Bitcoin is capable of reducing energy costs for consumers as opposed to the opposite-of-intended effects that renewables have.

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the infantry before transitioning to the Finance Corps.

Part One

A common critique of Bitcoin is that it uses too much energy, yet the ruling class wants everyone driving electric cars. In 2020, California Governor Gavin Newsom even went as far as passing an executive order phasing out the sale of traditional gas vehicles by 2035.

Bitcoin using electricity is bad. Cars using electricity is good. What gives?

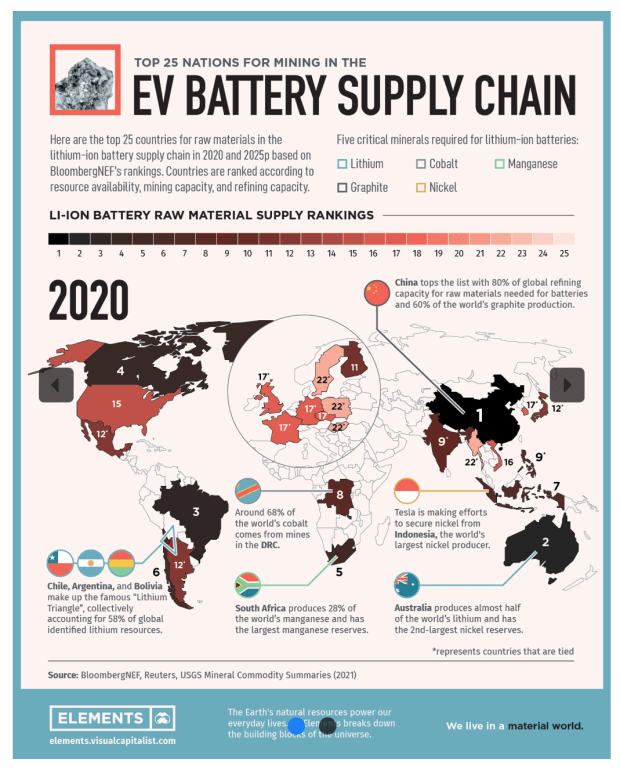

The dirty little secret that not so many people understand though is that all this green tech isn’t really all that green. A report from Seeking Alpha found that the carbon footprint of a Tesla battery would take nearly three years to reach neutrality compared to a typical vehicle. Not to mention the hundreds of pounds of heavy metals refined from tens of thousands of pounds of raw material to make said batteries.

Combine those with the source locations scattered around the globe … and it’s not looking so hot to me.

Solar panels and wind turbines aren’t much better. Solar panels require coal to heat up and refine the silicon that makes them work. AEI estimates that it takes 79 solar workers to produce the same amount of energy as two workers with natural gas and one with coal.

Wind turbines can be massive, requiring an entire semitruck to carry just one of the blades. Many are made of fiberglass, which precludes recycling. If recyclable at all, many forget that that requires energy to do in the first place, which I thought was bad.

Either way, with the way that both energy systems work, that’s a ton of solar panels and a ton of wind turbines. We’re gonna need more coal people.

You would think that the carbon footprint would improve once we plug those carbon-free sources into the grid. Duke Energy in North Carolina says you’d be wrong:

“Crawford provided measurements showing that even on sunny days — when solar power is at its maximum output — more NOx pollution is released into the air than would occur if no solar electricity were used and natural gas were used instead.

“That’s because traditional power plants — including cleaner burning natural gas plants — must scale back electric generation to accommodate solar energy surging onto the system when the sun rises, and power back up when the sun sets and solar energy dissipates. That starting and stopping reduces efficiency and incapacitates emission control devices, increasing pollutant levels.”

The issue is that solar and wind rely on predictable baseloads like natural gas. If you drive a natural gas power plant in stop-and-renewables traffic, you’re gonna produce more stuff that you don’t really like.

What we really need is something clean, reliable and predictable. Maybe something like … nuclear?

Bitcoin Out-ESGs The ESG

Bitcoin mining soaks up the excess supply of unpredictable energy that these probabilistic systems produce, smoothing demand curves and making these “zero carbon” green energy products financially viable.

It also prevents or slows rising energy costs for consumers. Every watt produced by additional sources of energy (like at-home solar panels) at best means lost revenue for the utility company, if not outright losses if the large solar panel farms produce enough energy.

The effects are compounding.

Who puts solar panels on their roof? People who can afford them. Who doesn’t? People who can’t.

With battery technology in its current state, people still need to be plugged into the grid, meaning that even with the solar panels, they still rely on utility companies.

With less revenue spread over the same power requirements, utility companies will have to raise prices faster than they would have previously had to. They have no choice, lest the solar panel craze puts them out of business.

Who does this affect? The people who can least afford it — the people who can’t afford solar panels.

Bitcoin fixes this too. It can help soak up excess supply from producers, allowing utility companies to slow the rate of electricity price inflation.

Bitcoin incentives clean, abundant, and cheap energy for everyone. Green energy incentivizes strip mining and coal production. Bitcoin is ESG. ESG is not.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.