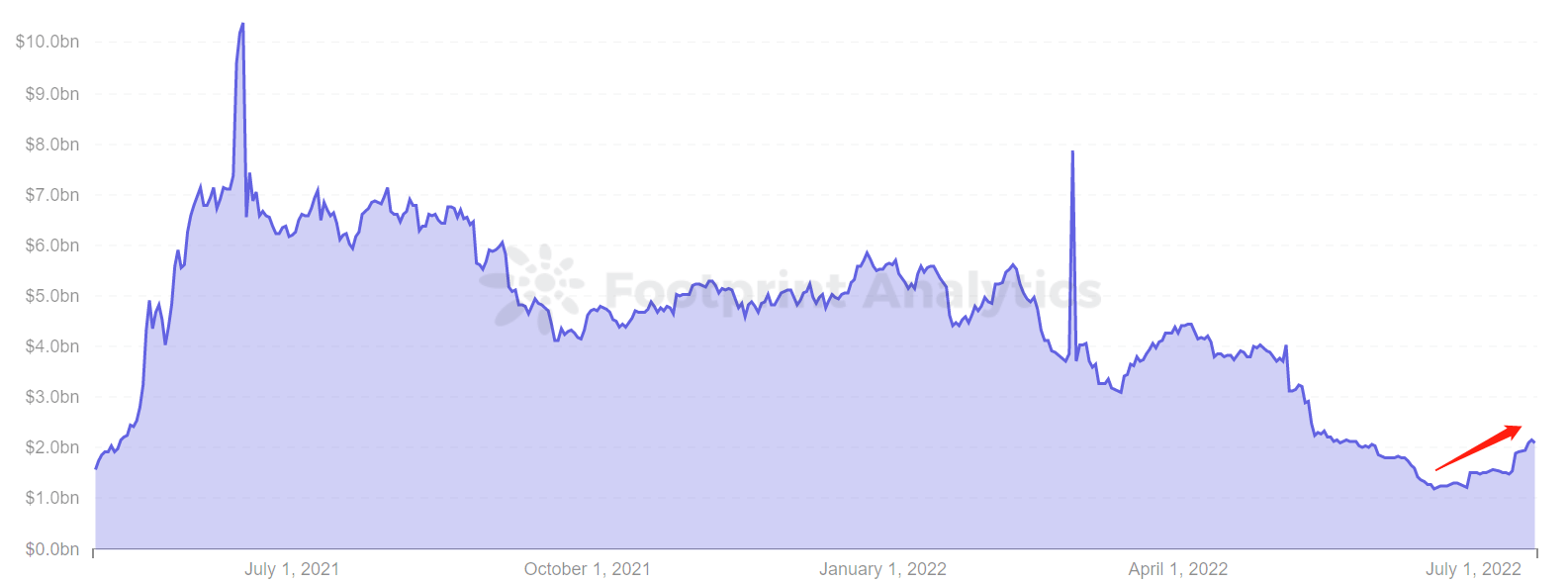

Polygon TVL and market cap have also gradually recovered following the trend of currency prices. This rise is out of the circle with its own advantages. The advantages of technical architecture, expansion plans and strategic layout have attracted many partners and agreements to settle in Polygon, including Reddit’s recent announcement of the launch of NFT’s avatar market on Polygon and the cooperation with technology company Nothing to introduce Web3 to smartphones. Push it to be one of the few dark horses in a bear market.

What has brought Polygon out of its bear market, and its numbers are showing signs of a rebound?

Polygon: Connecting Ethereum-compatible blockchain networks

Polygon is a protocol and a framework for building and connecting Ethereum-compatible blockchain networks. Polygon is one of the sidechain solutions to make Ethereum more efficient and it aims to solve some of Ethereum’s many issues, including:

- Low throughput

- Poor UX (gas, delayed PoW finality)

- No sovereignty (shared throughput/clogging risk, tech stack not customizable, governance dependence)

