Popular meme coin Shiba Inu (SHIB) recorded two all-time highs (ATH) in 2021. Still, the amount of SHIB held in exchanges responded to these highs in opposite directions, according to data from Glassnode.

Despite its success throughout 2021, SHIB has been following a downtrend for a year. According to CryptoSlate data, SHIB fell 15.36% in the last 30 days despite burning 329.8 million SHIB tokens since early September — equating to almost half of the initial circulating token supply.

In the last 365 days, SHIB fell 58.32%. It recorded its ATH on Oct. 28, 2021, and at the time of writing lingers around $0.000011 — 88% lower than its ATH.

Year of Success

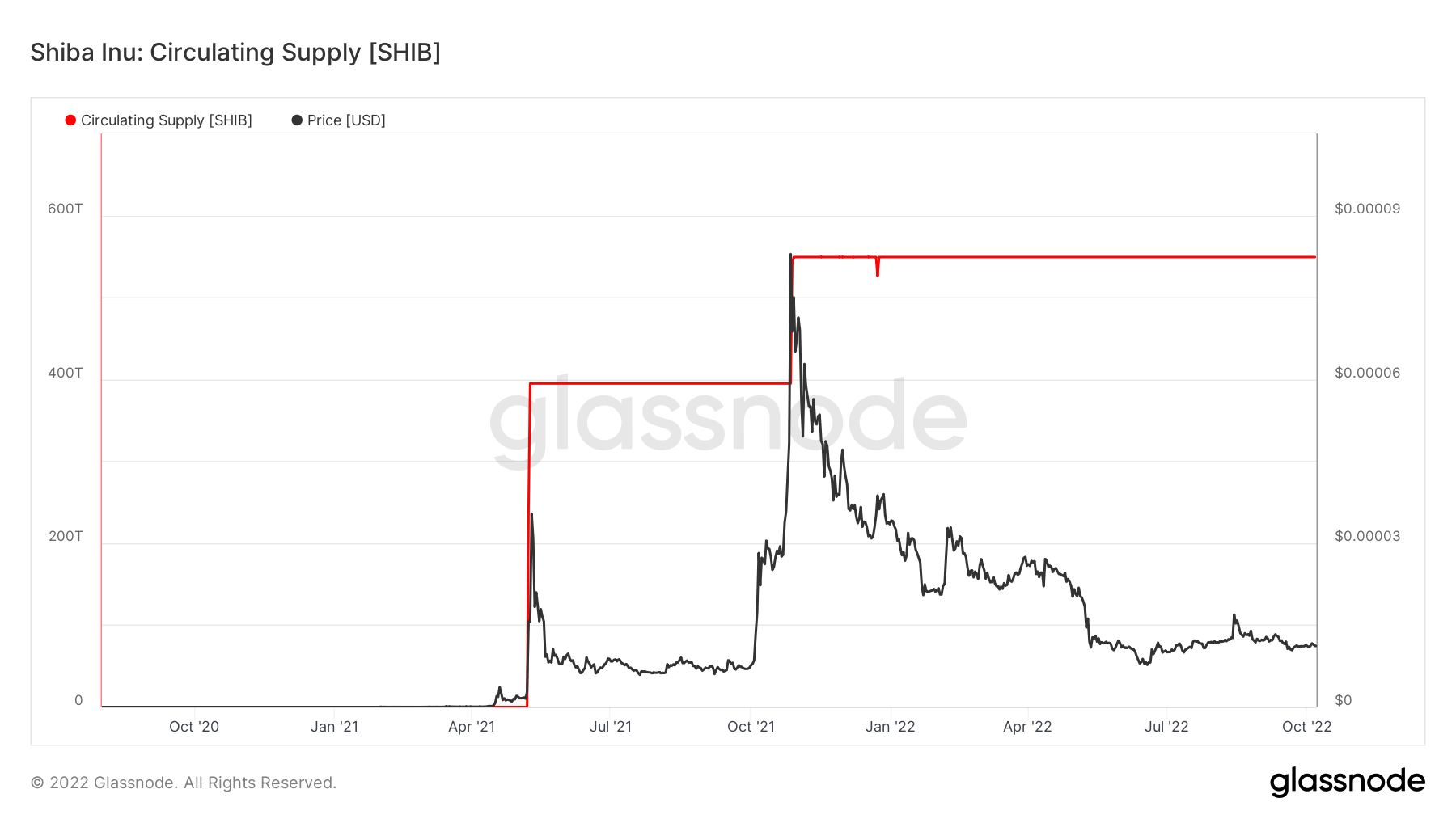

Shiba Inu came into circulation for the first time in April/May 2021 by releasing 400 trillion tokens into the market. A high number of unlocks occurred shortly after the release.

Five months after the first release, another 150 trillion tokens were released into circulation in October/November 2021 — increasing the total tokens in circulation to 550 trillion. During both these unlocks, SHIB price soared and claimed new highs.

