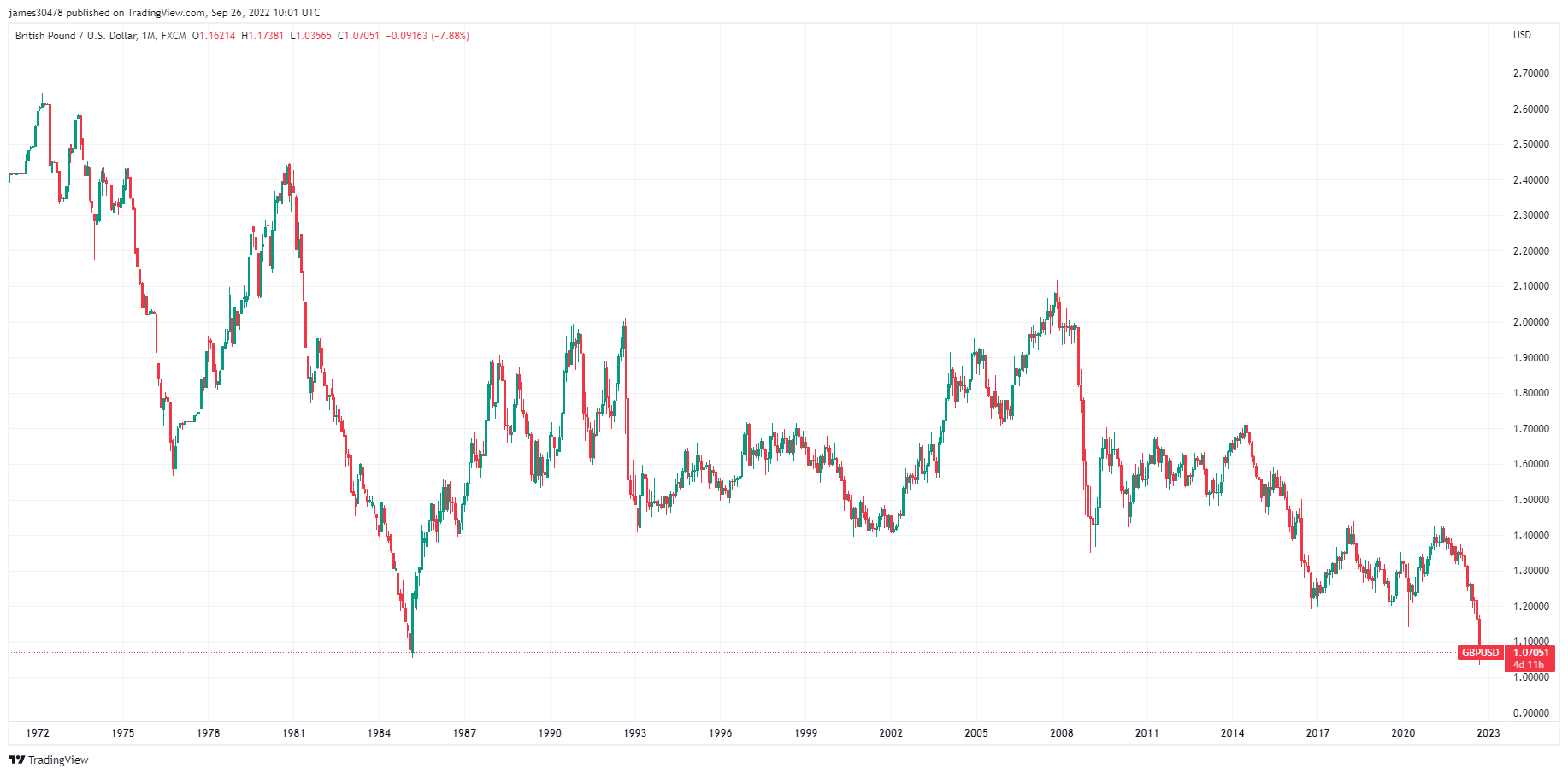

On Sept. 16, 1992, the British pound dropped to its all-time low. The day has since become known as “Black Wednesday,” or the day George Soros broke the Bank of England.

