BNB Chain released its new technical roadmap at the BNB Chain Revelation Summit event, which ran for five hours on May 31.

The event updated the community on the latest developments in the project. Team leaders and senior personnel, including founder Changpeng Zhao (CZ), also discussed topics related to blockchain technology and Web3.

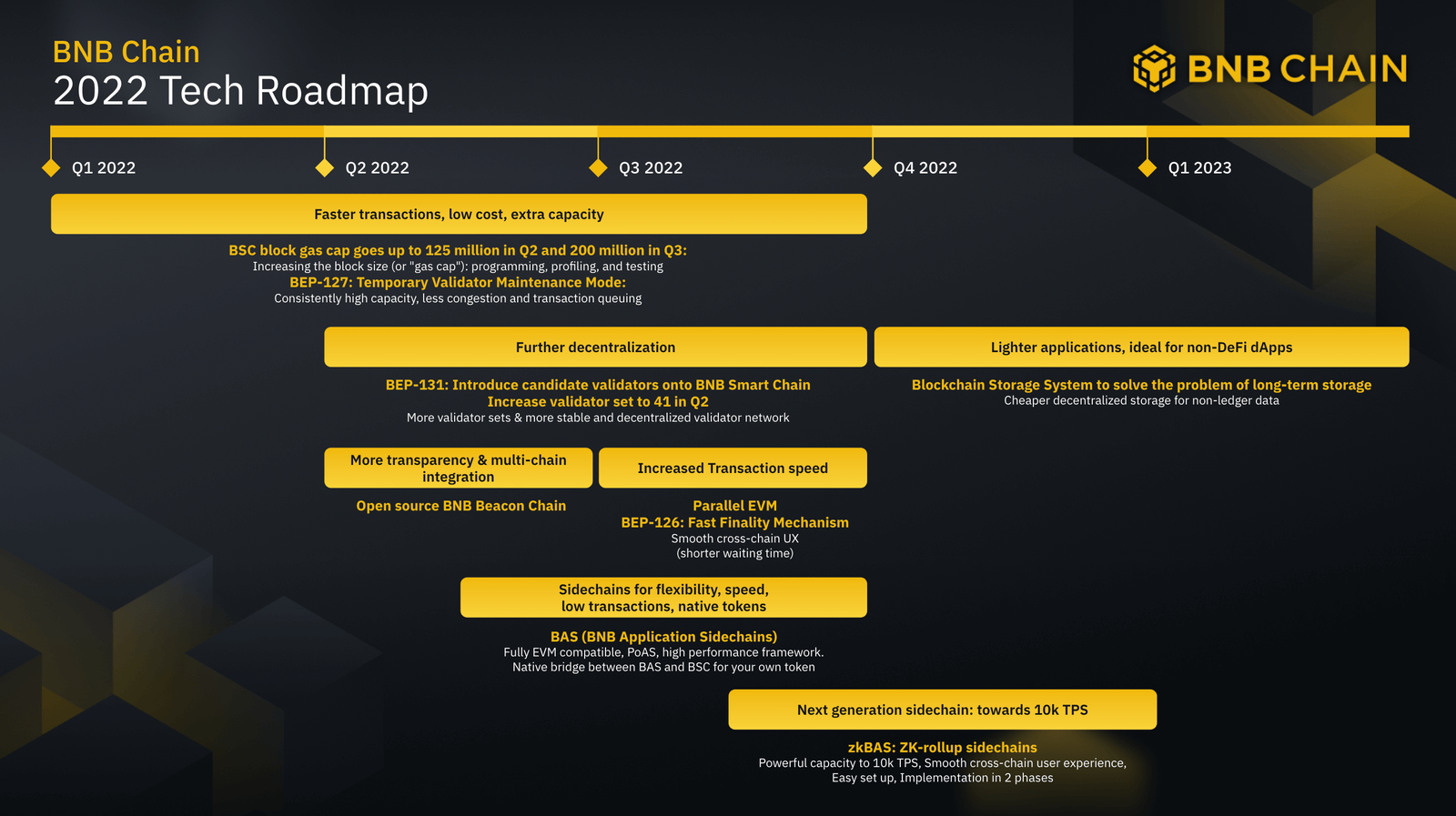

The roadmap shows a focus on faster transactions and better support for dApps. While also introducing more “candidate” validators for greater decentralization.

Critics have long argued that BNB Chain is faster and cheaper than the competition, not because of technical innovation. Instead, these benefits come at the expense of having a highly centralized set of just 21 validators.

BNB Chain gets more decentralized

Addressing this concern, the company said implementing BEP-131 will increase the number of mainnet validators from 21 to 41. The increase will provide more decentralization and validator incentives to innovate their hardware and infrastructure.

“BEP-131 will change the validator consensus module, introducing dynamic adjustment on the validator set. Validators will benefit from a more competitive consensus that gives even smaller candidate validators a chance to place in the validator set and earn rewards.”

Meanwhile, the firm said an increase in block size/gas cap would facilitate faster transactions, lower cost, and extra capacity for seamless dApp experiences. The upgrade will come in two phases, starting with an increase to 125 million in the second quarter and 200 million by the end of the third quarter.

Users will benefit from additional on-chain capacity and faster confirmation times. By packing more transactions in a single block, costs related to network congestion are also minimized.

Using the added capacity and the BNB App Sidechain (BAS) scaling solution, several high network usage dApps will launch, including META Apes, Project Galaxy, and Metaverse World.

Going cross chain

Earlier this year, BNB Chain detailed a summary of how they started and where they’re going. What began as an attempt to steal Ethereum’s lunch has grown into a behemoth.

“the network processed over 2.34 billion transactions from 130 million active addresses in just 16 months.”

BNB devs are considering multi-chains and cross-chain solutions in an effort to hit the goal of 1 billion on-chain users. In particular, this strategy aims to tranche games and social media apps off from financial and business transactions and onto dedicated chains, i.e., BAS chains.

“We cannot expect games and/or social media applications to compete for computing resources with financial ledgers and business transactions, let alone expect all these applications to run on the same network with the exact fees and transaction speeds.”

Binance Smart Chain (BSC) and Binance Chain rebranded to BNB Chain in February to increase expansion.

The post BNB Chain technical roadmap released, here’s what to expect appeared first on CryptoSlate.