The post AAVE Aims for 30% Rally Despite $6.75 Million Whale Sell-Off appeared first on Coinpedia Fintech News

Amid the ongoing struggling cryptocurrency market, whales and institutions appear to be dumping Aave (AAVE) tokens.

Whales and Institutions on AAVE

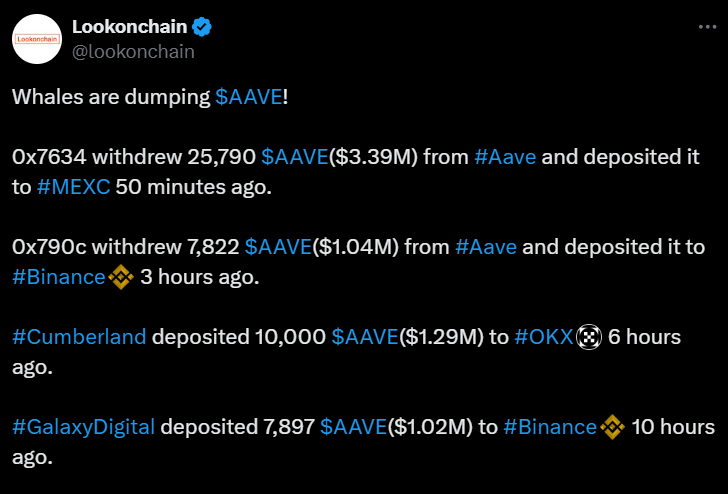

On November 5, 2024, the whale transactions tracker Lookonchain made a post on X (Previously Twitter) that wallet addresses “0x7634” and “0x790c,” along with Cumberland and Galaxy Digital, have collectively dumped a significant 51,509 AAVE tokens worth $6.74 million to various exchanges.

This significant dump happened within the last 24 hours on MEXC, Binance, and OKX, raising concerns about possible insider information or just a normal dump on the exchanges.

Current Price Momentum

Despite all these activities by whales and institutions, AAVE price has remained positive over the past 24 hours. Currently, it is trading near $131.75 and has experienced a price surge of over 1.71%.

During the same period, its trading volume soared by 17%, indicating an increase in the participation of traders and investors amid a struggling market.

AAVE Technical Analysis and Upcoming Level

According to the expert technical analysis, AAVE appears neutral and is at a crucial support level of $133. In addition to this horizontal support, the asset has also found support from the 200 Exponential Moving Average (EMA) on the daily timeframe.

Historically, whenever AAVE reaches this level, it experiences buying pressure and an upward rally. This time, however, traders and investors are expecting a similar price surge in the coming days.

Based on the recent price action, if AAVE holds itself above the $127 level, there is a strong possibility it could soar by 30% to reach the $173 level in the coming days.

Bullish On-Chain Metrics

On-chain metrics further support AAVE’s positive outlook. According to the on-chain analytics firm Coinglass, AAVE’s long-to-short ratio currently stands at 1.05, the highest since early October 2024. Additionally, its open interest has surged by 21%, indicating that traders are increasing their positions as market sentiment begins to shift.

The combination of rising open interest and a long-to-short ratio above 1 indicates a strong buy signal, with traders and investors viewing this as a perfect buying opportunity.