The historically stable currency lost 4.8% of its value against the U.S. dollar, effectively keeping the U.K. out of the E.U.’s newly formed European Exchange Rate Mechanism (ERM). The country joined the ERM in an effort to support the unification of European economies but effectively failed to adhere to the terms of the ERM.

Britain’s inability to keep the pound stable opened the door for speculators to short the currency. George Soros, an investor and fund manager, amassed one of the largest short positions on the pound which enabled him to pocket $1 billion.

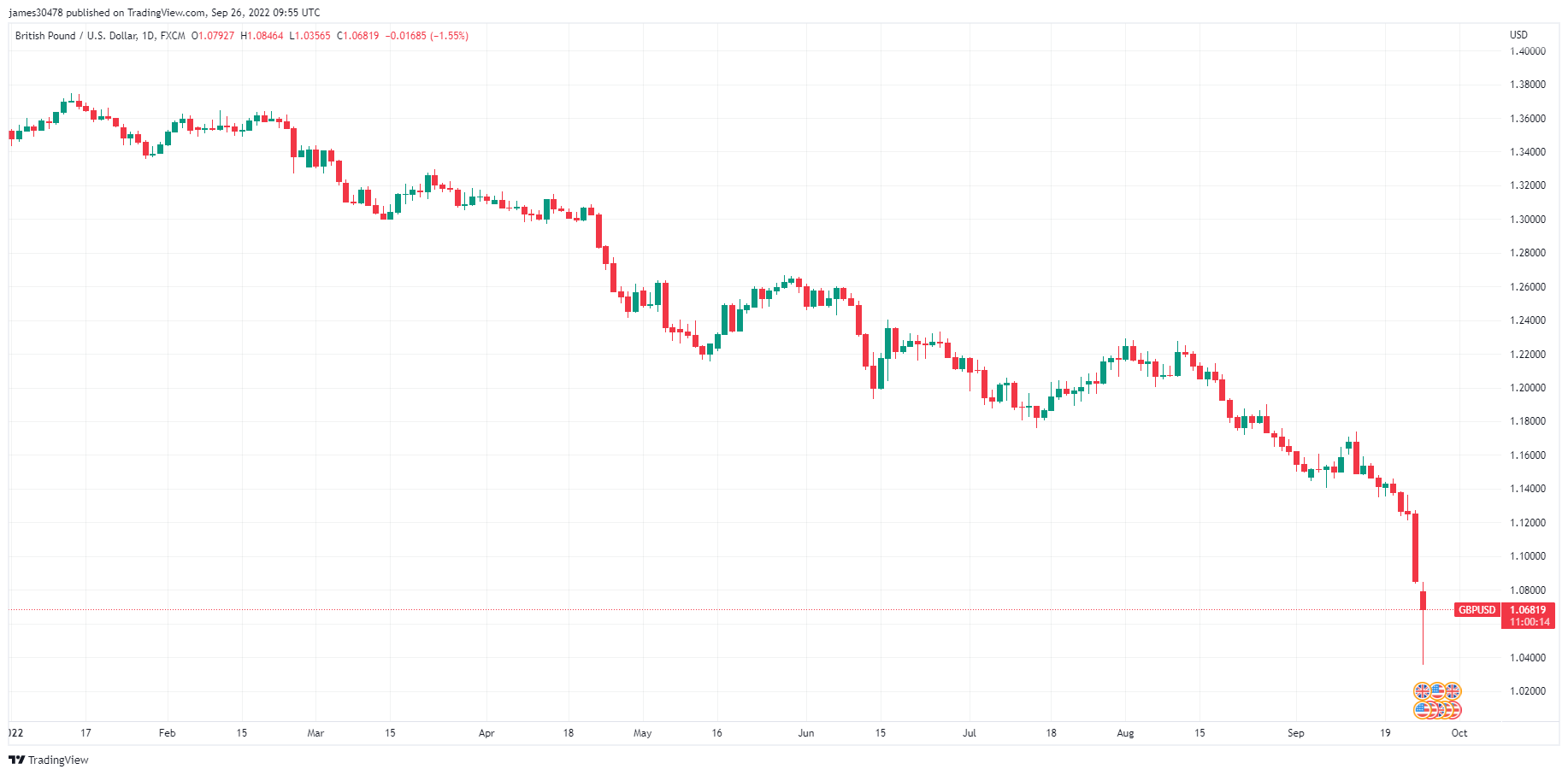

