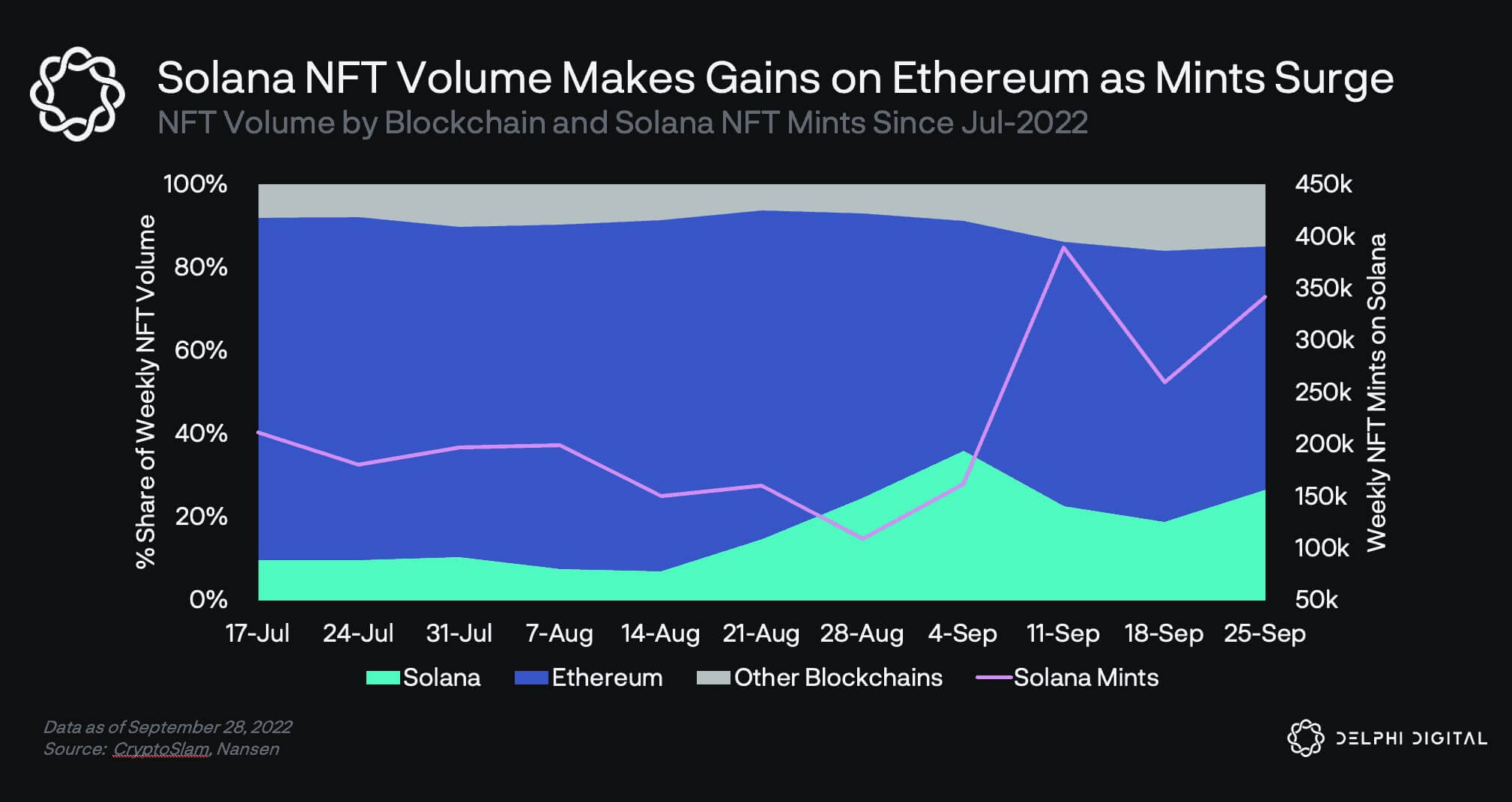

Cryptocurrency research firm Delphi Digital posted a chart showing Solana NFT volume surging, accompanied by the text:

“Solana’s share of total NFT trading volume has increased from 7% to 24% over the past 6 weeks.”