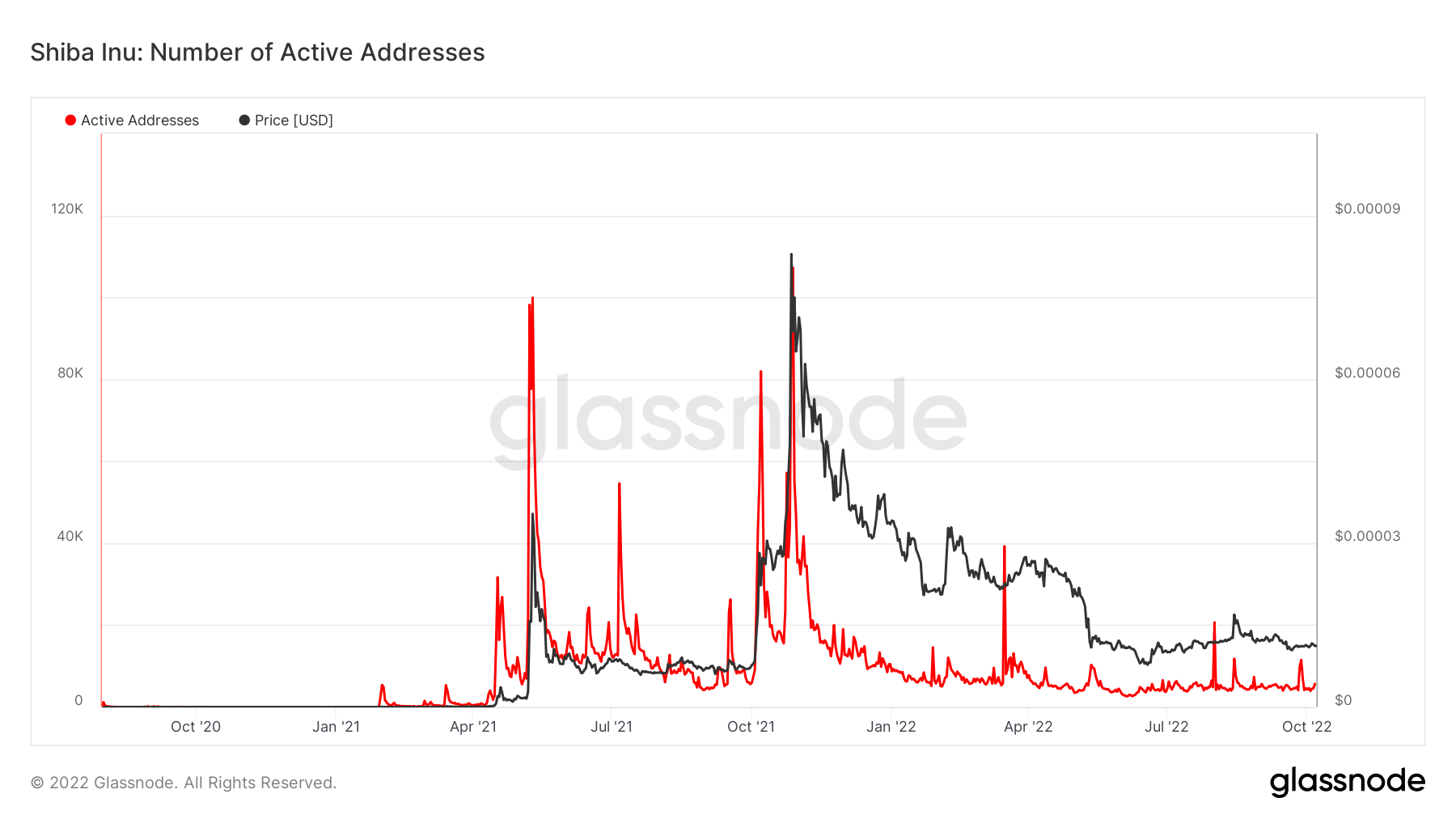

The Shiba Inu network also recorded strong usage rates throughout 2021, consistent with the token unlocks. The network reached over 100,000 active addresses a few months after the initial release.

This is an awe-inspiring rate when it is considered that it took Bitcoin (BTC) over four years to reach 100,000 active addresses.

