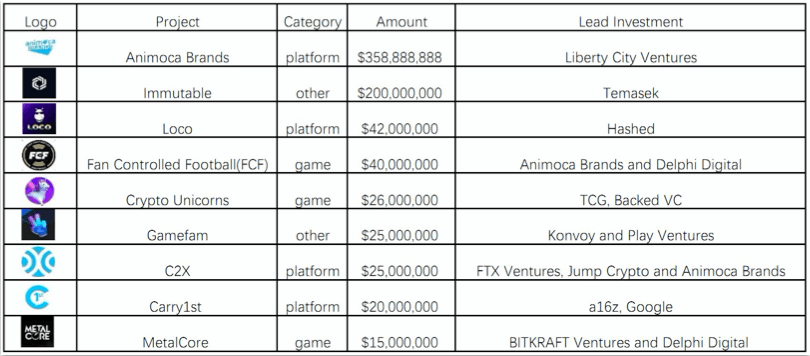

The distribution of the $1.1 billion in investments is quite uneven. While only nine projects received over $15 million in funding last quarter, half of the entire funding amount was distributed to just two projects—Animoca Brands and Immutable. Project platform Animoca Brands received $358 million in funding in Q1, making it the largest funding round in the GameFi market. Immutable received $200 million in investments, while Loco, another project platform, ranked third with $42 million in investments.

Out of the nine projects, only 3 are independent games, with the biggest one being Fan Controlled Football (FCF), which received $40 million in funding. Crypto Unicorns and MetalCore, both games, received $26 million and $15 million in funding, respectively.

The post Inside GameFi: $1.1B poured into blockchain gaming in Q1 appeared first on CryptoSlate.