On Sept. 26, 2022, the British pound experienced a flash crash almost as large as the one on Black Wednesday, losing 4.3% of its value against the U.S. dollar.

One of the main culprits behind this crash could be large traders. Significant options barriers at 1.07 pounds to the dollar triggered a cascade that saw the pound drop through 1.06, 1.05, and 1.04 in a matter of hours. The pound currently stands at just 7 cents above parity with the U.S. dollar.

Since the beginning of the year, the pound crashed over 21% against the U.S. dollar and 8% against the euro.

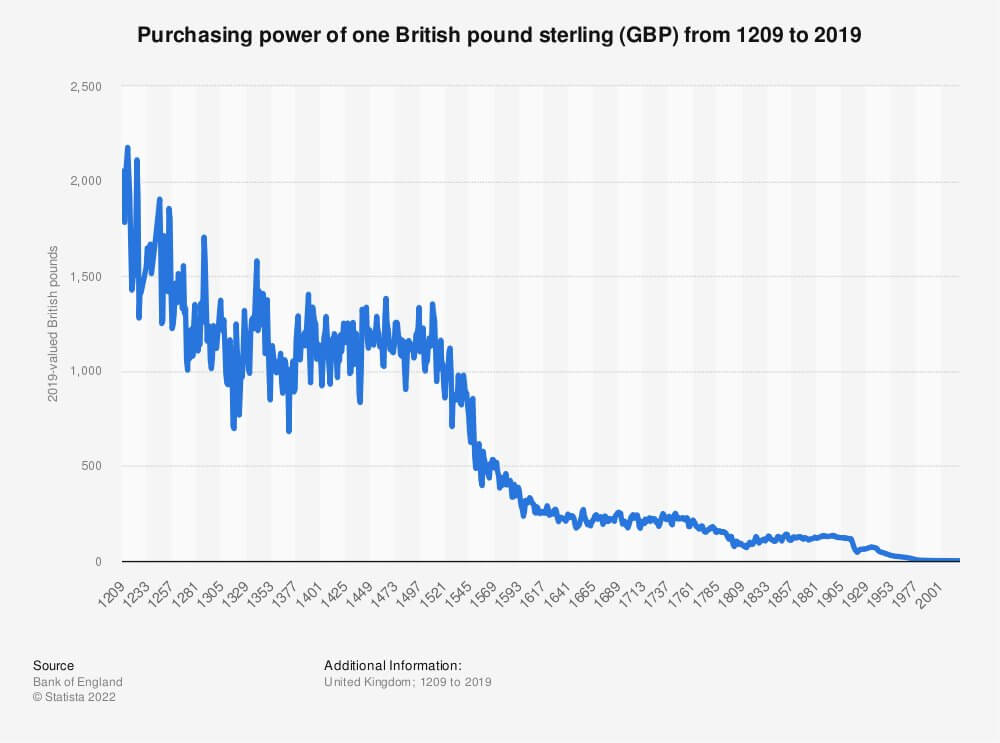

While the pound’s woes might look recent, the currency has been experiencing a steady drop for the better part of the last 8 centuries.

