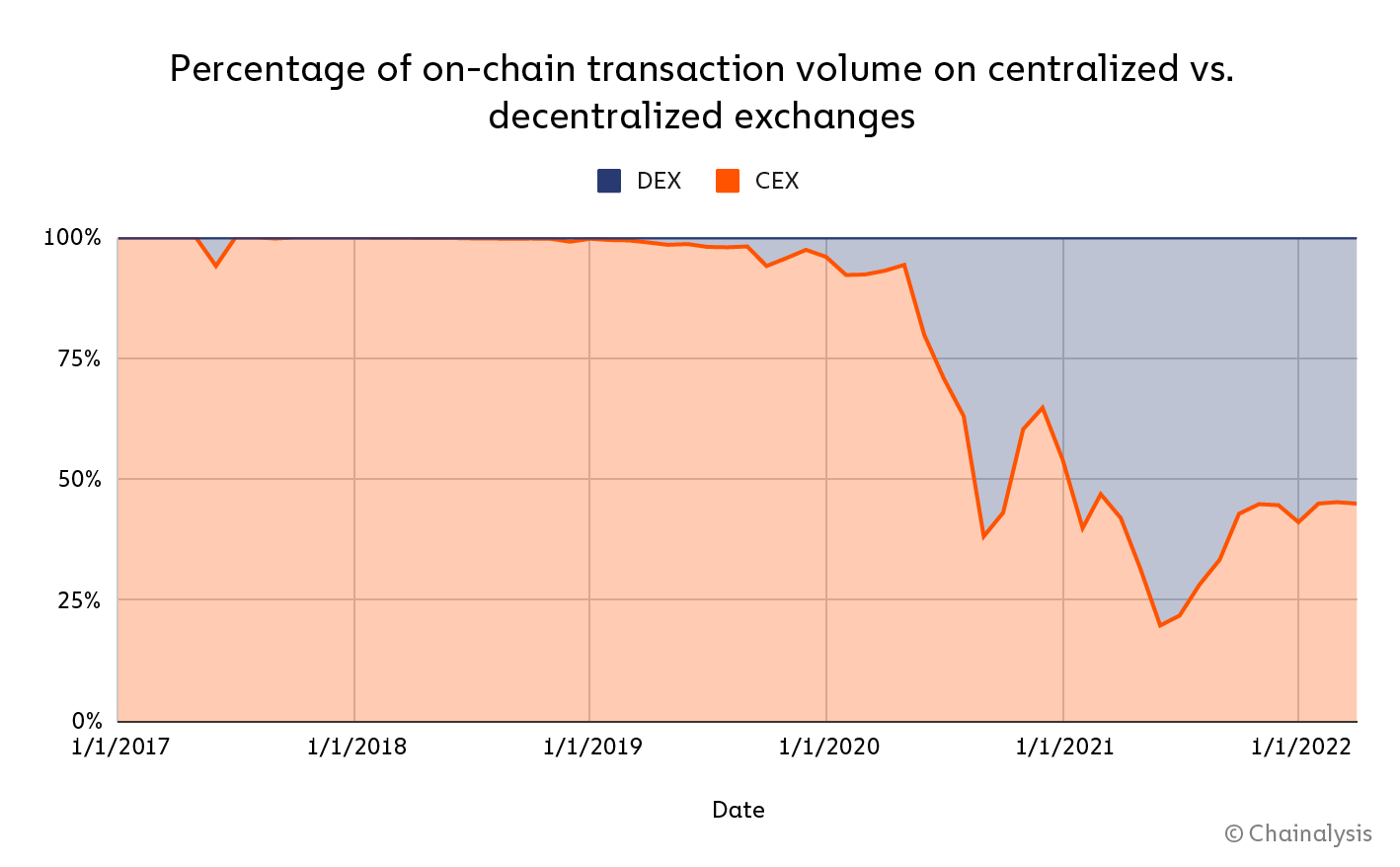

Decentralized exchanges (DEXs) have seen higher on-chain transaction volumes than centralized exchanges (CEXs) since 2020, Chainalysis’ new report reveals.

A preview of the State of Web3 Report shows that between April 2021 and April 2022, the on-chain transaction volume of DEXs was $224 billion, which is miles ahead of the $175 billion for CEXs.

According to the report, the major reason for DEXs leading over CEXs is the growth of DeFi in the past few years.

Generally, the transaction volumes on centralized and decentralized exchanges tend to mirror the market performance of the crypto industry. So it is usually high during a bull market and declines during a bear market.

The report pointed out that the first time DEX trading volume surpassed that of CEX was in September 2020, when the on-chain trading volume of centralized exchanges dropped by 50%.

In June 2021, DEX’s trading volume reached its peak as it facilitated 80% of on-chain transaction volumes that month. However, that figure has now dropped to 55%, showing a slight dominance of the transaction volume.

According to the report, since most centralized exchange transactions happen off-chain through order books, it is impossible to capture every transaction. So the report focused only on assets sent to centralized exchanges on-chain.

5 DEXs dominate

Per the report, most of the trading volume on decentralized exchanges comes from the top five exchanges. However, the top five centralized exchanges do not enjoy this kind of market dominance.

Presently, the top five DEXs are Uniswap, SushiSwap, Curve, dYdX, and the 0x Protocol supported about 85% of all trading volume from decentralized exchanges and aggregated DEXs.

However, the top five CEXs – Binance.com, OKX.com, Coinbase.com, Gemini.com, and FTX.com – only support about 50% of all on-chain centralized exchange transactions.

The reports provide the likely reasons for the dominance of these few decentralized exchanges. One is the recent emergence of the DeFi sector which means most decentralized exchanges are yet to establish themselves to maintain a strong user base.

Additionally, DEXs rely on liquidity, and the top five have the most liquidity. So they will attract more users since higher liquidity guarantees price stability for the biggest traders.

Meanwhile, the possibility of decentralized exchanges maintaining their dominance over centralized exchanges depends on whether they can continue to offer cheaper trading fees while circumventing the regulatory hurdles being faced by centralized exchanges.

The post Report: DEXs on-chain transaction volume surpasses that of CEXs appeared first on CryptoSlate.