SHIB flow to exchanges

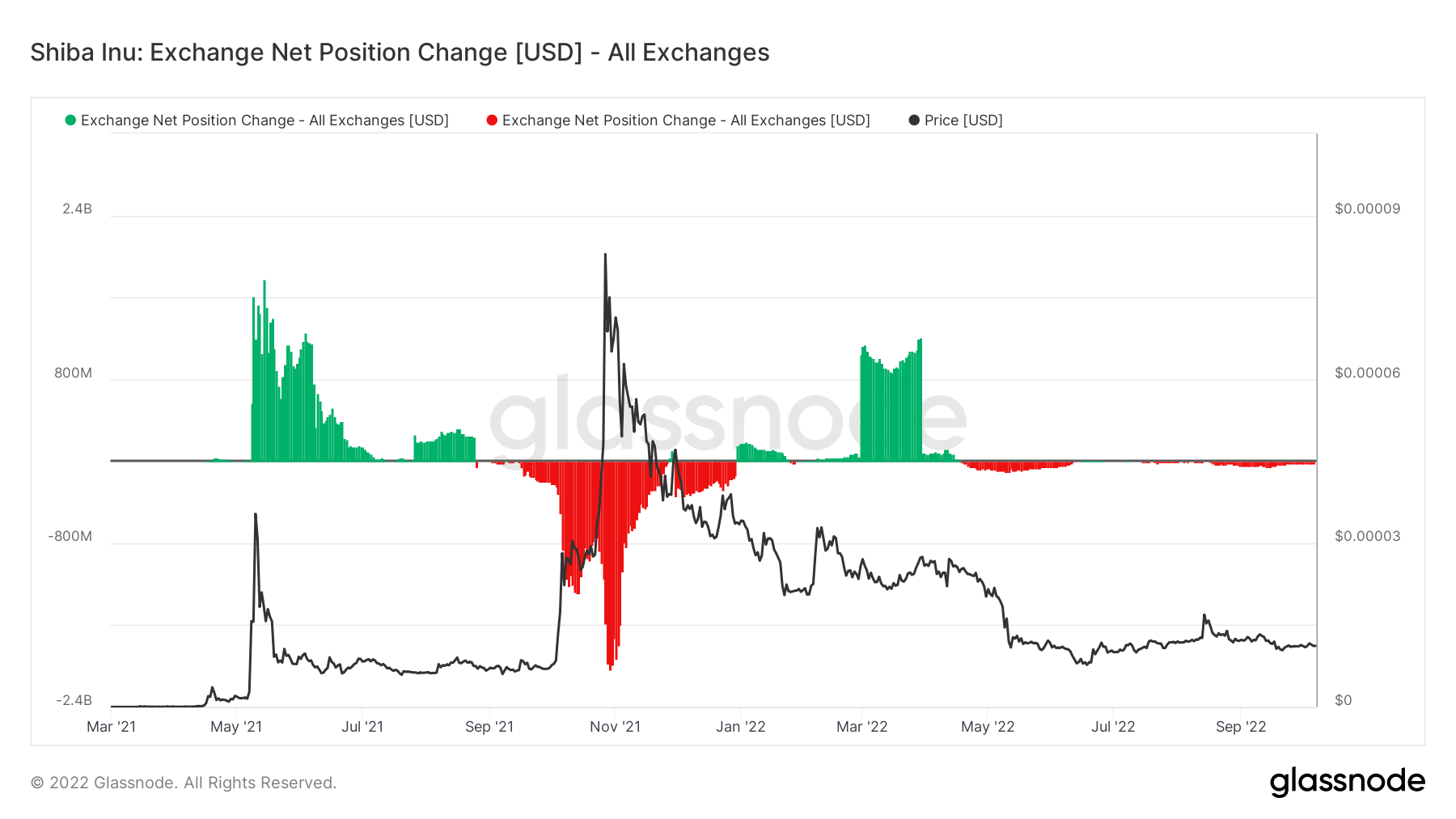

While price responses to both unlock periods are consistent, token flows to exchanges are drastically different.

After the first unlock in 2021, over 1 billion SHIB tokens were put back onto exchanges. These tokens likely belonged to the founders and early participants of the project and were sold during the price peak.

However, after the second unlock in October/May, SHIB tokens in exchanges did not decrease. Even though SHIB recorded a new ATH, over 2 billion tokens were withdrawn from exchanges from September 2021 to January 2022. This period was also the time when Bitcoin recorded its ATH at nearly $68,000.

Highlights since 2021

The success of the SHIB token in 2021 is also reflected in the news. In November 2021, SHIB made up the most significant holding of the top 1,000 Ethereum (ETH) wallets. A study from the same month also revealed that over 70% of SHIB holders were in profit at the time.

However, the community’s interest in SHIB started to fall in early 2022. The project team tried to re-ignite the interest by revealing plans for a doggy metaverse and launching a cross-chain DEX during the first months of the year. At the same time, they initiated token burns to shrink supply to inflate the prices. In the first week of April, 2.41 billion SHIB tokens were burned.

Towards the middle of the year, Shiba turned to payments. AMC Theatres saw potential in Shiba Inu and started accepting it as a payment method in late April. A month later, the Shiba team decided to rely on the payment utility function of SHIB and announced their plans to launch a SHI stablecoin. They also said:

“The end goal is that SHI (operating both on ETH and the Shibarium) becomes a global stable currency that plebs across all countries are able to use as both a store of value and method of payment.”

Regardless, SHIB continued its fall even more heavily as the crypto market entered its coldest winter. A survey conducted among fintech experts in the early days of the market revealed that 73% of the participants believed SHIB would perish before 2030. Another 30% argued that it wouldn’t even make it to year-end.

Participants commented that the bear market would eliminate “joke-type” coins such as Shiba Inu to make room for real innovation.

The post Research: What exactly happened in 2021 for Shiba Inu? appeared first on CryptoSlate.