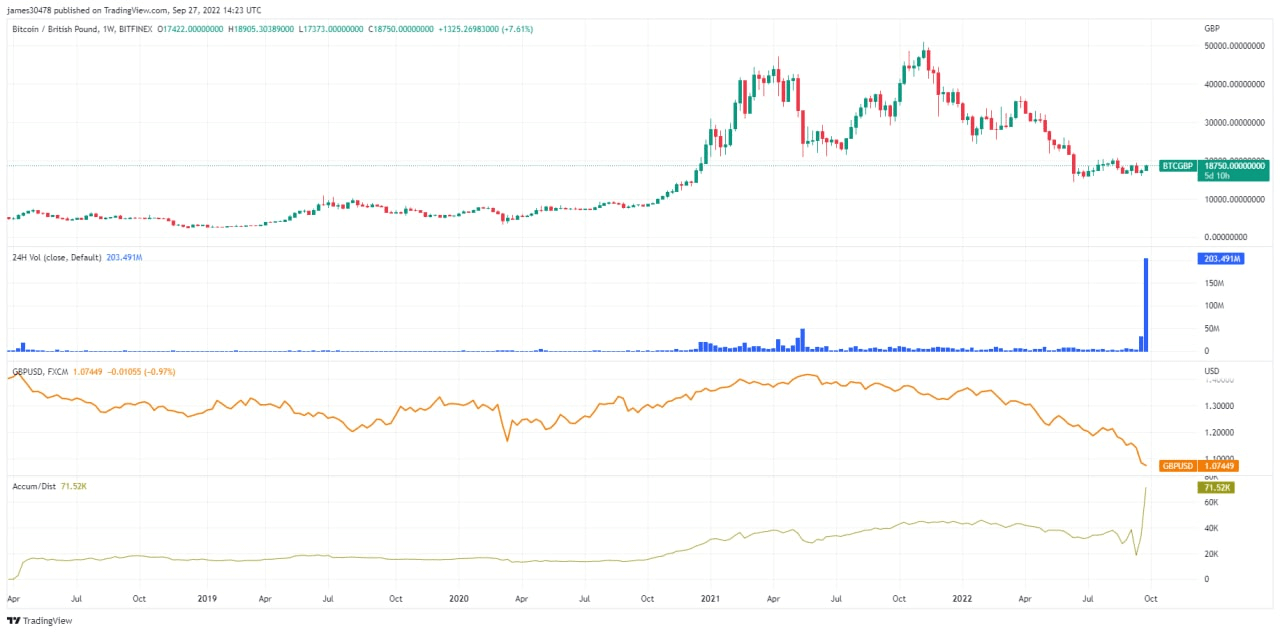

With the pound plummeting to its 30-year low, people flocked to hard assets to avoid major losses. On Sept. 26, the BTC/GBP trading volume soared over 1,200% as British pound holders began aggressively purchasing Bitcoin. This stands in sharp contrast to the BTC/USD pair, which has seen a relatively flat trading volume on centralized exchanges throughout the summer.

The rapidly weakening pound posed a massive threat to government debt markets in the U.K. The possibility of systemic risk to the country’s financial stability forced the Bank of England to take emergency action and intervene in the bond market. On Sept. 28, the Bank of England announced that it would suspend its program to sell gilts and start buying long-dated bonds.

British chancellor Kwasi Kwarteng’s newly imposed tax cuts and borrowing plans further debased the pound and led to a sharp decrease in U.K. government bonds. To protect their holdings from risks associated with inflation and rising interest rates, most pension funds invest heavily in long-term government bonds. The Bank of England’s emergency measures are an attempt to provide support to thousands of cash-strapped pension funds that are in danger of failing to meet margin calls.

This is a stark reminder that the world of traditional finance can be as unpredictable as the crypto market. Flash crashes and speculation could become a new reality for fiat currencies and commodities many thought to be resistant to manipulation.

The post British pound drops to all time lows against the dollar appeared first on CryptoSlate.