Solana is establishing itself as a viable alternative to ETH for NFTs

The chart showed since mid-August, NFT volume on the Solana chain has been trending upwards, leading to a peak of 40% in early September.

A dip followed this, but the last two weeks or so have seen a resurgence to the point Solana currently accounts for almost a quarter of the total weekly NFT volume.

During this time, the number of weekly Solana mints also spiked higher, suggesting a positive correlation between newly circulated non-fungibles and trading volume on the chain. In other words, freshly minted Solana NFTs are finding buyers.

Of interest, “other blockchains” accounted for significantly less volume than ETH or SOL. However, since early September, other blockchains have extended their market share alongside Solana, accounting for approximately 18% of the market.

The data indicates that Ethereum is becoming less popular for NFTs, despite moving to Proof-of-Stake and addressing the issue of carbon/energy-intensive usage.

NFTs metrics continue trending down

Despite the win for Solana and other blockchains, the relatively short time frame of change casts doubt on whether this is an enduring trend.

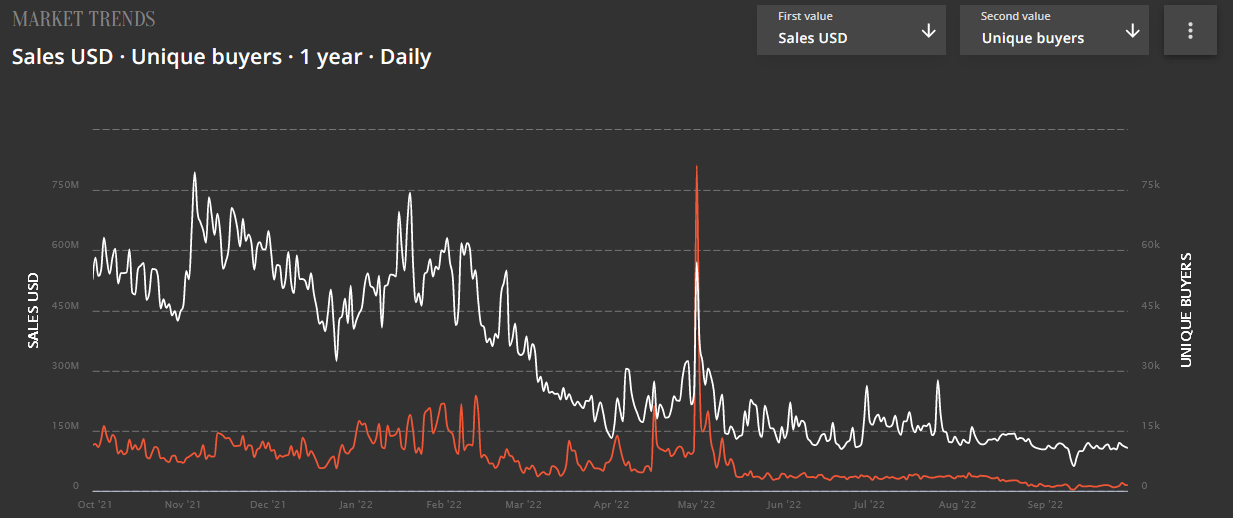

In any case, the NFT marketplace has been in dire straits over the past year. According to data from nonfungible.com, sales and the number of unique buyers have sunk since October 2021.

Over this period, up to February 2022, sales have been somewhat buoyant. However, from May onwards, NFT sales have flatlined. May 1 is an outlier as sales spiked to $811 million. Sales for September 29 stand at $14.8 million.

Unique NFT buyers show a downward trend, with a peak of 79.4k on November 5, 2021. This has sunk to 10.9k as of Thursday – an 86% decline.

Marketing Lead at Proofed, Callum Carlstrom, isn’t too concerned. He commented that the downturn is tied to broader macro and cryptocurrency factors. However, he remains confident that “NFTs will be back in vogue” once the macro conditions pick up.

The post Ethereum losing ground as Solana now accounts for a quarter of total NFT volume appeared first on CryptoSlate.