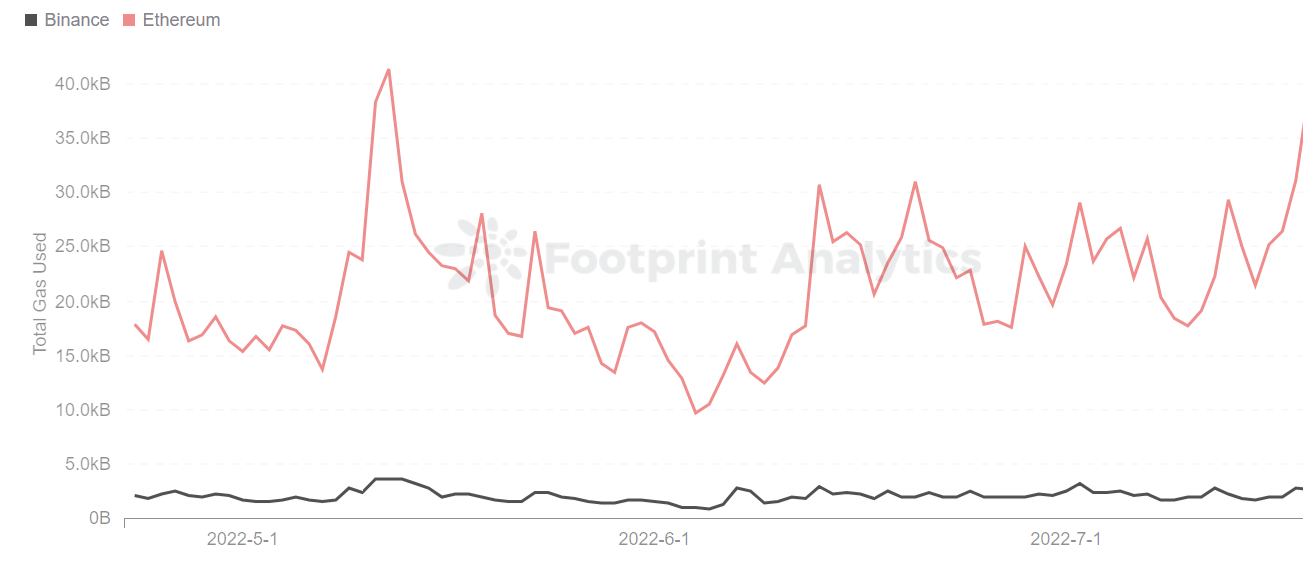

Polygon cross-chains the assets on the mainnet to Polygon for processing by establishing a side chain. It alleviates problems such as high gas fees and low throughput. This is why most project parties use it as their preferred blockchain.

5 Solution Benefits of Polygon

Let’s take a look at some of Polygon’s most compelling features.

- Scalability: Polygon has specialized Wasm execution environments, customized blockchains, and scalable consensus algorithms. As a result, shorter transaction speeds and lower gas fees benefit both developers and participants.

- Ethereum compatibility: Because of its lead in the industry, established tech stack, tools, languages, standards, and corporate acceptance, Polygon has interoperability with Ethereum and other blockchain networks for exchanging arbitrary messages.

- Modular design: Polygon’s modularity allows for customization, upgradeability, reduced time-to-market, and community cooperation.Developers can establish preset blockchain networks through Polygon with qualities specific to their needs. With community participation, there is a growing collection of modules for developing custom networks that enable great customizability, extensibility, upgradeability, and a quick access to the market.

- Interoperability: Polygon processes transactions off-chain before confirming them on Ethereum, using a technology called Plasma. Polygon is intended to be a complete framework for the development of interoperable blockchains. It comes with built-in support for arbitrary message passing (tokens, contract calls, and so on), allowing it to connect to external systems.

- User Experience: Polygon requires no protocol knowledge, token deposits, or approvals. Its modular design also makes it simple to create customized solutions or add new features. It also features low transaction costs (about 10,000 times lower per transaction than Ethereum) and fast transaction speeds (up to 7,000 tx/s).

These advantages are enough to promote the development of DeFi, NFT, Web3 and GameFi projects on Polygon’s chain, making Polygon stand out in many blockchains.

