Bitcoin FUD comes in all shapes and sizes, ranging from unbridled energy consumption to rampant crime.

Since 2017, the World Economic Forum has been warning that Bitcoin will eventually consume more power than the entire world. Governments around the world have been campaigning against Bitcoin mining and warning about its effects on climate change.

Regulators have also been waging a war against Bitcoin. Law enforcement agencies and central banks claim it’s not a secure network as it’s vulnerable to attacks and manipulation while providing infrastructure for money laundering and crime.

However, all of these claims are not only unfounded but also completely false.

While they could be disputed in numerous ways, Bitcoin transaction fees provide the simplest explanation.

Bitcoin transaction fees are the lifeblood of the Bitcoin network and are what secures the network both in the short term and in the long term.

Those critical of the network fear that as block subsidy reduces with each halving, the fees alone won’t be enough to keep miners from switching off their machines. Miners leaving the network en masse would drastically reduce the network’s speed and leave it highly vulnerable to attacks.

These claims are highly hypothetical and equally unlikely. The security of the Bitcoin network has remained strong since its inception over a decade ago. None of the major events the network has experienced have so far managed to make a crack in its security foundation.

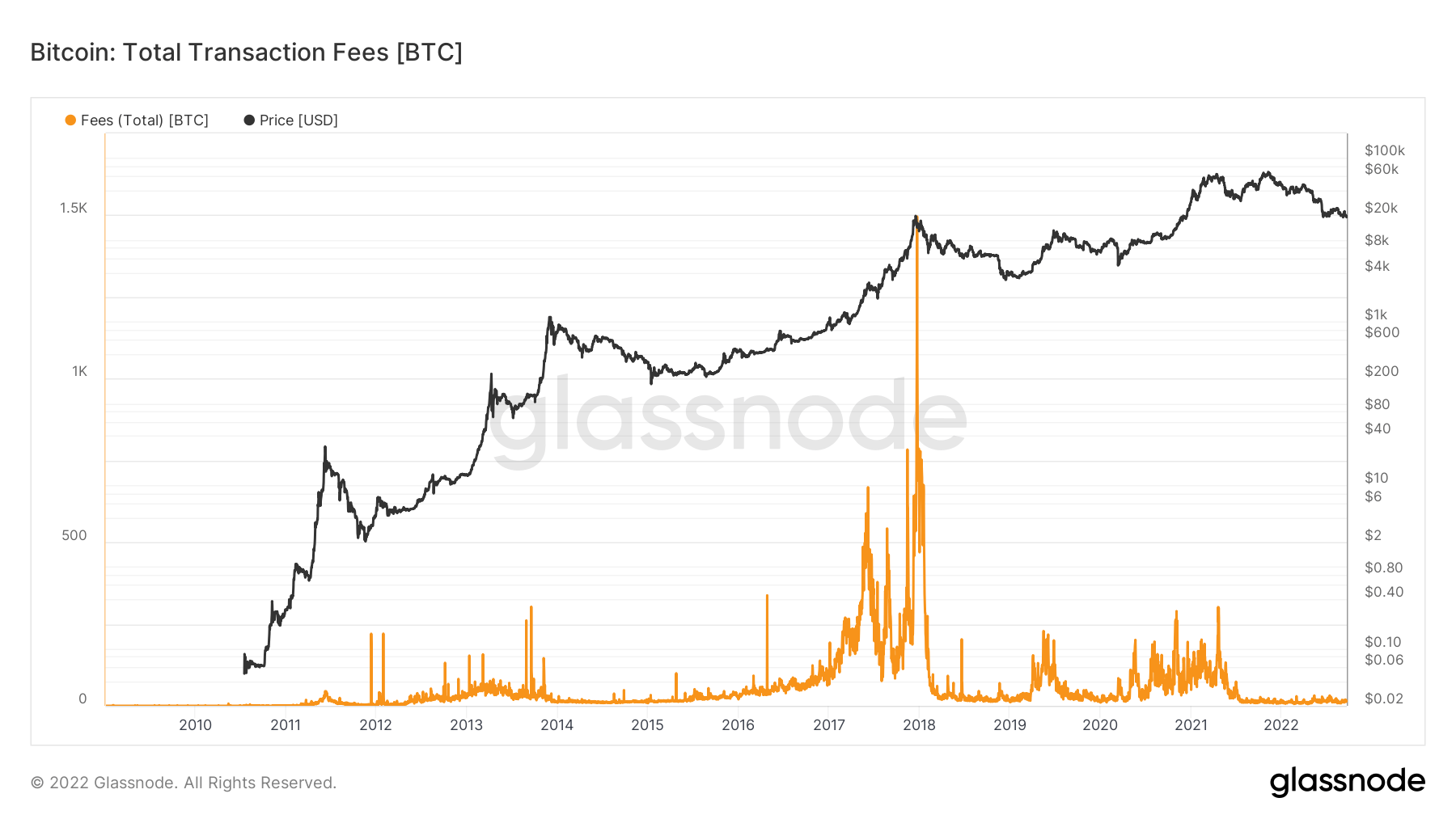

In 2017, the network saw one of its first major congestion issues as Bitcoin made the run toward $20,000. Transaction fees spiked to their all-time high as a massive sell-off was taking place. Once a correction began, transaction fees began to drop considerably, leaving many to wonder whether such a sudden drop in miner revenue could impact the network.