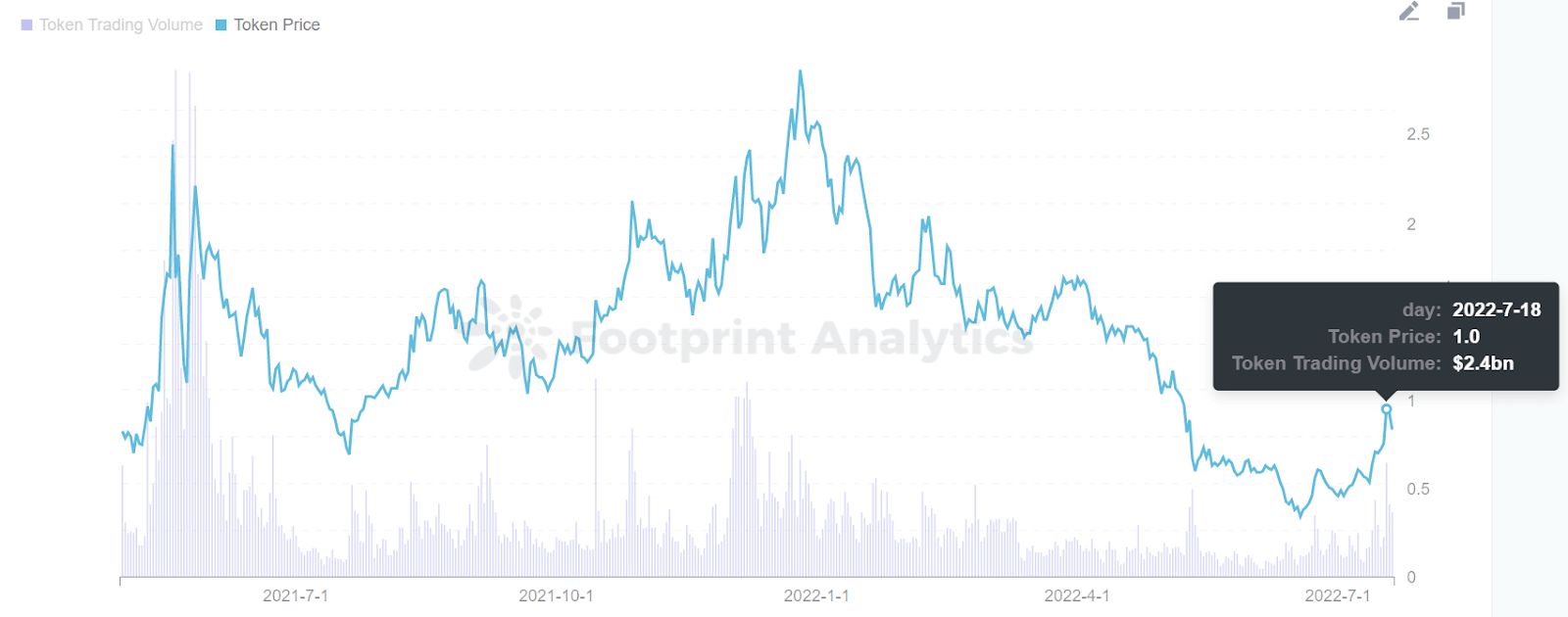

According to Footprint Analytics, Polygon’s TVL and MATIC have shown signs of a rebound, with TVL up 75% from $1.2 billion on June 20 to $2.1 billion on July 20. MATIC’s coin price is also up 233%, making it a rare bear market breakout among many blockchains.