Since 2017, the Bitcoin network has settled trillions of dollars worth of transactions with just a fraction of the fees. Throughout 2022, miner fees have remained relatively consistent. As the Lightning Network and SegWit become more widely used, congestion will become an even rarer occurrence.

Those concerned about the security of Bitcoin believe that it’s only a matter of time before it experiences an attack.

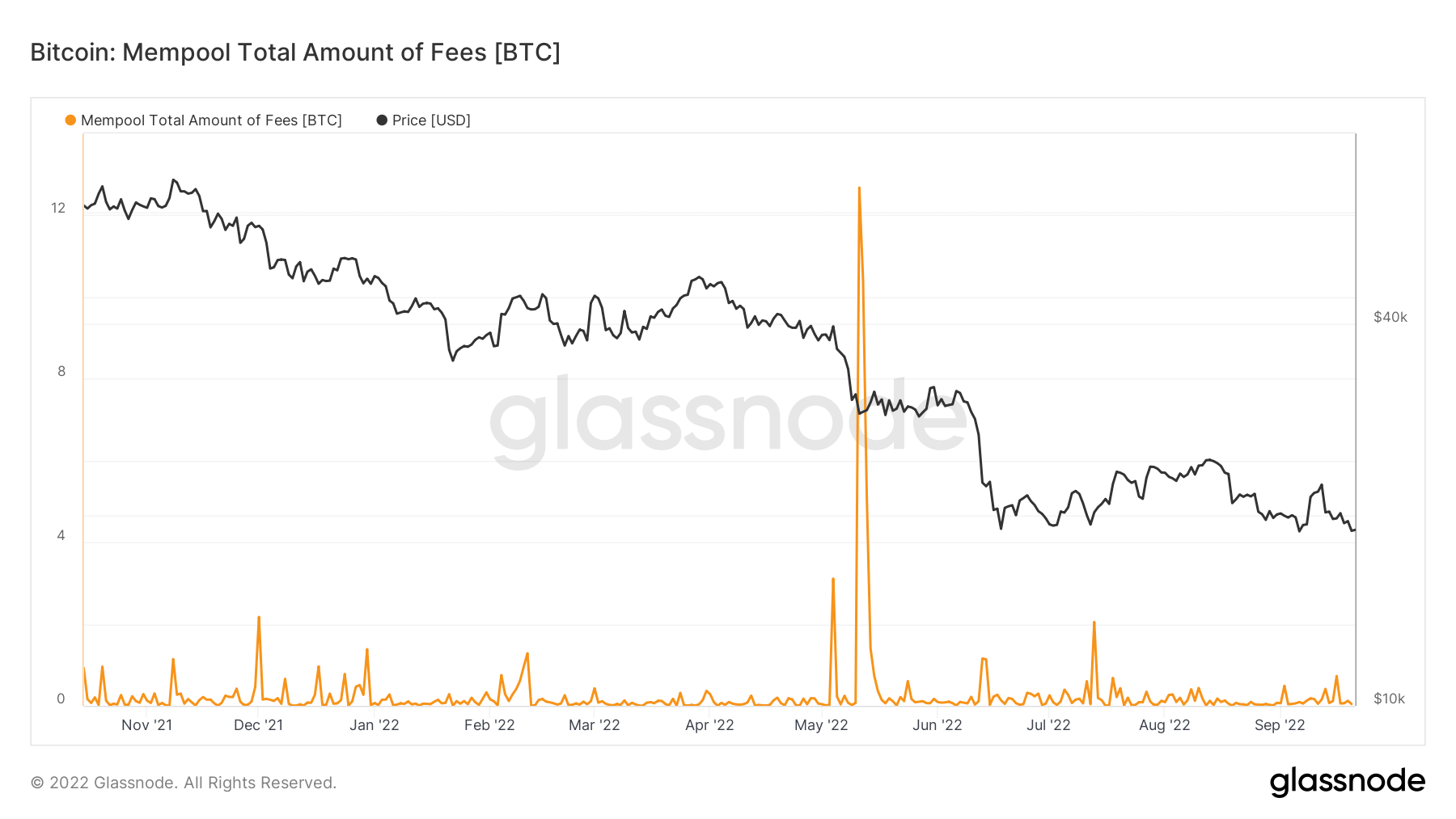

However, any type of attack on the Bitcoin network would unquestionably lead to a significant spike in fees in the mempool. Users would begin competing for the next block with higher and higher fees, making it more expensive for the attackers to take control of the network.

This is evident in the huge spike that occurred during the Terra (LUNA) collapse in May this year. The total amount of transaction fees waiting in the mempool increased by over tenfold as users began racing to sell their Bitcoin before it dropped too low. Those willing to pay higher fees saw their transactions processed and losses curbed, while those whose transactions got stuck in the mempool were forced to wait for the congestion to clear.

This is a testament to the security of the network. Transaction fees are the lifeblood of the network that keeps it running and the defense mechanism that keeps it secure even in times of high volatility.

The post Research: Debunking the FUD surrounding Bitcoin transaction fees appeared first on CryptoSlate.