Polygon’s Ecosystem Expands from DeFi to NFT and More

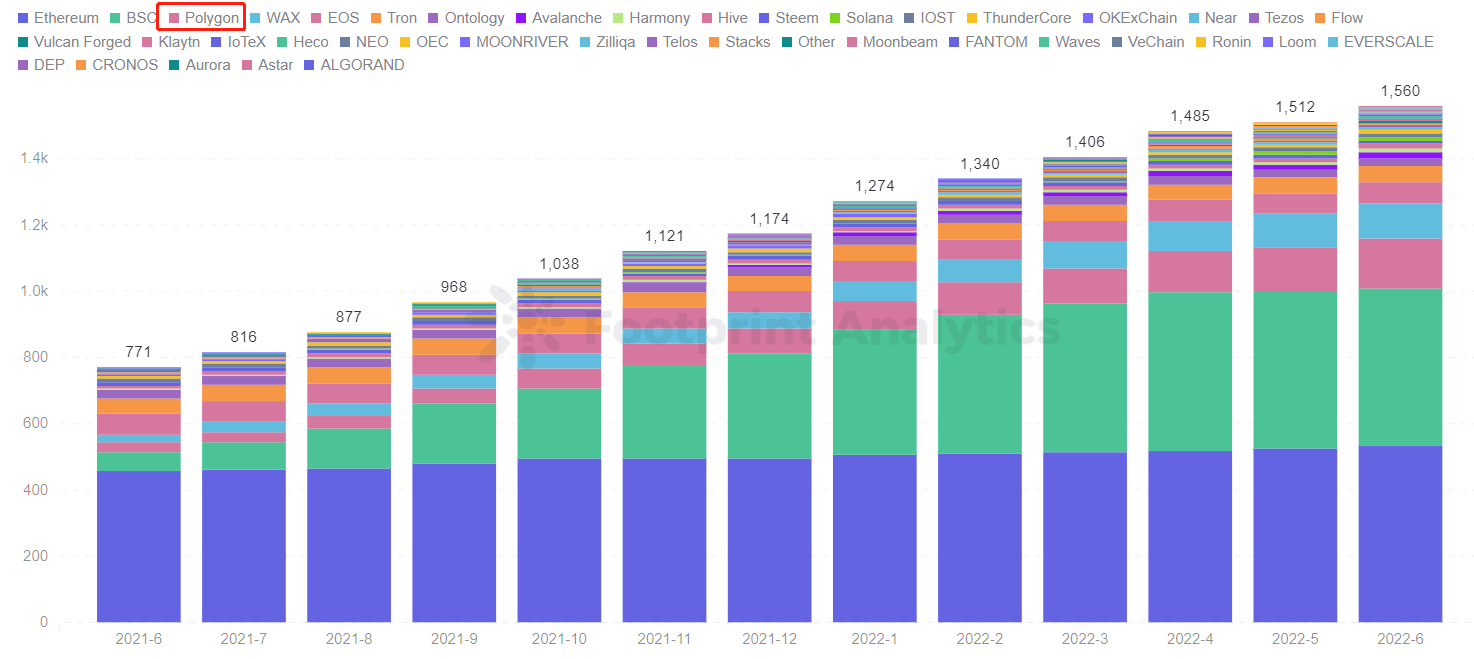

Last year, the protocols on the Polygon network were mainly from various blue-chip DeFi projects on Ethereum, including giant projects such as Curve and Aave. But since the beginning of this year, with the rise of GameFi, NFT and Web3, Polygon’s cheap and fast advantages have been vividly reflected in these sectors. Especially in the GameFi sector, the number of projects on Polygon has jumped to third place in WAX.

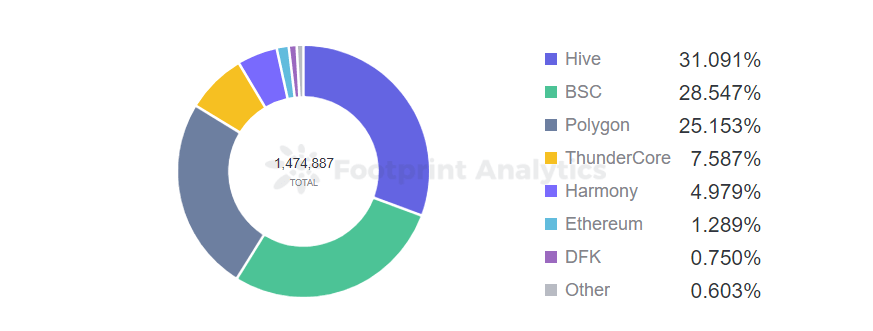

Moreover, Polygon accounts for 25% of GameFi’s total active users, gradually dividing up the number of Ethereum and BSC chains. The reason for this phenomenon may be that, on the one hand, the frequent interaction between games and chains leads to a surge of transactions, and the low fees are more attractive to users. On the other hand, the game experience is highly susceptible to the speed of transactions. Therefore, Polygon has the edge.

Not only that, but Reddit recently announced the launch of its NFT-based avatar marketplace on Polygon. The move woke up whales to increase their holdings of MATIC, whose price is showing a small rally to help Polygon out of its bear market.

Summary

The emergence of Polygon is actually to strengthen the support for the Ethereum network, and with the advantages of cheap transaction fees and high throughput, it is destined to have an unshakable position in some sectors.

GameFi’s active users and Reddit’s timely launch of a new NFT avatar marketplace have prompted Polygon to show signs of rebounding from the bear market.

The Footprint Analytics community contributed this piece in July 2022 by Vincy.

Data Source: Footprint Analytics – Polygon Dashboard

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

The post Polygon (MATIC) price soared 233% in one month, what brought it out of the bear market? appeared first on CryptoSlate.